Maryland Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title

Description

How to fill out Affidavit By Heirs Regarding Agreement As To Who Shall Inherit Motor Vehicle - To Obtain Transfer Of Title?

If you have to total, obtain, or print authorized file layouts, use US Legal Forms, the most important selection of authorized varieties, which can be found on the web. Utilize the site`s basic and handy lookup to discover the files you require. A variety of layouts for enterprise and individual reasons are sorted by categories and says, or keywords. Use US Legal Forms to discover the Maryland Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title within a number of click throughs.

Should you be presently a US Legal Forms client, log in for your profile and click the Acquire button to obtain the Maryland Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title. You can even gain access to varieties you earlier saved in the My Forms tab of your profile.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the form for that appropriate area/land.

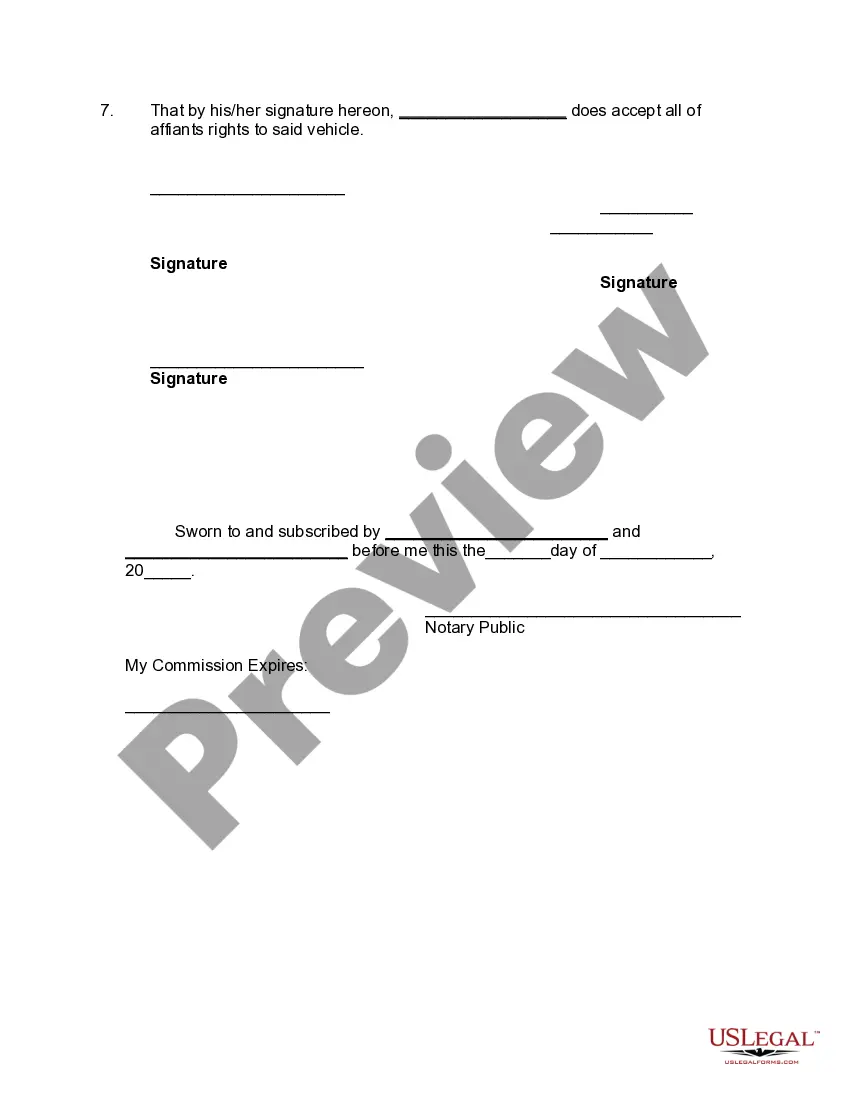

- Step 2. Make use of the Preview method to look through the form`s information. Never neglect to see the information.

- Step 3. Should you be not satisfied together with the kind, take advantage of the Search area on top of the screen to get other types of your authorized kind template.

- Step 4. When you have identified the form you require, select the Buy now button. Pick the pricing plan you like and add your accreditations to register for an profile.

- Step 5. Method the deal. You may use your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Find the formatting of your authorized kind and obtain it on your own device.

- Step 7. Full, edit and print or sign the Maryland Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title.

Each and every authorized file template you buy is the one you have permanently. You possess acces to each kind you saved inside your acccount. Click the My Forms portion and choose a kind to print or obtain once more.

Compete and obtain, and print the Maryland Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title with US Legal Forms. There are thousands of expert and state-particular varieties you may use for your personal enterprise or individual requirements.

Form popularity

FAQ

Non-probate estate: property that passes outside the probate estate, including, but not limited to jointly held assets, life estate or remainder interests in a trust or deed, trusts in which the decedent had an interest, payable on death (P.O.D.)

If you intend to transfer the ownership of the vehicle to another person, either by sale or as a gift, please complete the "assignment of ownership" section on the back of the "Certificate of Title." To the new owner you will need to give the title, a certified copy of the death certificate or the letter (form VR-278 ...

In Maryland, when a person dies and they own any assets in their name, those assets would have to go through the probate process.

?A vehicle owner can designate a beneficiary to receive ownership of a Maryland titled vehicle upon their death. Since the designation is made prior to the death of the individual, the vehicle will not be considered part of the estate, therefore Letters of Administration will not be required for transfer.

If the vehicle is titled in Maryland, excise tax (6% of the vehicle's value) may not be collected when a family member gives the vehicle to you as a bona fide gift. Allowable family relationships are identified on the Application for Maryland Gift Certification (see below).

The family member needs the title, a certified copy of the death certificate or the letter (form VR-278 or VR-264P) sent by the MVA notifying the surviving vehicle owner that the title must be transferred to remove the deceased owners name.

Non-probate property ? Property not subject to the terms of a decedent's Last Will and Testament, and which passes to a beneficiary outside of the probate process, such as property that had been transferred into trust prior to death, joint tenants by right of survivorship (or tenants by the entireties), payable on ...

Ownership of your car passes by title. Many couples only hold title to a vehicle in the name of the spouse who will be the primary driver of the car. When a car is titled in the sole name of the Decedent (the person who passed away), ordinarily the car must be included in the Decedent's probate estate.