The Maryland Notice of Debtors Motion To Avoid Lien Pursuant To 11 USC 522(f) is a legal document used by a debtor to ask the court to invalidate a lien against their property. This document is used when the debtor believes that the lien was obtained improperly or without legal cause. There are two types of Maryland Notice of Debtors Motion To Avoid Lien Pursuant To 11 USC 522(f): a voluntary motion to avoid lien and an involuntary motion to avoid lien. A voluntary motion to avoid lien is when the debtor files the motion on their own and is asking the court to invalidate the lien. An involuntary motion to avoid lien is when another party, such as a creditor or lender, files the motion on behalf of the debtor. In either case, the debtor must demonstrate that the lien was obtained improperly or without legal cause in order for the court to rule in their favor.

Maryland Notice of Debtors Motion To Avoid Lien Pursuant To 11 USC 522(f)

Description

How to fill out Maryland Notice Of Debtors Motion To Avoid Lien Pursuant To 11 USC 522(f)?

How much time and resources do you typically spend on drafting official documentation? There’s a better option to get such forms than hiring legal experts or wasting hours browsing the web for a proper template. US Legal Forms is the leading online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Maryland Notice of Debtors Motion To Avoid Lien Pursuant To 11 USC 522(f).

To acquire and prepare a suitable Maryland Notice of Debtors Motion To Avoid Lien Pursuant To 11 USC 522(f) template, adhere to these simple steps:

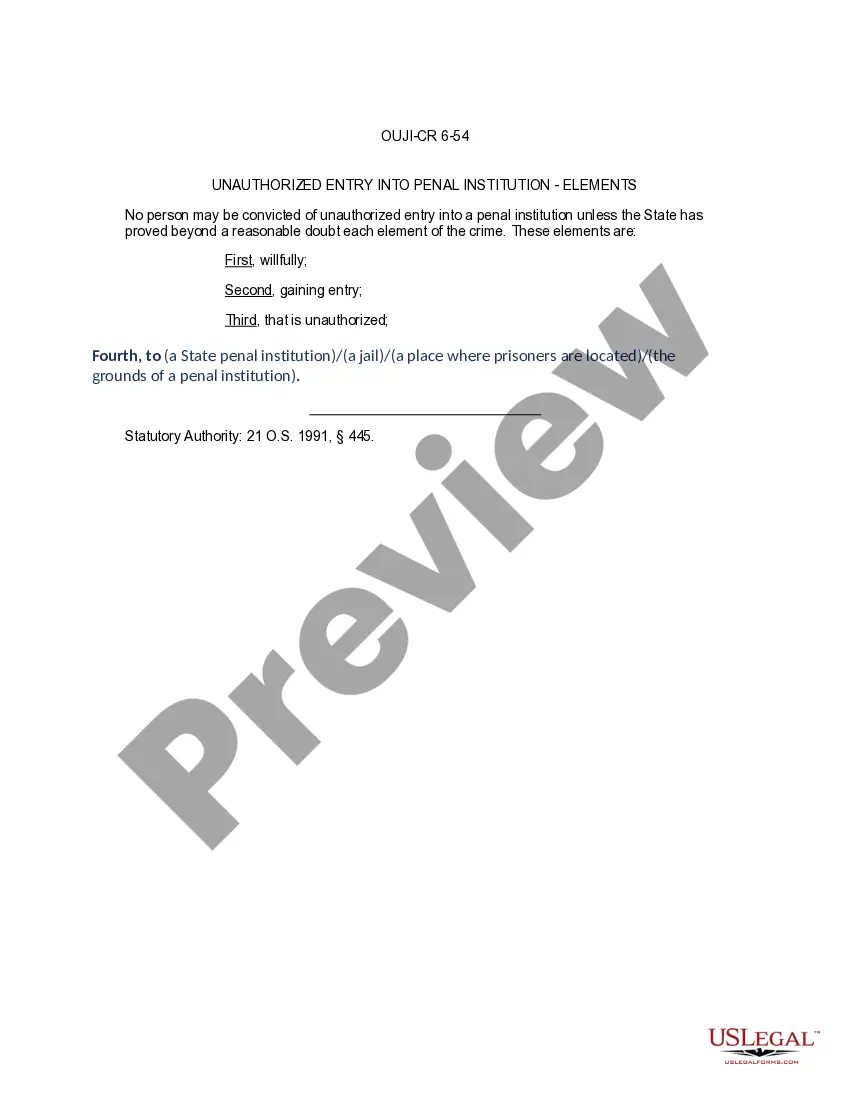

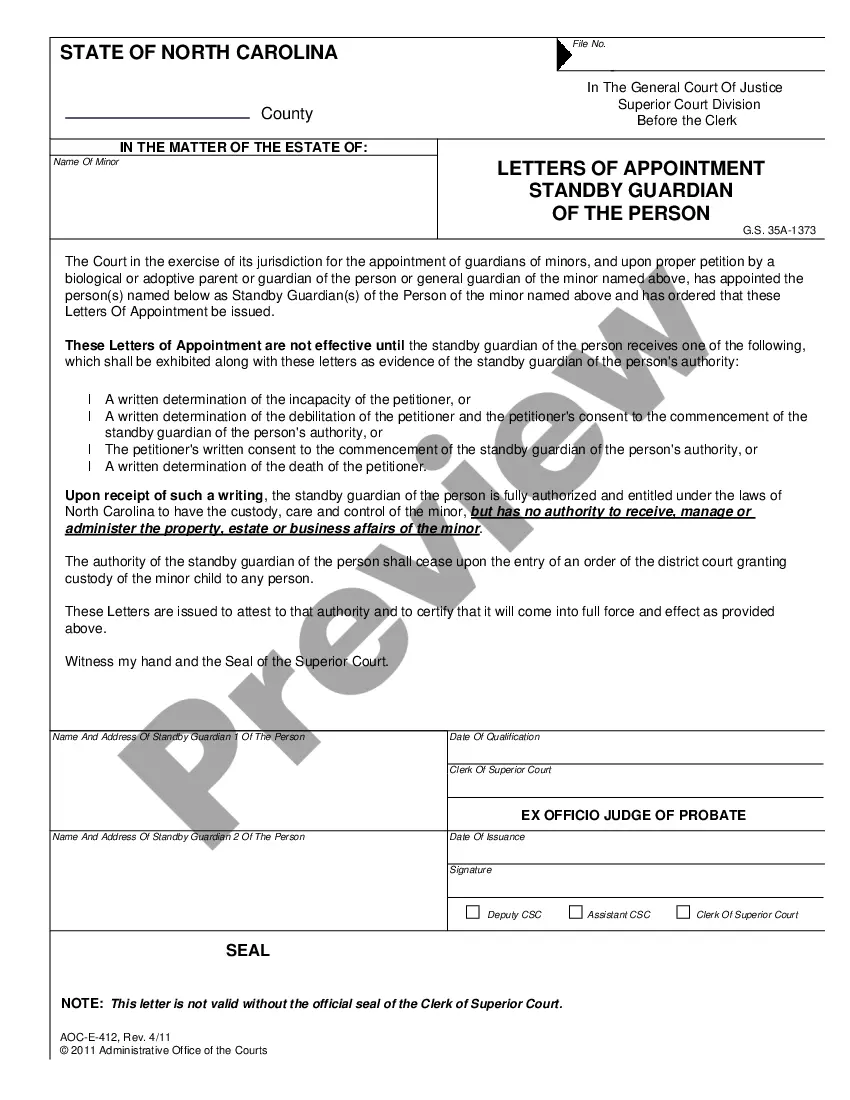

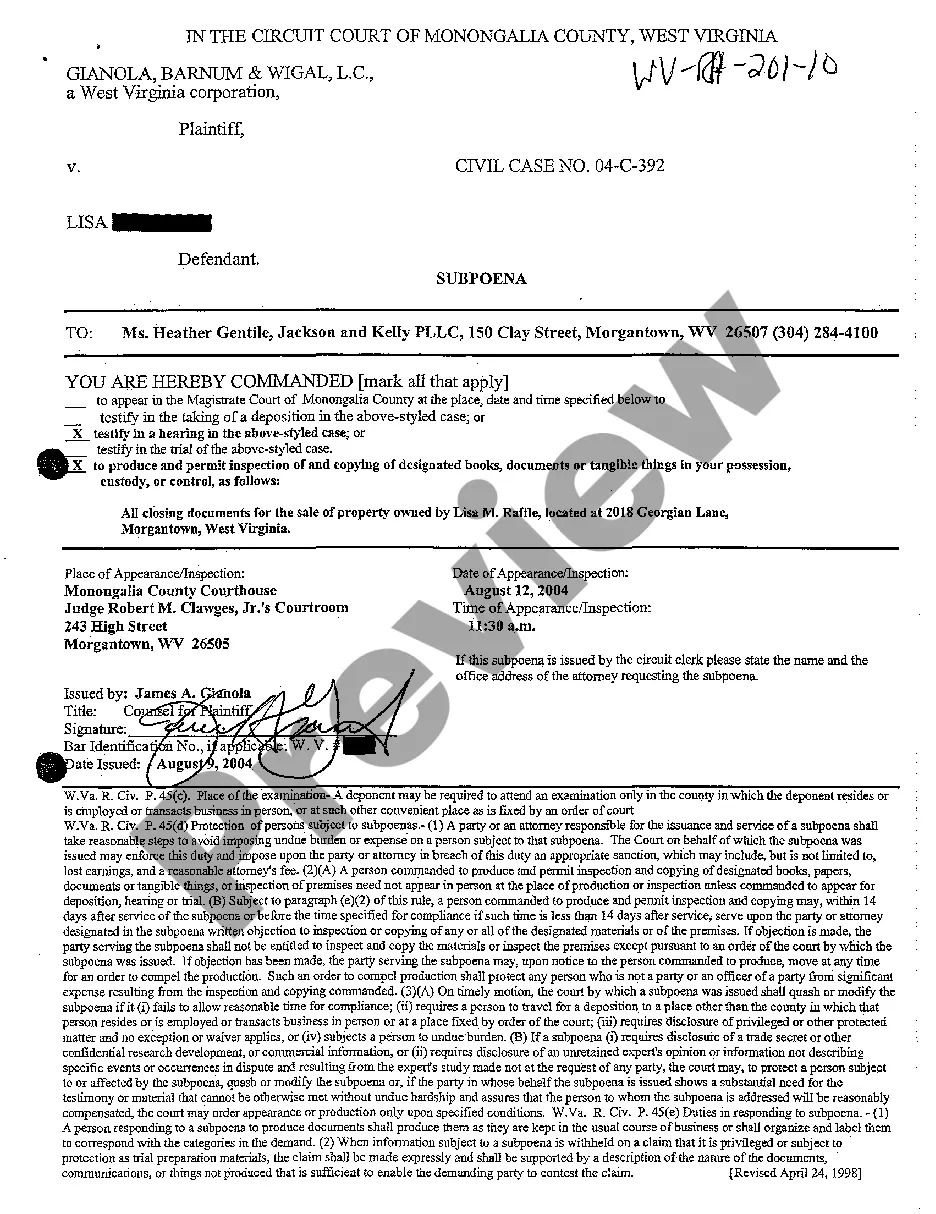

- Examine the form content to make sure it meets your state laws. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Maryland Notice of Debtors Motion To Avoid Lien Pursuant To 11 USC 522(f). If not, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally safe for that.

- Download your Maryland Notice of Debtors Motion To Avoid Lien Pursuant To 11 USC 522(f) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

How much cash can you keep in Chapter 7 bankruptcy? In Florida, a person is entitled to exempt $1,000 of personal property, including cash, in a Chapter 7 bankruptcy. For people that do not claim homestead exemption, the amount of the exemption increases to $4,000.

Exempt property is any property that creditors cannot seize and sell in order to satisfy debt during chapter 7 or chapter 13 bankruptcy. The type of property exempted differs from state to state but often includes clothes, home furnishings, retirement plans, and small amounts of equity in a house and car.

§522. Exemptions. (2) "value" means fair market value as of the date of the filing of the petition or, with respect to property that becomes property of the estate after such date, as of the date such property becomes property of the estate.

Federal Bankruptcy Exemption Laws 11 U.S.C. 522(d)(1); (d)(5) Homestead: Real property, including co-op or mobile home, or burial plot to $20,200; unused portion of homestead to $10,125 may be applied to any property.

522(f) LBR 4003-2 provides the procedure for a party to file a motion to avoid a lien when the judgment lien is on real property.