Maryland Instructions for Completing CC-GN-002 is a set of detailed instructions for filing a Combined Corporate Franchise Tax Return (Form 500CR) in the state of Maryland. It includes information on who must file, what information must be reported, and how to properly complete the form. The instructions cover all types of entities, including corporations, limited liability companies, and partnerships. The instructions provide information on what type of information must be reported on the form, including gross income, taxable income, income tax liability, and franchise tax liability. It also explains how to calculate the license tax, how to compute the alternative minimum tax, and the filing requirements for all types of entities. Additionally, it outlines the rules and regulations for filing a Combined Corporate Franchise Tax Return to Maryland. The four types of Maryland Instructions for Completing CC-GN-002 are: 1. General Instructions: These instructions provide a complete overview of the Combined Corporate Franchise Tax Return and the Maryland Tax System. 2. Corporation Instructions: These instructions provide specific information on filing a Combined Corporate Franchise Tax Return for corporations. 3. Limited Liability Company Instructions: These instructions provide specific information on filing a Combined Corporate Franchise Tax Return for limited liability companies. 4. Partnership Instructions: These instructions provide specific information on filing a Combined Corporate Franchise Tax Return for partnerships.

Maryland Instructions for Completing CC-GN-002

Description

How to fill out Maryland Instructions For Completing CC-GN-002?

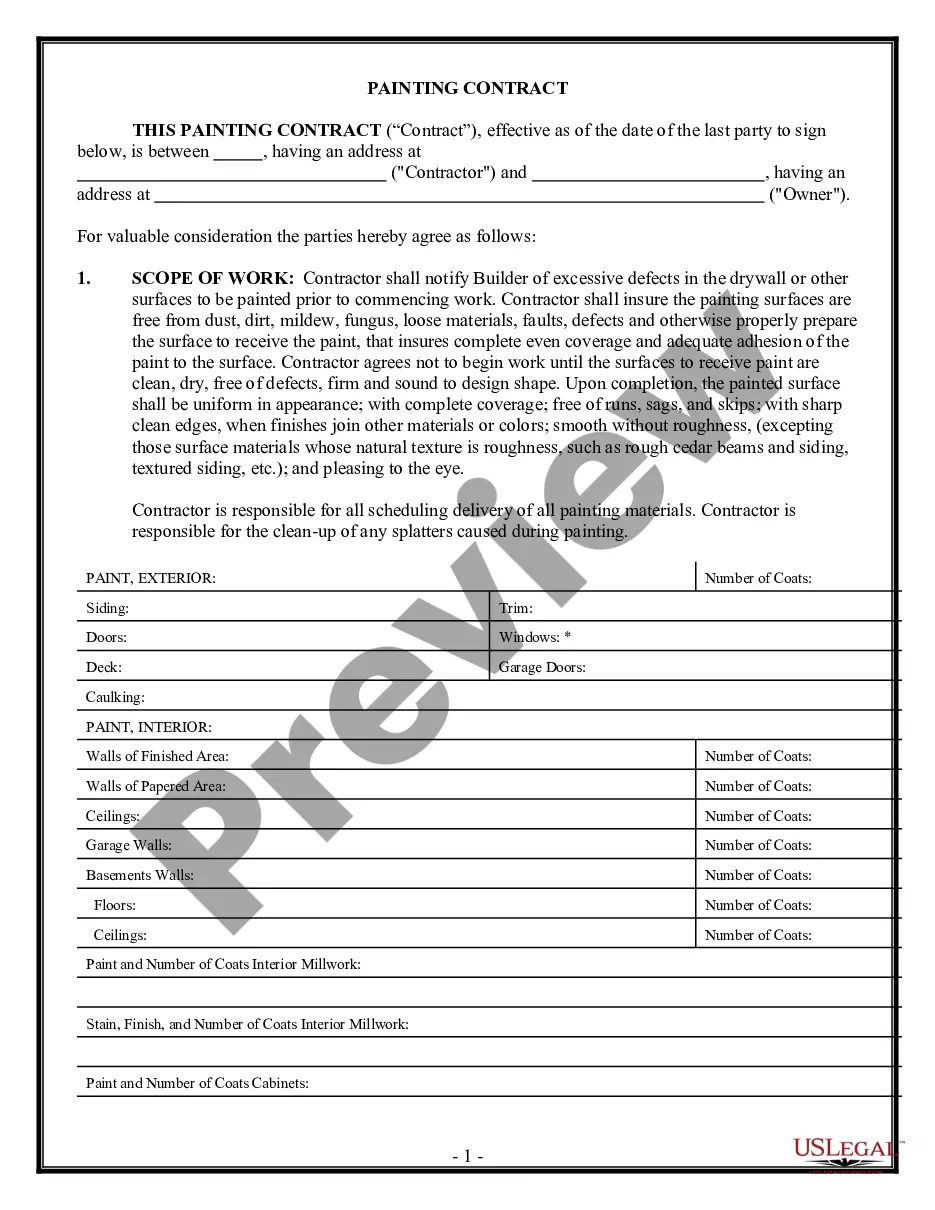

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state regulations and are examined by our specialists. So if you need to complete Maryland Instructions for Completing CC-GN-002, our service is the best place to download it.

Getting your Maryland Instructions for Completing CC-GN-002 from our service is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button after they find the correct template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance verification. You should carefully review the content of the form you want and make sure whether it suits your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now once you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Maryland Instructions for Completing CC-GN-002 and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any official document quickly and easily any time you need to, and keep your paperwork in order!