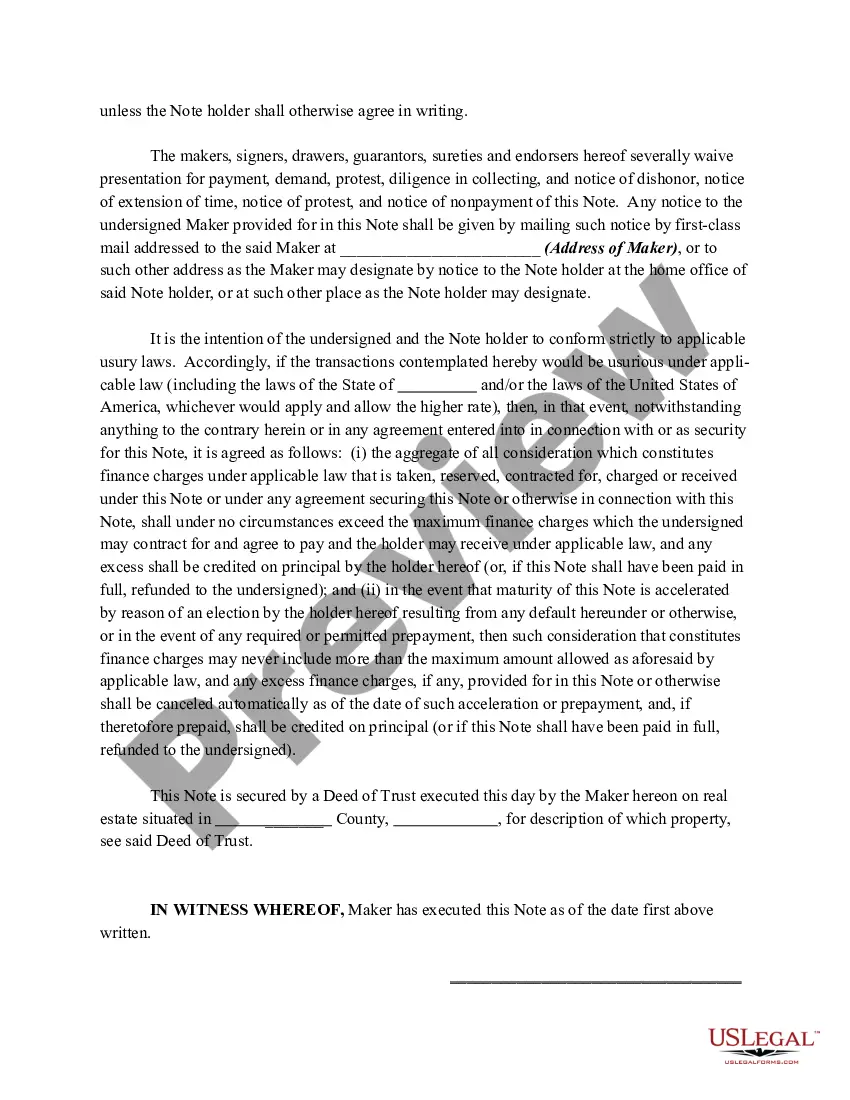

A Maryland Promissory Note — Balloon Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Maryland. This type of promissory note is known as a balloon note because it includes a large, final payment that is due at the end of the loan term. Keywords associated with a Maryland Promissory Note — Balloon Note include: Maryland, promissory note, balloon note, loan agreement, lender, borrower, terms and conditions, final payment, loan term. In this type of promissory note, the borrower agrees to repay the loan amount, typically with interest, in regular installments over a specified period of time. However, unlike a traditional promissory note, which requires equal payments throughout the loan term, a balloon note requires smaller, regular payments with a large, lump-sum payment due at the end. The purpose of including a balloon payment in a promissory note is to lower the regular monthly payments for the borrower during the loan term. This can be especially beneficial for borrowers who have limited resources or cash flow, allowing them to make smaller payments until the final payment comes due. There are different types of Maryland Promissory Note — Balloon Notes, including: 1. Secured Balloon Note: This type of balloon note includes a specific collateral, such as property or a vehicle, that acts as security for the loan. If the borrower defaults on the loan, the lender has the right to seize the collateral to satisfy the outstanding debt. 2. Unsecured Balloon Note: This type of balloon note does not require any collateral as security for the loan. If the borrower defaults, the lender does not have any specific property or asset to seize, but they can pursue legal action to recover the outstanding debt. 3. Commercial Balloon Note: This type of balloon note is commonly used for commercial loans, such as business financing or real estate transactions. It typically involves larger loan amounts and longer loan terms compared to personal loans. In conclusion, a Maryland Promissory Note — Balloon Note is a loan agreement that includes smaller regular payments with a large, final payment due at the end of the loan term. Different types of balloon notes include secured, unsecured, and commercial balloon notes. The main purpose of a balloon note is to reduce the regular monthly payments for the borrower and can be beneficial for individuals or businesses with limited cash flow.

Maryland Promissory Note - Balloon Note

Description

How to fill out Maryland Promissory Note - Balloon Note?

You can commit several hours on the Internet attempting to find the legal record template that meets the state and federal requirements you require. US Legal Forms supplies thousands of legal types which are examined by pros. It is simple to obtain or printing the Maryland Promissory Note - Balloon Note from the service.

If you already possess a US Legal Forms account, you are able to log in and click on the Download switch. After that, you are able to full, modify, printing, or signal the Maryland Promissory Note - Balloon Note. Each and every legal record template you purchase is the one you have forever. To obtain an additional version of any acquired form, proceed to the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms site the first time, adhere to the basic guidelines listed below:

- Initial, make sure that you have chosen the right record template for the region/town of your liking. See the form information to ensure you have picked out the proper form. If offered, make use of the Review switch to search through the record template too.

- If you would like locate an additional model of the form, make use of the Look for industry to obtain the template that meets your needs and requirements.

- Once you have discovered the template you want, simply click Acquire now to move forward.

- Select the pricing program you want, enter your credentials, and sign up for a free account on US Legal Forms.

- Total the purchase. You should use your bank card or PayPal account to pay for the legal form.

- Select the formatting of the record and obtain it to the device.

- Make changes to the record if necessary. You can full, modify and signal and printing Maryland Promissory Note - Balloon Note.

Download and printing thousands of record themes utilizing the US Legal Forms web site, that offers the most important selection of legal types. Use skilled and state-specific themes to deal with your company or specific demands.