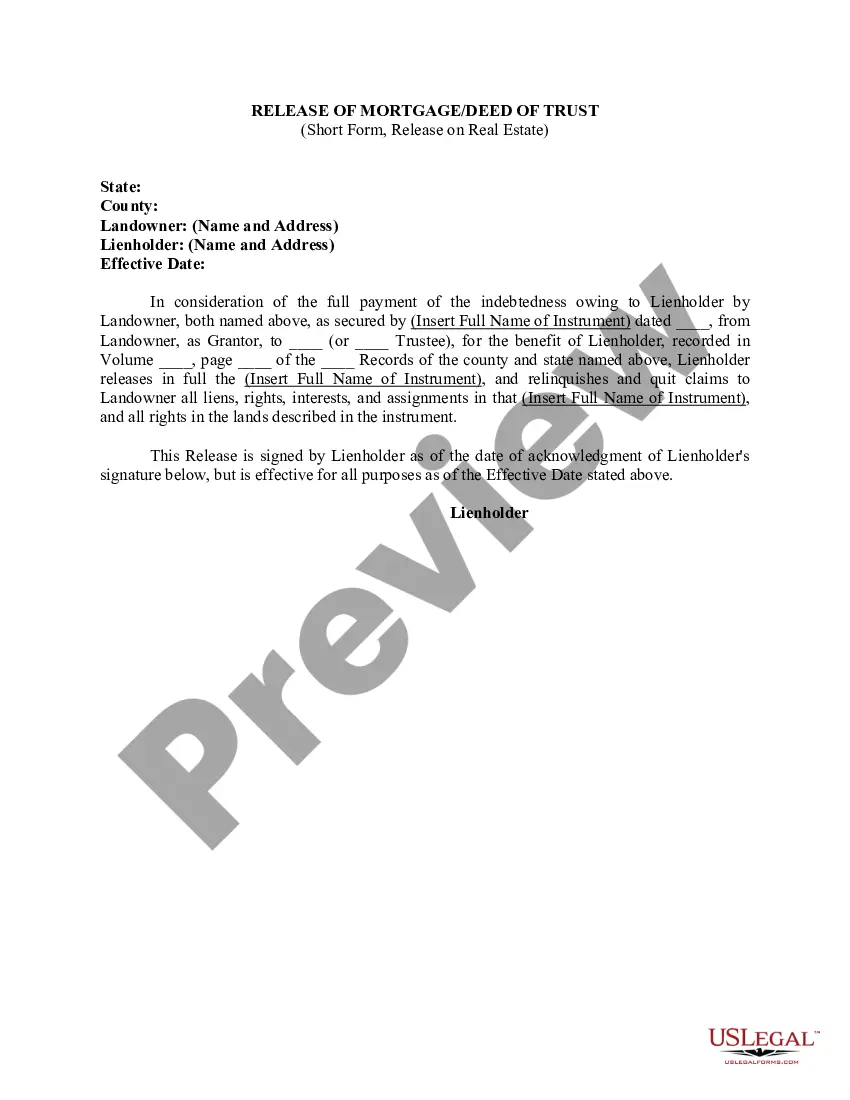

Maryland Deed of Trust - Release

Description

How to fill out Deed Of Trust - Release?

It is possible to commit hrs on the Internet trying to find the legitimate record web template that meets the state and federal requirements you want. US Legal Forms offers thousands of legitimate forms that are examined by pros. It is possible to download or printing the Maryland Deed of Trust - Release from our service.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Acquire switch. After that, you are able to full, modify, printing, or indicator the Maryland Deed of Trust - Release. Every single legitimate record web template you purchase is yours forever. To acquire an additional version of any bought type, check out the My Forms tab and then click the related switch.

If you use the US Legal Forms site for the first time, follow the basic recommendations under:

- Very first, make certain you have selected the best record web template to the county/area that you pick. Look at the type explanation to make sure you have chosen the correct type. If readily available, take advantage of the Review switch to look through the record web template as well.

- If you want to discover an additional model from the type, take advantage of the Research industry to find the web template that fits your needs and requirements.

- Once you have located the web template you desire, just click Buy now to continue.

- Pick the pricing program you desire, enter your qualifications, and register for your account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal accounts to pay for the legitimate type.

- Pick the format from the record and download it for your gadget.

- Make alterations for your record if needed. It is possible to full, modify and indicator and printing Maryland Deed of Trust - Release.

Acquire and printing thousands of record templates utilizing the US Legal Forms Internet site, that provides the largest collection of legitimate forms. Use skilled and state-particular templates to handle your company or individual requirements.

Form popularity

FAQ

To take someone's name off a deed, a new deed must be prepared to transfer the property from all of the current owners to all of the remaining owners.

(4) Unless otherwise stated in an instrument recorded among the land records, a trustee under a deed of trust may execute, acknowledge, and deliver partial releases.

Maryland deed of trust and note forms are generally sealed documents to which the 12 year period applies.

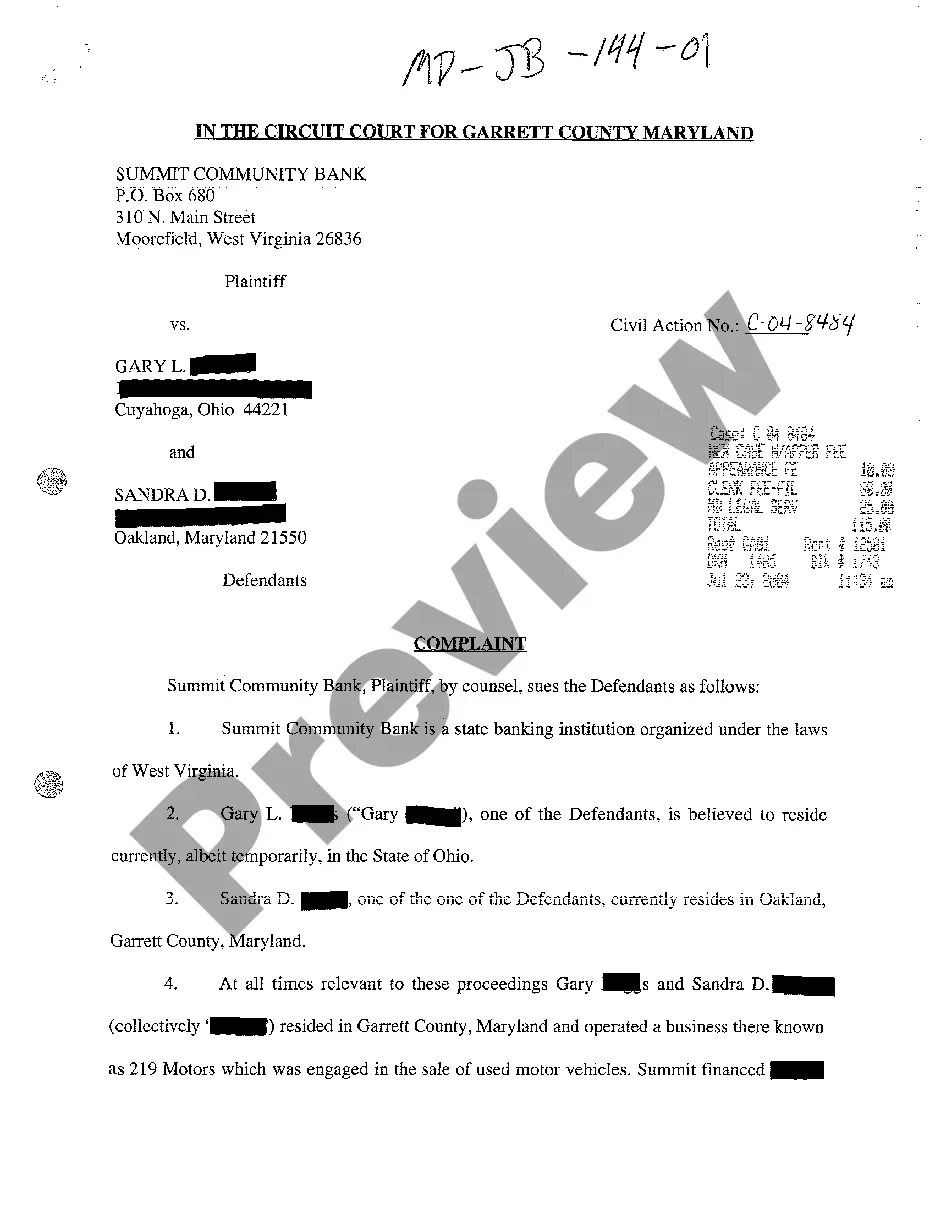

Rule 12-307 - Release of Lien (a) Motion. At any time after a complaint to establish a mechanics' lien is filed, the owner of the land or any other person interested in the land may move to have the land released from any lien that has been established by court order or that may thereafter be established.

County or Independent City Forms An individual (i.e., a "natural person") appointed as trustee in a deed of trust or as a substitute trustee shall conduct the sale of property subject to a deed of trust. The individual need not be a Maryland resident.

Through a deed of release of mortgage, also called a release of deed of trust, the lender agrees to remove the deed of trust, which is the document containing all of the mortgage's terms and conditions that is filed at the beginning of the mortgage process.

There are two ways to get a copy of your deed. Either get your deed online or pick up a copy in person at the circuit court. Deeds and most other documents kept by the Land Records Department are available through mdlandrec.net.