Maryland Corporate Guaranty — General is a legal document that serves as a promise or assurance made by a corporation located in Maryland, United States, to guarantee the obligations or debts of another party. This type of guarantee provides a safeguard for lenders or creditors in case the primary borrower fails to fulfill their financial commitments. The Maryland Corporate Guaranty — General is a widely recognized and accepted form of assurance, offering protection to lenders and creditors by establishing the liability of the guarantor. It ensures that the creditors have an additional layer of security and can seek payment or compensation from the guarantor if the debtor defaults. There are various types of Maryland Corporate Guaranty — General that may differ in terms of their specifics or purpose. Some common variations include: 1. Full Guaranty: This type of guaranty provides a complete assurance for the entire debt or obligation. In case the primary borrower fails to fulfill their financial commitments, the guarantor is fully responsible for repaying the debt. 2. Limited Guaranty: As the name suggests, a limited guaranty only covers a specific portion of the debt or obligation. The guarantor's liability is limited to a predefined amount or a certain period of time. 3. Continuing Guaranty: This type of guaranty extends to future obligations or debts as they arise. It remains in effect until the guarantor gives written notice to terminate the guarantee. It provides ongoing protection to the lenders or creditors. 4. Payment Guaranty: In a payment guaranty, the guarantor ensures the prompt and full payment of debts or obligations by the primary borrower. If the borrower fails to make payments, the guarantor steps in to fulfill the financial commitments. 5. Performance Guaranty: Unlike a payment guaranty, a performance guaranty assures the performance of certain obligations or duties by the primary borrower. If the borrower fails to meet their obligations, the guarantor takes responsibility for fulfilling the terms outlined in the agreement. It's crucial for the parties involved to understand the terms and conditions specified in the Maryland Corporate Guaranty — General before signing the agreement. Consulting with legal professionals familiar with the laws and regulations in Maryland are highly advisable to ensure compliance and protection for all parties involved.

Maryland Corporate Guaranty - General

Description

How to fill out Maryland Corporate Guaranty - General?

Discovering the right lawful papers template can be quite a have a problem. Naturally, there are a variety of templates accessible on the Internet, but how will you find the lawful develop you want? Take advantage of the US Legal Forms website. The service gives thousands of templates, for example the Maryland Corporate Guaranty - General, which you can use for company and private demands. Each of the kinds are checked out by professionals and satisfy federal and state requirements.

Should you be already authorized, log in for your profile and click the Acquire button to have the Maryland Corporate Guaranty - General. Use your profile to look from the lawful kinds you may have acquired earlier. Go to the My Forms tab of your own profile and get an additional copy from the papers you want.

Should you be a brand new customer of US Legal Forms, allow me to share basic directions for you to stick to:

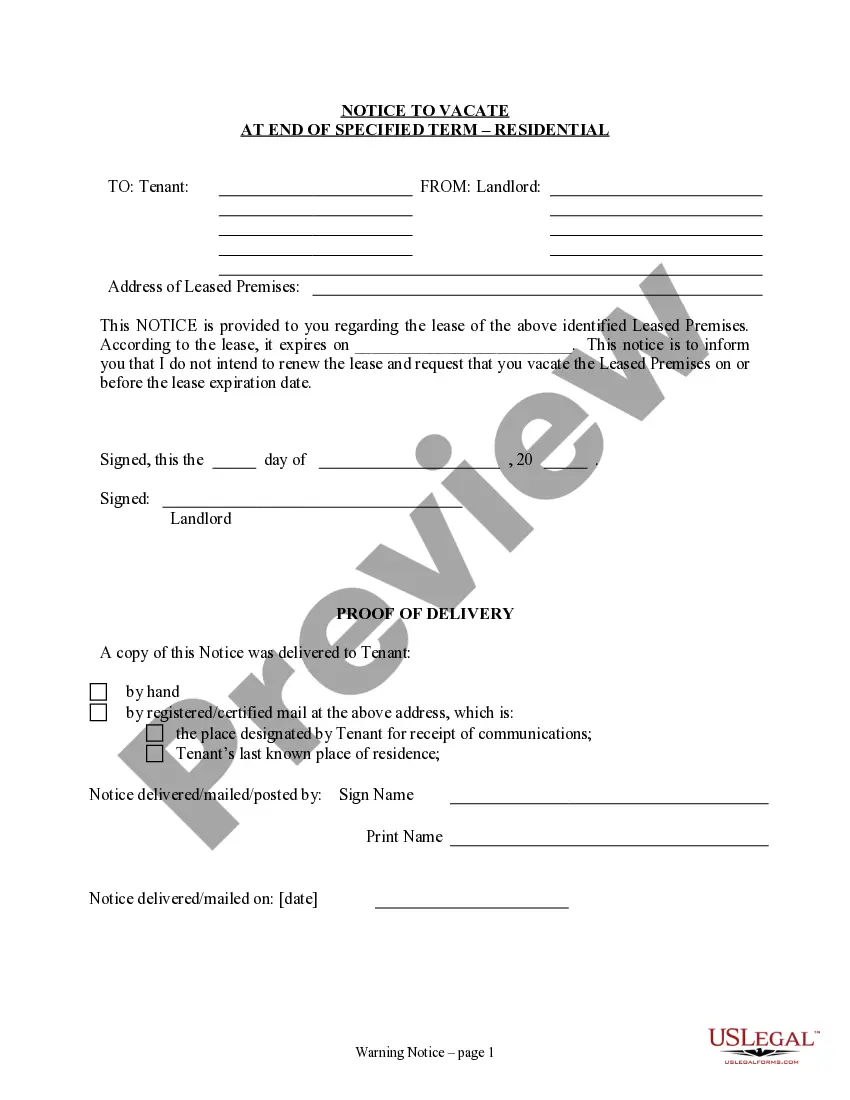

- Very first, ensure you have chosen the right develop for your personal metropolis/county. You are able to check out the shape utilizing the Review button and look at the shape explanation to guarantee it will be the best for you.

- In the event the develop will not satisfy your needs, take advantage of the Seach field to get the appropriate develop.

- When you are positive that the shape would work, go through the Get now button to have the develop.

- Opt for the prices strategy you would like and enter the required details. Build your profile and buy the order using your PayPal profile or charge card.

- Select the document formatting and down load the lawful papers template for your system.

- Total, modify and print out and indication the acquired Maryland Corporate Guaranty - General.

US Legal Forms will be the largest collection of lawful kinds for which you can discover different papers templates. Take advantage of the service to down load expertly-manufactured papers that stick to express requirements.