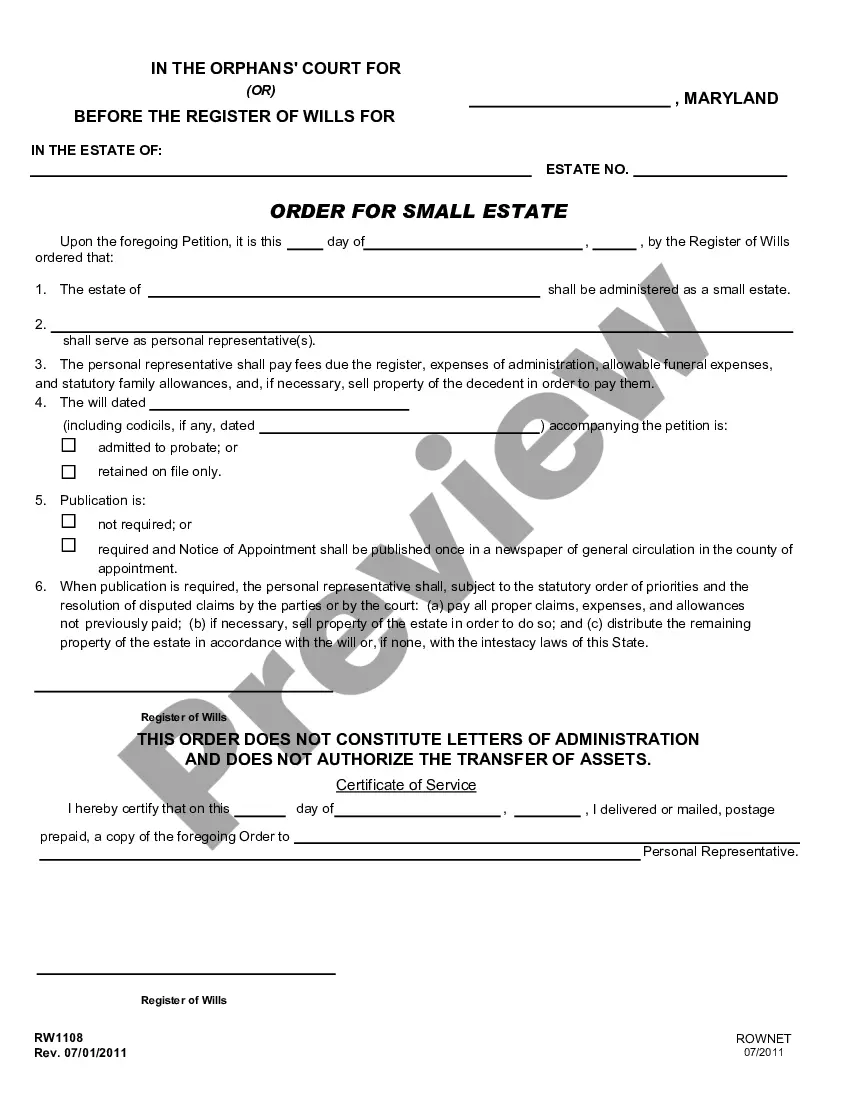

Maryland Order For Small Estate is a legal process for settling the estate of a deceased person who had no Will. It is a simplified process for distributing the assets of a small estate valued at $50,000 or less. This simplified process is available when the decedent did not have a Will and does not require the probate of the estate. There are two types of Maryland Order For Small Estate: Small Estate Affidavit and Small Estate Petition. The Small Estate Affidavit is the simpler option and can be filed with the Register of Wills in the county where the decedent resided. This process requires the surviving spouse, children, or other heirs to submit an affidavit documenting their relationship to the deceased and the value of the estate’s assets. The assets must be listed and the affidavit must be signed and notarized. The Small Estate Petition is the more complex option and should be used if the estate consists of real estate, is valued over $25,000, or the decedent had debts that need to be paid. This process requires an attorney to file a petition with the court and includes a hearing to confirm the value of the estate, payment of creditors, and distribution of the assets.

Maryland Order For Small Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Order For Small Estate?

If you're seeking a method to correctly finalize the Maryland Order For Small Estate without enlisting a lawyer, then you’re in the perfect location.

US Legal Forms has established itself as the most comprehensive and trusted repository of official templates for every personal and business circumstance. Each document you find on our platform is crafted in accordance with national and state regulations, so you can trust that your files are properly arranged.

One more fantastic aspect of US Legal Forms is that you will never lose the documents you purchased — you can access any of your downloaded templates in the My documents section of your account whenever you require it.

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its text description or exploring the Preview mode.

- Input the document title in the Search tab at the top of the page and select your state from the list to find another template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are assured that the paperwork meets all the requirements.

- Log in to your account and hit Download. Register for the service and choose a subscription plan if you don't have one yet.

- Utilize your credit card or PayPal to buy your US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format in which you want to receive your Maryland Order For Small Estate and download it by clicking the appropriate button.

- Upload your template to an online editor for quick completion and signature or print it out to prepare your physical copy manually.

Form popularity

FAQ

The 3-year rule for deceased estates pertains to the time frame within which claims can be made against an estate. Generally, creditors must file their claims within three years of the date of death to ensure they are considered. However, if you are handling a Maryland Order For Small Estate, it's crucial to understand how this timeline affects your specific situation. Be proactive and consult a legal professional to safeguard your interests.

To open a small estate, the personal representative must file several forms at the Register of Wills office where the decedent had his or her permanent home or was ?domiciled.? The addresses to these offices, along with other contact information, can be found on the Register of Wills homepage.

Estate value of $50,000 or less. (If spouse is sole heir or legatee, $100,000.)

A Maryland small estate affidavit is a document used by an individual who believes they have legal rights to all or part of a deceased loved one's estate. It requires that the petitioner have specific details about the estate, the property in question, and any other potential heirs to the estate.

For estates with a value of at least $50,000, there is probate fee to cover the processing costs. The probate fee is based on the value of the assets. Please see the Fees Page for more information. Unless exempted under Maryland statute, there is also an inheritance tax due on distribution of remaining assets.

Gather and complete the following forms: Bond of Personal Representative (RW 1115) Copy of Death Certificate ? This can be obtained through Maryland's Division of Vital Records. Copy of vehicle title and book value (if the decedent owned a vehicle). List of Interested Persons. Paid Funeral Bill.

Who Gets What in Maryland? If you die with:here's what happens:parents but no spouse or descendantsparents inherit everythingsiblings but no spouse, descendants, or parentssiblings inherit everything5 more rows

Under the Ann. Code of MD, Estates and Trusts § 5-601, the main factor to consider is the value of the estate. If the estate contains property values of $50,000 or less at the date of death of the decedent, the estate will always qualify for small estate status.