This form is a sample letter in Word format covering the subject matter of the title of the form.

Maryland Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney

Description

How to fill out Sample Letter To Credit Bureau Concerning Decedent's Credit Report - Attorney?

Are you currently in a position where you require documents for both business or personal purposes almost every day.

There is a plethora of legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, including the Maryland Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney, designed to satisfy federal and state regulations.

Once you locate the right form, click on Get now.

Choose the pricing plan you want, fill out the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Maryland Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

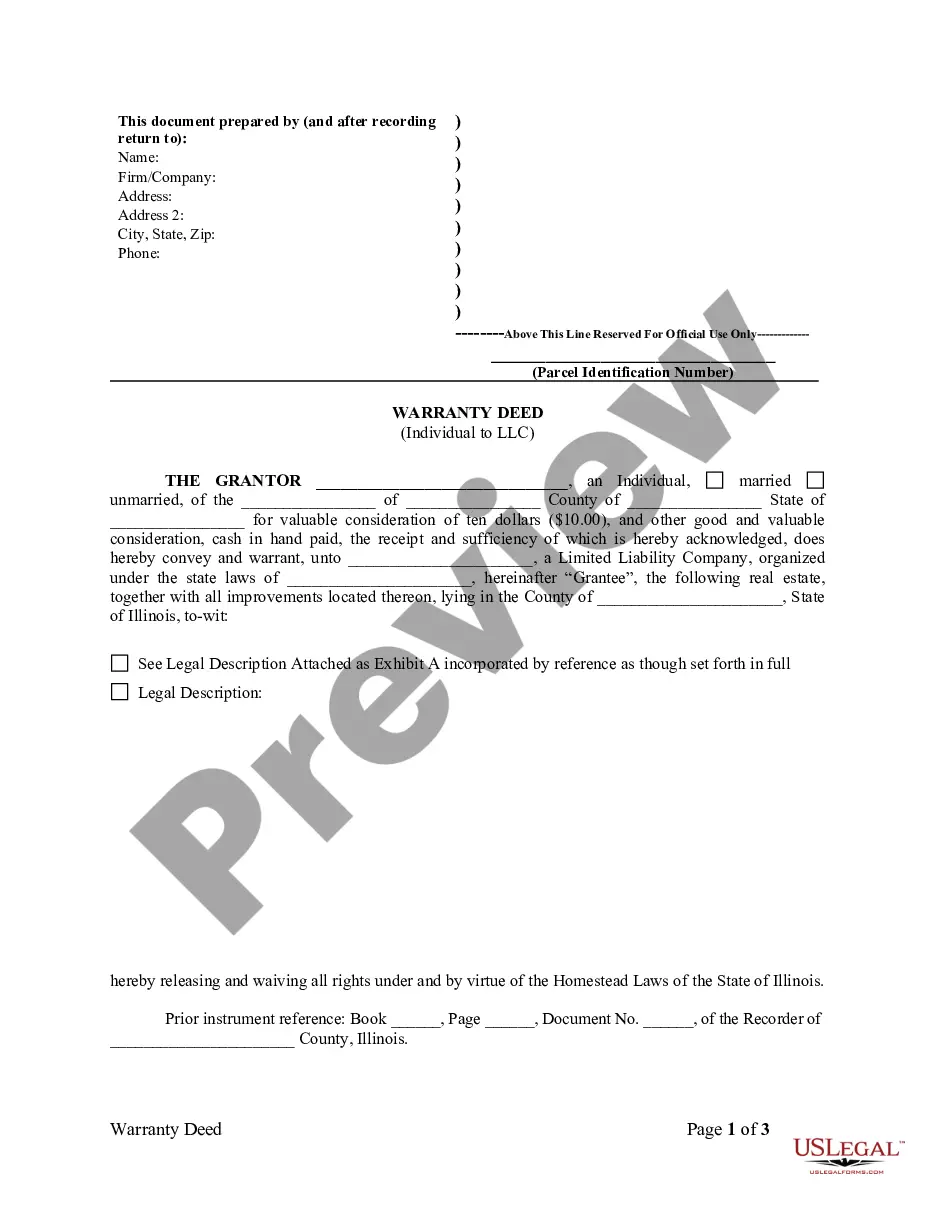

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Based on my otherwise spotless payment history, I would like to request that you apply a goodwill adjustment to remove the late payment mark from my credit report. Granting this request will help me improve my overall credit history and demonstrate my consistency as a creditworthy borrower.

I truly believe that it doesn't reflect my creditworthiness and commitment to repaying my debts. It would help me immensely if you could give me a second chance and make a goodwill adjustment to remove the late [payment/payments] on [date/dates]. Thank you for your consideration, and I hope you'll approve my request.

Here are the mailing addresses for each credit bureau: Equifax. P.O. Box 7404256. Atlanta, GA 30374-0256. Experian. Dispute Department. P.O. Box 9701. Allen, TX 75013. TransUnion. Consumer Solutions. P.O. Box 2000. Chester, PA 19022-2000.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.