The Maryland Limited Offering Exemption Under Maryland Securities Act is a state exemption offered to companies to allow for the sale of securities without having to register them with the Maryland Securities Commissioner. This exemption is designed to help small businesses in the state of Maryland raise capital by allowing them to offer limited amounts of securities to investors. This exemption is also beneficial for investors as it provides them with an alternative to more risky investments. Under this exemption, companies are allowed to offer up to $1,000,000 in securities over a 12-month period to an unlimited number of Maryland residents. Companies must provide investors with a disclosure document that includes information about the company and the securities it is offering. Companies must also file a notice of intent to use the exemption with the Maryland Securities Commissioner and provide the commissioner with copies of the disclosure document. The Maryland Limited Offering Exemption Under Maryland Securities Act comes in two types: the Accredited Investor Exemption and the Qualified Purchaser Exemption. The Accredited Investor Exemption allows companies to offer securities to accredited investors, which are individuals with a net worth of at least $1 million or an annual income of at least $200,000. The Qualified Purchaser Exemption allows companies to offer securities to individuals who meet certain financial thresholds.

Maryland Limited Offering Exemption Under Maryland Securities Act

Description

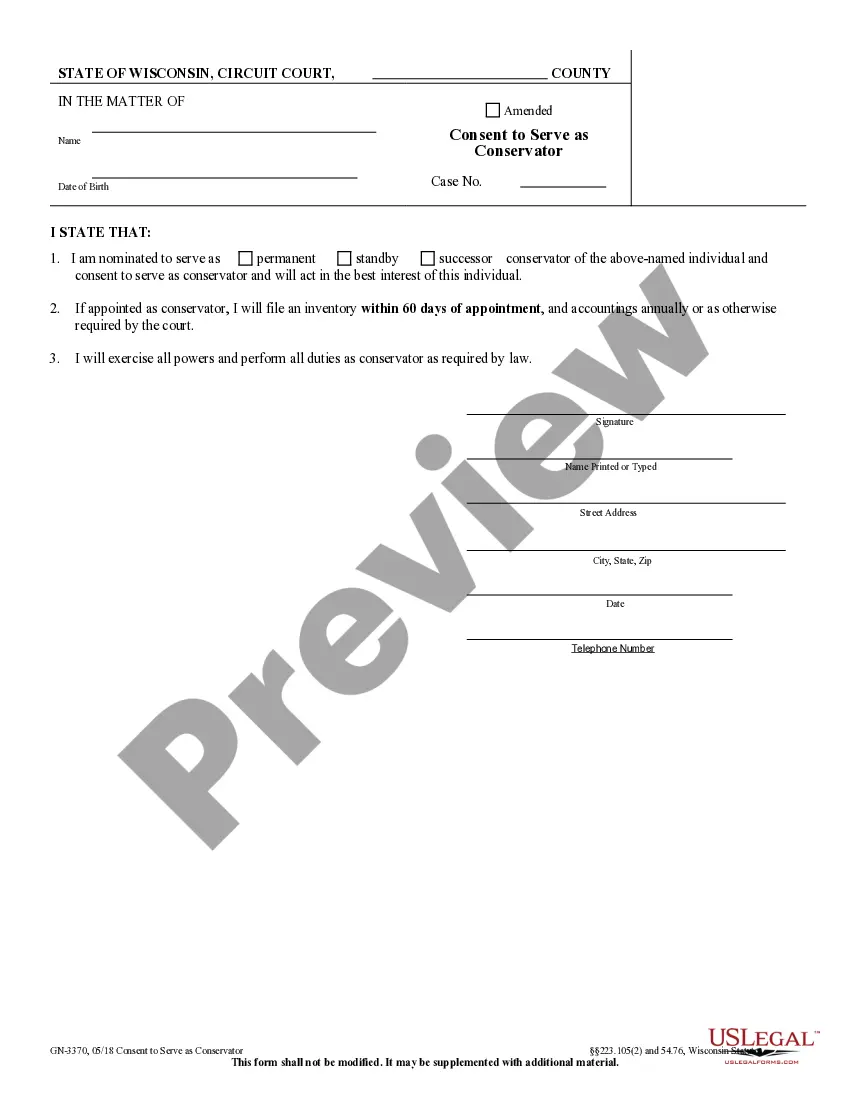

How to fill out Maryland Limited Offering Exemption Under Maryland Securities Act?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state laws and are examined by our experts. So if you need to complete Maryland Limited Offering Exemption Under Maryland Securities Act, our service is the best place to download it.

Getting your Maryland Limited Offering Exemption Under Maryland Securities Act from our library is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the proper template. Later, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance verification. You should carefully examine the content of the form you want and ensure whether it satisfies your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Maryland Limited Offering Exemption Under Maryland Securities Act and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily every time you need to, and keep your paperwork in order!