Maryland Financial Statement Form — Universal Use is a standardized document utilized for reporting financial information in the state of Maryland. This comprehensive form provides a detailed overview of an individual's or entity's financial standing, including assets, liabilities, income, expenses, and other relevant financial data. This financial statement form is designed to be universally applicable, making it accessible for various purposes, such as loan applications, divorce settlements, estate planning, and business transactions. It serves as a crucial tool for assessing an individual's financial health, allowing lenders, attorneys, or other parties to make informed decisions based on a clear and accurate understanding of their financial situation. Some key sections found within the Maryland Financial Statement Form — Universal Use include: 1. Personal Information: This section requires the individual's basic details such as name, address, contact information, and social security number. 2. Assets: Here, individuals are expected to provide a detailed list of their assets, including cash on hand, bank accounts, real estate properties, vehicles, investments, retirement accounts, and any other valuable possessions. 3. Liabilities: This section encompasses all the debts and financial obligations an individual has, including credit card balances, mortgages, loans, outstanding taxes, and any other liabilities. 4. Income: Individuals are required to disclose their sources of income, such as employment salaries, business income, rental income, dividends, interest, and any other applicable revenue streams. Additionally, details about other sources of financial support, such as alimony or child support, may be included in this section. 5. Expenses: This section highlights an individual's monthly or annual expenses, including rent or mortgage payments, utilities, transportation costs, insurance, education expenses, healthcare costs, and other relevant expenditures. 6. Other Financial Information: The form may include sections for additional financial details, such as bank account information, investment portfolios, and any significant financial transactions. While the Maryland Financial Statement Form — Universal Use provides a comprehensive framework, it's important to note that there may be variations or supplemental forms available for specific purposes. For instance, there might be specialized financial statement forms tailored for businesses, non-profit organizations, or specific legal proceedings like divorce or child custody cases. To ensure accuracy and compliance, it is always recommended consulting with a financial advisor, attorney, or relevant expert familiar with Maryland's regulations and guidelines when completing the Maryland Financial Statement Form — Universal Use or any associated specialized forms.

Maryland Financial Statement Form - Universal Use

Description

How to fill out Maryland Financial Statement Form - Universal Use?

Have you ever found yourself in a situation where you need documents for either business or personal reasons nearly every single day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of template options, such as the Maryland Financial Statement Form - Universal Use, designed to comply with federal and state regulations.

Once you have found the right form, click Purchase now.

Choose your preferred pricing plan, fill out the necessary information to create your account, and complete the purchase using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Financial Statement Form - Universal Use template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is appropriate for your specific city/county.

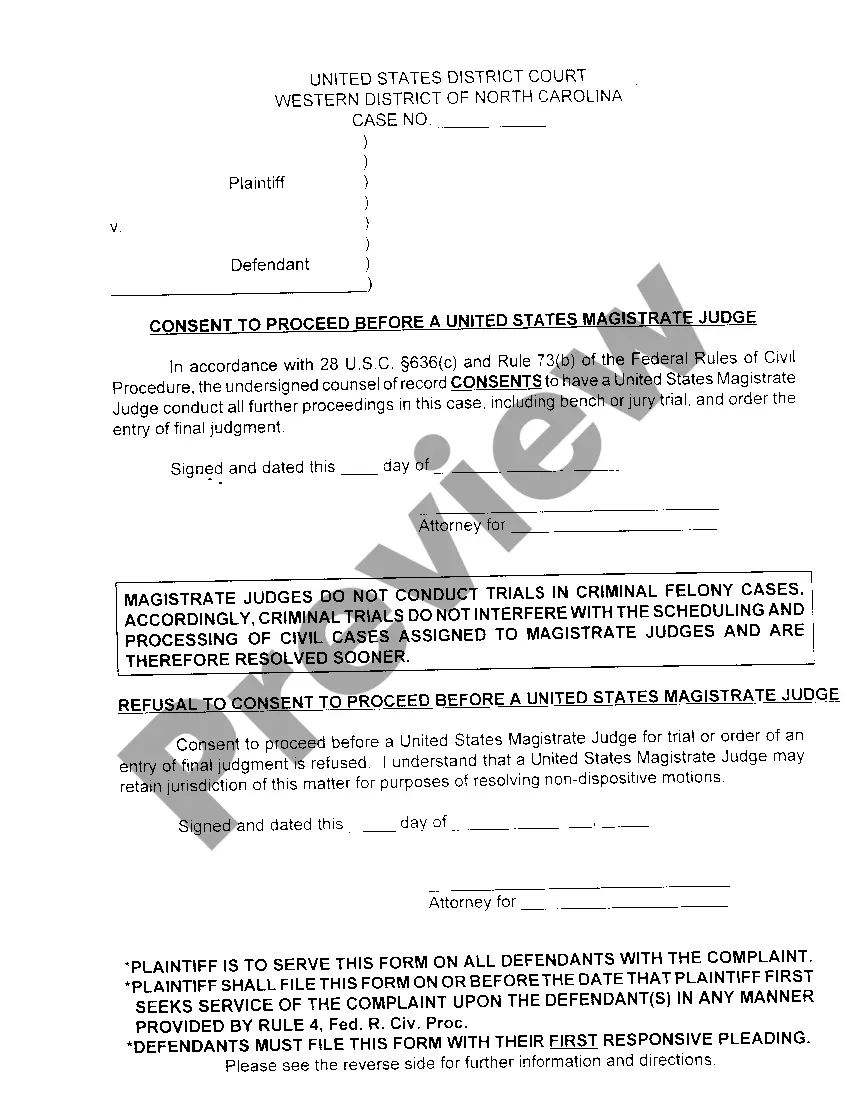

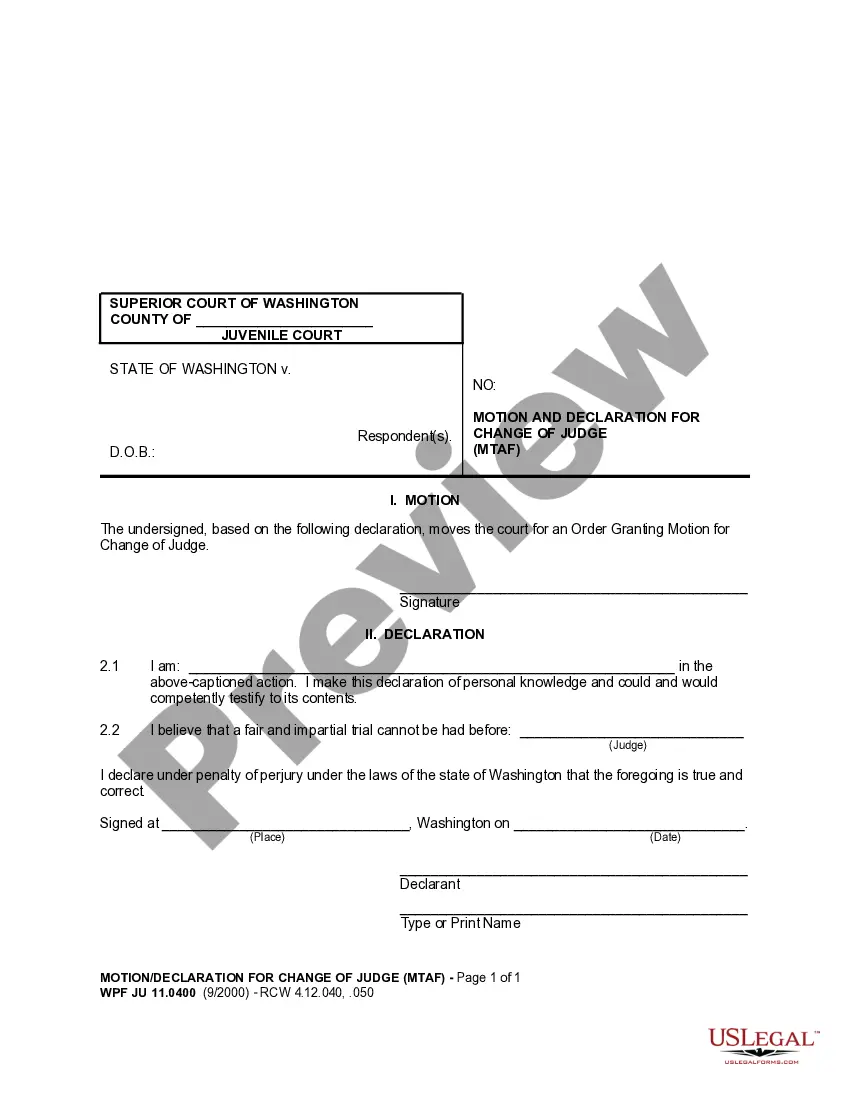

- Utilize the Preview feature to review the document.

- Examine the description to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search field to find the document that fits your needs.

Form popularity

FAQ

How to Prepare a Basic Balance SheetDetermine the Reporting Date and Period.Identify Your Assets.Identify Your Liabilities.Calculate Shareholders' Equity.Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

According to the Corporate Finance Institute, the basic financial statement format for an income statement states revenues first, followed by expenses. The expenses are subtracted from the revenue to calculate the net income of the business.

But with the help of computer software, you may be able to prepare your own financial statements. If you need to prepare financial statements for a third party, such as a banker, sometimes the third party may request that the financial statements be prepared by a professional accountant or certified public accountant.

How To Fill Out the Personal Financial StatementStep 1: Choose The Appropriate Program.Step 2: Fill In Your Personal Information.Step 3: Write Down Your Assets.Step 4: Write Down Your Liabilities.Step 5: Fill Out the Notes Payable to Banks and Others Section.Step 6: Fill Out the Stocks and Bonds Section.More items...?27-Oct-2021

The income statement summarizes a company's revenues and expenses over a period, either quarterly or annually. The income statement comes in two forms, multi-step and single-step. The multi-step income statement includes four measures of profitability: gross, operating, pretax, and after tax.

A Maryland Long Form Financial Statement is a key document which the Court relies on when determining child support and alimony and is often used by the court to determine whether a party should be awarded attorney's fees.

To write an income statement and report the profits your small business is generating, follow these accounting steps:Pick a Reporting Period.Generate a Trial Balance Report.Calculate Your Revenue.Determine Cost of Goods Sold.Calculate the Gross Margin.Include Operating Expenses.Calculate Your Income.More items...

The key things a financial report should include are:Cash flow data.Asset and liability evaluation.Shareholder equity analysis.Profitability measurements.

Steps to Prepare an Income StatementChoose Your Reporting Period. Your reporting period is the specific timeframe the income statement covers.Calculate Total Revenue.Calculate Cost of Goods Sold (COGS)Calculate Gross Profit.Calculate Operating Expenses.Calculate Income.Calculate Interest and Taxes.Calculate Net Income.

The divorce financial statement is a form that lists all assets and liabilities of each person involved in the divorce. Each person must fill one out their portion and submit it to the court in order to explain their financial situation to the court.