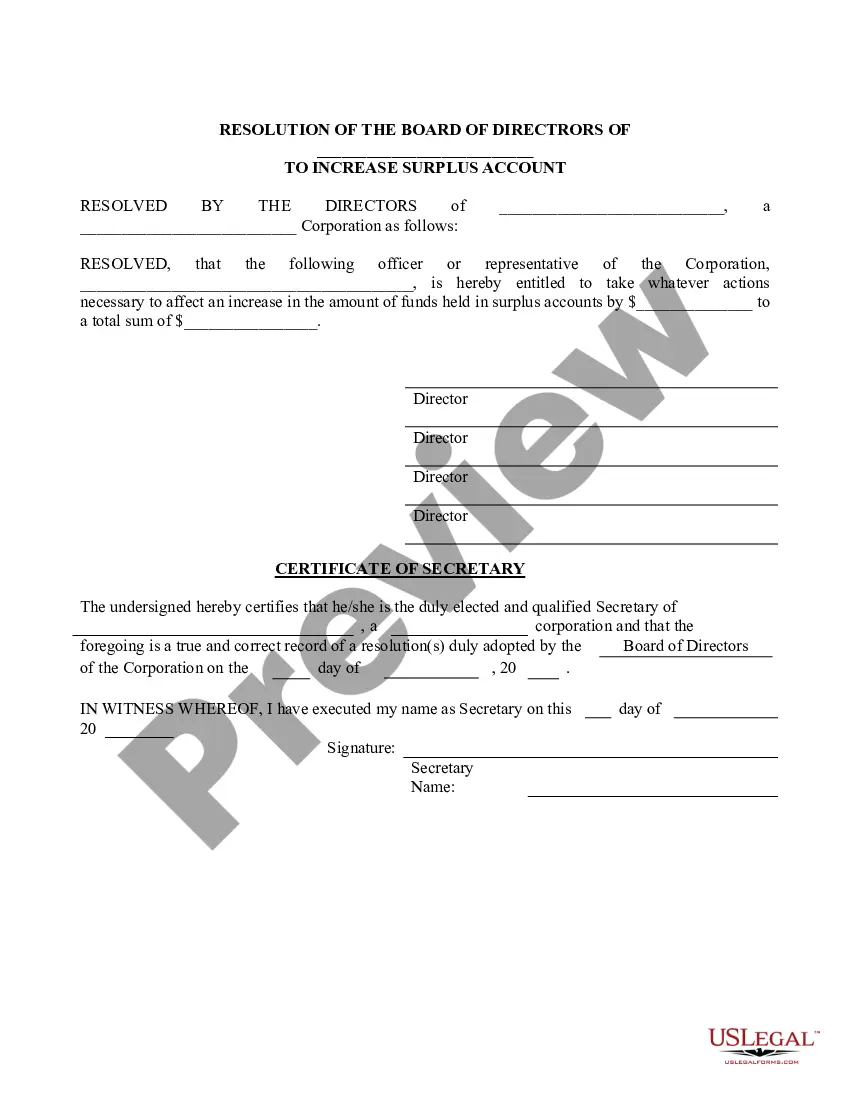

The Maryland Increase Surplus Account — Resolution For— - Corporate Resolutions is a legal document used by corporations registered in Maryland to officially authorize the increase of the company's surplus account. The surplus account refers to the portion of a corporation's net worth that exceeds its stated capital. By increasing the surplus account, a corporation can retain additional earnings or allocate funds for various purposes such as investment, expansion, debt repayment, or working capital. This resolution form is a standardized template that outlines the necessary details for the increase in the surplus account. It serves as a record of the decision made by the corporation's board of directors or shareholders to authorize the increase. By completing and filing this form with the appropriate authorities, the corporation ensures compliance with Maryland state laws and regulations. The Maryland Increase Surplus Account — Resolution For— - Corporate Resolutions typically includes the following key elements: 1. Heading: The form starts with a heading that clearly identifies the document as the resolution form for the increase of the surplus account. 2. Corporation Details: The name, address, and other identifying information of the corporation are provided. This helps to accurately identify the specific corporation for which the resolution is being implemented. 3. Resolution Details: This section outlines the resolutions being passed to increase the surplus account. It includes the specific amount or percentage by which the surplus account will be increased, as well as the effective date of the increase. 4. Legal Authorization: The resolution must state the specific Maryland state laws or provisions that grant the corporation the authority to increase its surplus account. This ensures compliance with relevant statutes and regulations. 5. Signatures: The resolution form requires the signatures of the corporation's authorized individuals, typically the board of directors or majority shareholders. These signatures validate the decision and indicate their consent to the increase of the surplus account. 6. Notarization: Depending on the specific requirements of the jurisdiction or the corporation's bylaws, the resolution may need to be notarized by a certified notary public. Different types of Maryland Increase Surplus Account — Resolution For— - Corporate Resolutions may exist based on the specific circumstances or needs of the corporation. For example, there might be separate forms for the increase of surplus account for profit corporations, non-profit corporations, or specific industries. However, the core elements detailed above will likely be present in all variations of the resolution form.

The Maryland Increase Surplus Account — Resolution For— - Corporate Resolutions is a legal document used by corporations registered in Maryland to officially authorize the increase of the company's surplus account. The surplus account refers to the portion of a corporation's net worth that exceeds its stated capital. By increasing the surplus account, a corporation can retain additional earnings or allocate funds for various purposes such as investment, expansion, debt repayment, or working capital. This resolution form is a standardized template that outlines the necessary details for the increase in the surplus account. It serves as a record of the decision made by the corporation's board of directors or shareholders to authorize the increase. By completing and filing this form with the appropriate authorities, the corporation ensures compliance with Maryland state laws and regulations. The Maryland Increase Surplus Account — Resolution For— - Corporate Resolutions typically includes the following key elements: 1. Heading: The form starts with a heading that clearly identifies the document as the resolution form for the increase of the surplus account. 2. Corporation Details: The name, address, and other identifying information of the corporation are provided. This helps to accurately identify the specific corporation for which the resolution is being implemented. 3. Resolution Details: This section outlines the resolutions being passed to increase the surplus account. It includes the specific amount or percentage by which the surplus account will be increased, as well as the effective date of the increase. 4. Legal Authorization: The resolution must state the specific Maryland state laws or provisions that grant the corporation the authority to increase its surplus account. This ensures compliance with relevant statutes and regulations. 5. Signatures: The resolution form requires the signatures of the corporation's authorized individuals, typically the board of directors or majority shareholders. These signatures validate the decision and indicate their consent to the increase of the surplus account. 6. Notarization: Depending on the specific requirements of the jurisdiction or the corporation's bylaws, the resolution may need to be notarized by a certified notary public. Different types of Maryland Increase Surplus Account — Resolution For— - Corporate Resolutions may exist based on the specific circumstances or needs of the corporation. For example, there might be separate forms for the increase of surplus account for profit corporations, non-profit corporations, or specific industries. However, the core elements detailed above will likely be present in all variations of the resolution form.