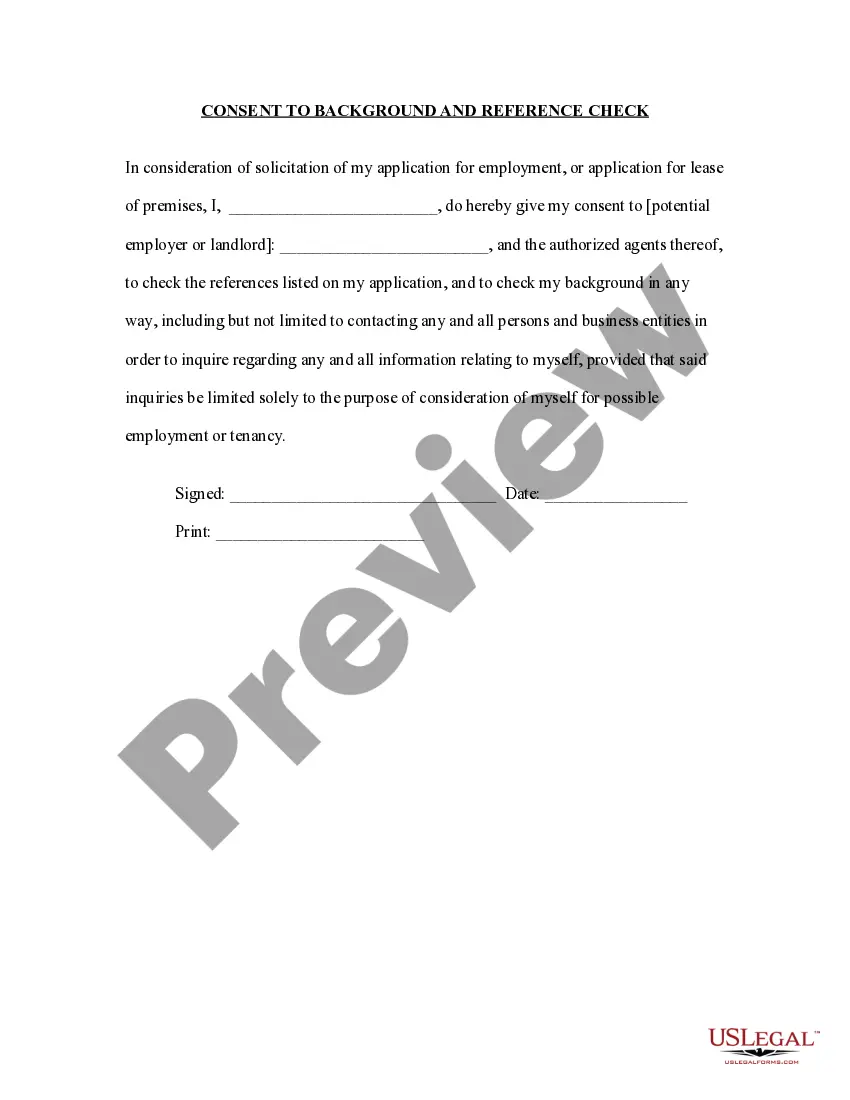

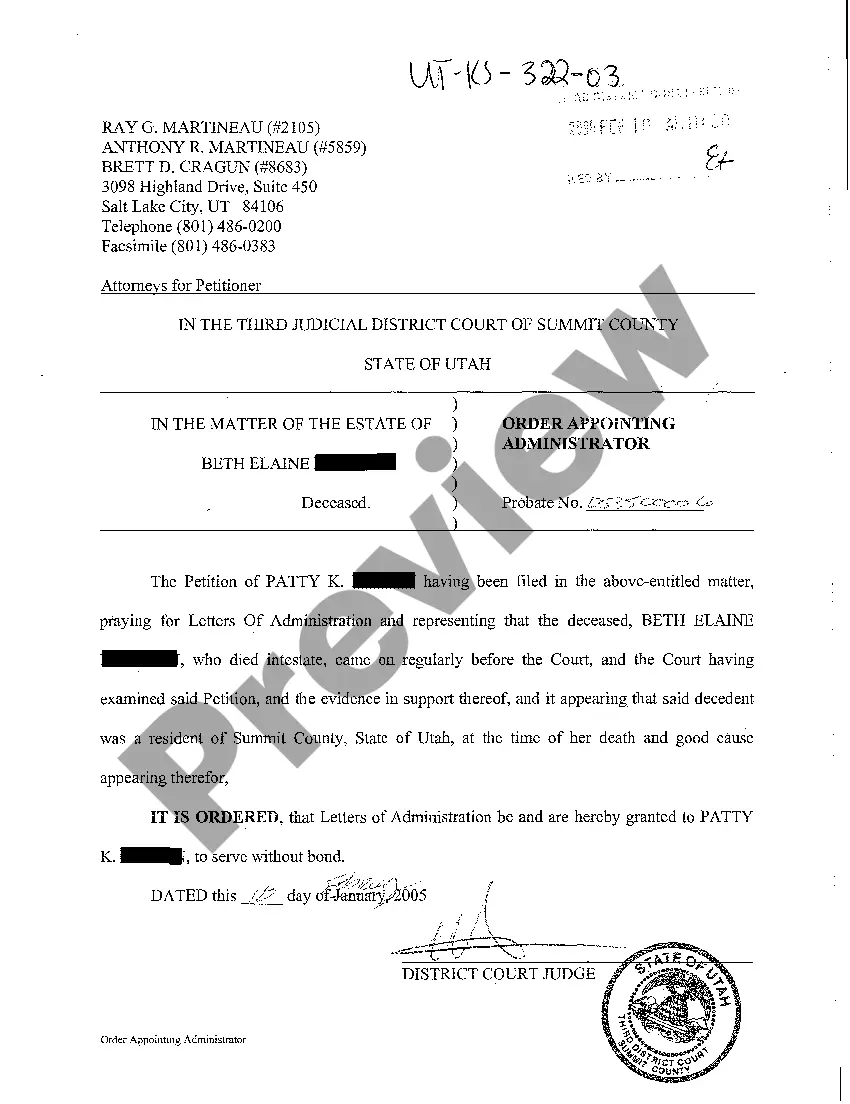

This form is a sample letter in Word format covering the subject matter of the title of the form.

Maryland is a state located in the Mid-Atlantic region of the United States. It is known for its rich history, vibrant culture, and diverse landscapes. In Maryland, there are several sample letters that can be used for acknowledging the receipt of a gift or donation with a tone of appreciation. One type of Maryland sample letter for acknowledgment of receipt of a gift or donation is the "Appreciative" letter. This type of letter is meant to express gratitude and thankfulness to the recipient for their generous contribution. Keywords that can be used to describe this type of letter include "gratitude," "thankfulness," "generosity," "appreciation," and "acknowledgment." The letter should convey a sense of genuine appreciation for the gift or donation received and express how it will make a positive impact on the organization or cause it supports. It is essential for this type of letter to be personalized and unique, addressing the donor by name and mentioning the specific gift or donation they made. Including specific details about how the contribution will be used or highlighting any special projects it will support can help strengthen the bond between the organization and the donor. The "Appreciative" letter should be written in a professional yet warm and friendly tone. It should be concise and easy to read, avoiding excessive jargon or complicated language. The letter should also include the organization's contact information, making it easy for the donor to get in touch if they have any further questions or wish to discuss their contribution in more detail. In summary, a Maryland sample letter for acknowledgment of receipt of a gift or donation — appreciative, is a personalized letter expressing gratitude and appreciation to the donor for their generous contribution. It should be written in a friendly and approachable tone, highlighting the impact the gift or donation will have on the organization or cause.

Maryland is a state located in the Mid-Atlantic region of the United States. It is known for its rich history, vibrant culture, and diverse landscapes. In Maryland, there are several sample letters that can be used for acknowledging the receipt of a gift or donation with a tone of appreciation. One type of Maryland sample letter for acknowledgment of receipt of a gift or donation is the "Appreciative" letter. This type of letter is meant to express gratitude and thankfulness to the recipient for their generous contribution. Keywords that can be used to describe this type of letter include "gratitude," "thankfulness," "generosity," "appreciation," and "acknowledgment." The letter should convey a sense of genuine appreciation for the gift or donation received and express how it will make a positive impact on the organization or cause it supports. It is essential for this type of letter to be personalized and unique, addressing the donor by name and mentioning the specific gift or donation they made. Including specific details about how the contribution will be used or highlighting any special projects it will support can help strengthen the bond between the organization and the donor. The "Appreciative" letter should be written in a professional yet warm and friendly tone. It should be concise and easy to read, avoiding excessive jargon or complicated language. The letter should also include the organization's contact information, making it easy for the donor to get in touch if they have any further questions or wish to discuss their contribution in more detail. In summary, a Maryland sample letter for acknowledgment of receipt of a gift or donation — appreciative, is a personalized letter expressing gratitude and appreciation to the donor for their generous contribution. It should be written in a friendly and approachable tone, highlighting the impact the gift or donation will have on the organization or cause.