Maryland Certificate of Cancellation Of A Foreign Limited Liability Company Registration

Description

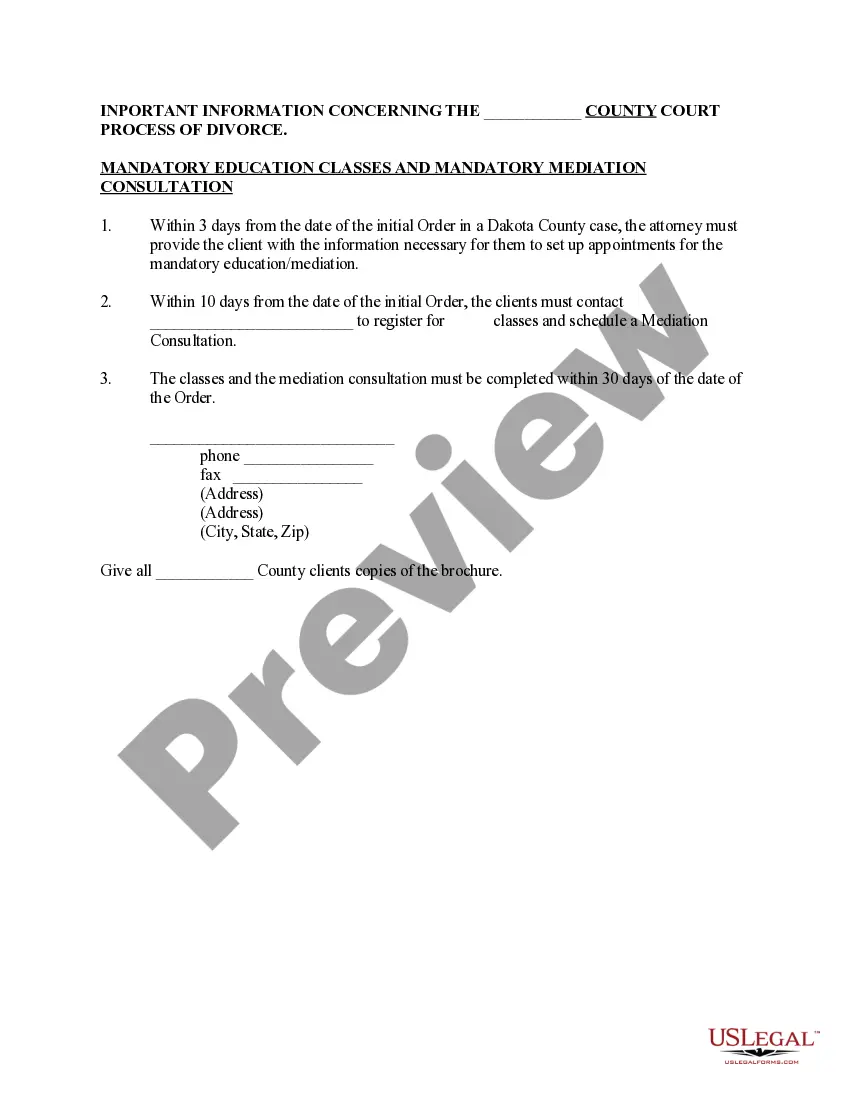

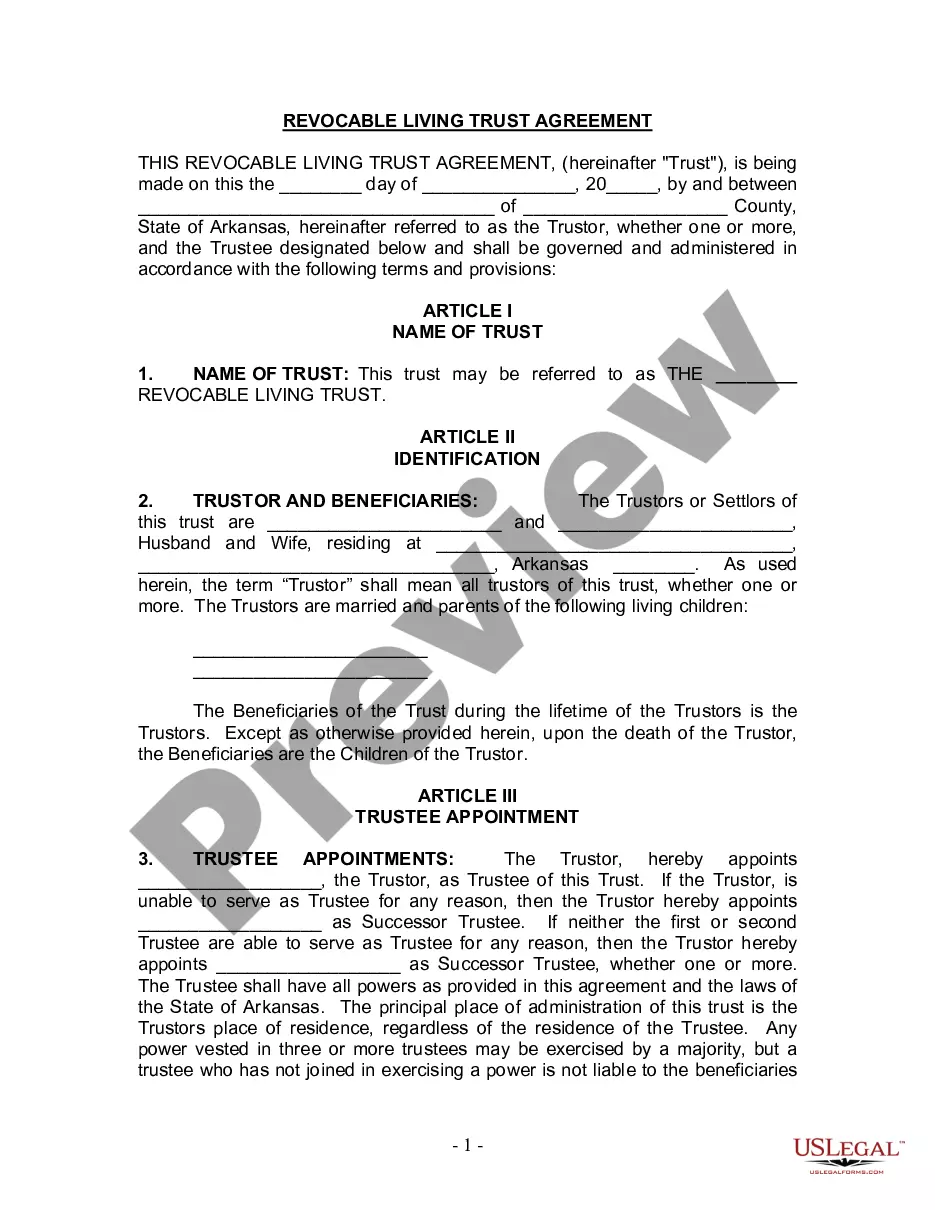

How to fill out Maryland Certificate Of Cancellation Of A Foreign Limited Liability Company Registration?

How much time and resources do you typically spend on drafting official documentation? There’s a better opportunity to get such forms than hiring legal experts or wasting hours searching the web for an appropriate template. US Legal Forms is the premier online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Maryland Certificate of Cancellation Of A Foreign Limited Liability Company Registration.

To obtain and complete an appropriate Maryland Certificate of Cancellation Of A Foreign Limited Liability Company Registration template, follow these easy steps:

- Look through the form content to ensure it complies with your state requirements. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t meet your requirements, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Maryland Certificate of Cancellation Of A Foreign Limited Liability Company Registration. If not, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally secure for that.

- Download your Maryland Certificate of Cancellation Of A Foreign Limited Liability Company Registration on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trusted web solutions. Join us today!

Form popularity

FAQ

You can close your sales and use tax account by calling 410-260-7980 from Central Maryland, or 1-800-638-2937 from elsewhere, Monday - Friday, a.m. - p.m.

To withdraw your foreign corporation or LLC from Maryland, you just have to file a termination or cancellation form with the Maryland State Department of Assessments and Taxation (SDAT). You can file documents with the SDAT by mail or in person.

First-time license applicants must register with the Maryland Department of Assessments and Taxation before contacting the local Clerk of the Court. The State License Bureau is responsible for monitoring and enforcing the use of business licenses in Maryland.

To register a foreign corporation in Maryland, you must file a Maryland Foreign Corporation Qualification Form with the Maryland State Department of Assessments and Taxation, Corporation Charter Division. You can submit this document by mail, in person, or online.

How to Register as a Foreign Entity in Every State Conduct a name availability search.Select a registered agent to represent your business in the state.Many states will require that you provide a certificate of good standing from your business formation state.Provide a copy of your formation documents.

A foreign Maryland Corporation is an INC originally formed in another state that registers to do business in Maryland. The process of registering a foreign Corporation in Maryland is called foreign qualification.

Foreign LLCs in Maryland must register with the Maryland State Department of Assessments and Taxation and pay a $100 state fee. (Expedited online filings cost $150, plus a $5 credit card fee.) Maryland law considers you to be doing business in Maryland if you own income-producing property in the state.