The Maryland Guaranty of Promissory Note by Corporation — Individual Borrower is a legal document that outlines the obligations and responsibilities of an individual borrower and a corporation in a loan agreement. This document is specific to the state of Maryland and serves as a guarantee for the repayment of a promissory note. The guaranty is a contract between the individual borrower and the corporation, in which the borrower agrees to repay the loan on behalf of the corporation if the corporation defaults on its payment obligations. This provides an added level of security for the lender, ensuring that they will receive the full amount of the loan in the event of default. A Maryland Guaranty of Promissory Note by Corporation — Individual Borrower typically includes the following key provisions: 1. Identification of the parties: The document clearly identifies the corporation and the individual borrower involved in the loan agreement. 2. Purpose: It states the purpose of the guaranty, which is to provide additional assurance to the lender that the loan will be repaid. 3. Guarantor's obligations: The guarantor, who is the individual borrower, agrees to be personally responsible for fulfilling the corporation's repayment obligations under the promissory note. This means that if the corporation defaults, the guarantor will repay the loan amount on its behalf. 4. Guarantor's representations: The guarantor often makes certain representations and warranties in the guaranty, which may include statements regarding their authority to enter into the agreement, their financial position, and their understanding of the risks involved. 5. Events of default: The document often outlines specific events that would trigger a default by the corporation. This could include failure to make timely loan payments, breach of any terms of the promissory note, or insolvency of the corporation. 6. Release: The guaranty may state conditions under which the guarantor's obligations will be released, such as full repayment of the loan by the corporation, termination of the loan agreement, or upon mutual agreement between all parties involved. There may be different types or variations of the Maryland Guaranty of Promissory Note by Corporation — Individual Borrower, depending on the specific terms and conditions agreed upon by the parties. Some variations may include specific provisions related to interest rates, repayment schedules, collateral, and any additional warranties or guarantees made by either party. It is important to note that while this description provides a general overview of a Maryland Guaranty of Promissory Note by Corporation — Individual Borrower, legal advice from a qualified attorney can provide more specific and accurate information based on individual circumstances.

Maryland Guaranty of Promissory Note by Corporation - Individual Borrower

Category:

State:

Multi-State

Control #:

US-00527B

Format:

Word;

Rich Text

Instant download

Description

This Guaranty of Promissory Note by Corporation - Individual Borrower is a guarantee to Payees, jointly and severally, the full and prompt payment and performance by the Borrower of all of its obligations under and pursuant to the Promissory Notes, together with the full and prompt payment of any and all costs and expenses of and incidental to the enforcement of the Guaranty, including attorneys' fees.

The Maryland Guaranty of Promissory Note by Corporation — Individual Borrower is a legal document that outlines the obligations and responsibilities of an individual borrower and a corporation in a loan agreement. This document is specific to the state of Maryland and serves as a guarantee for the repayment of a promissory note. The guaranty is a contract between the individual borrower and the corporation, in which the borrower agrees to repay the loan on behalf of the corporation if the corporation defaults on its payment obligations. This provides an added level of security for the lender, ensuring that they will receive the full amount of the loan in the event of default. A Maryland Guaranty of Promissory Note by Corporation — Individual Borrower typically includes the following key provisions: 1. Identification of the parties: The document clearly identifies the corporation and the individual borrower involved in the loan agreement. 2. Purpose: It states the purpose of the guaranty, which is to provide additional assurance to the lender that the loan will be repaid. 3. Guarantor's obligations: The guarantor, who is the individual borrower, agrees to be personally responsible for fulfilling the corporation's repayment obligations under the promissory note. This means that if the corporation defaults, the guarantor will repay the loan amount on its behalf. 4. Guarantor's representations: The guarantor often makes certain representations and warranties in the guaranty, which may include statements regarding their authority to enter into the agreement, their financial position, and their understanding of the risks involved. 5. Events of default: The document often outlines specific events that would trigger a default by the corporation. This could include failure to make timely loan payments, breach of any terms of the promissory note, or insolvency of the corporation. 6. Release: The guaranty may state conditions under which the guarantor's obligations will be released, such as full repayment of the loan by the corporation, termination of the loan agreement, or upon mutual agreement between all parties involved. There may be different types or variations of the Maryland Guaranty of Promissory Note by Corporation — Individual Borrower, depending on the specific terms and conditions agreed upon by the parties. Some variations may include specific provisions related to interest rates, repayment schedules, collateral, and any additional warranties or guarantees made by either party. It is important to note that while this description provides a general overview of a Maryland Guaranty of Promissory Note by Corporation — Individual Borrower, legal advice from a qualified attorney can provide more specific and accurate information based on individual circumstances.

Free preview

How to fill out Maryland Guaranty Of Promissory Note By Corporation - Individual Borrower?

Are you currently in a circumstance where you require documents for either business or personal purposes almost all the time.

There are many legal document templates available online, but finding templates that you can trust is not simple.

US Legal Forms offers a vast collection of forms, including the Maryland Guaranty of Promissory Note by Corporation - Individual Borrower, that are drafted to comply with federal and state regulations.

Choose the pricing option you prefer, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Guaranty of Promissory Note by Corporation - Individual Borrower template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

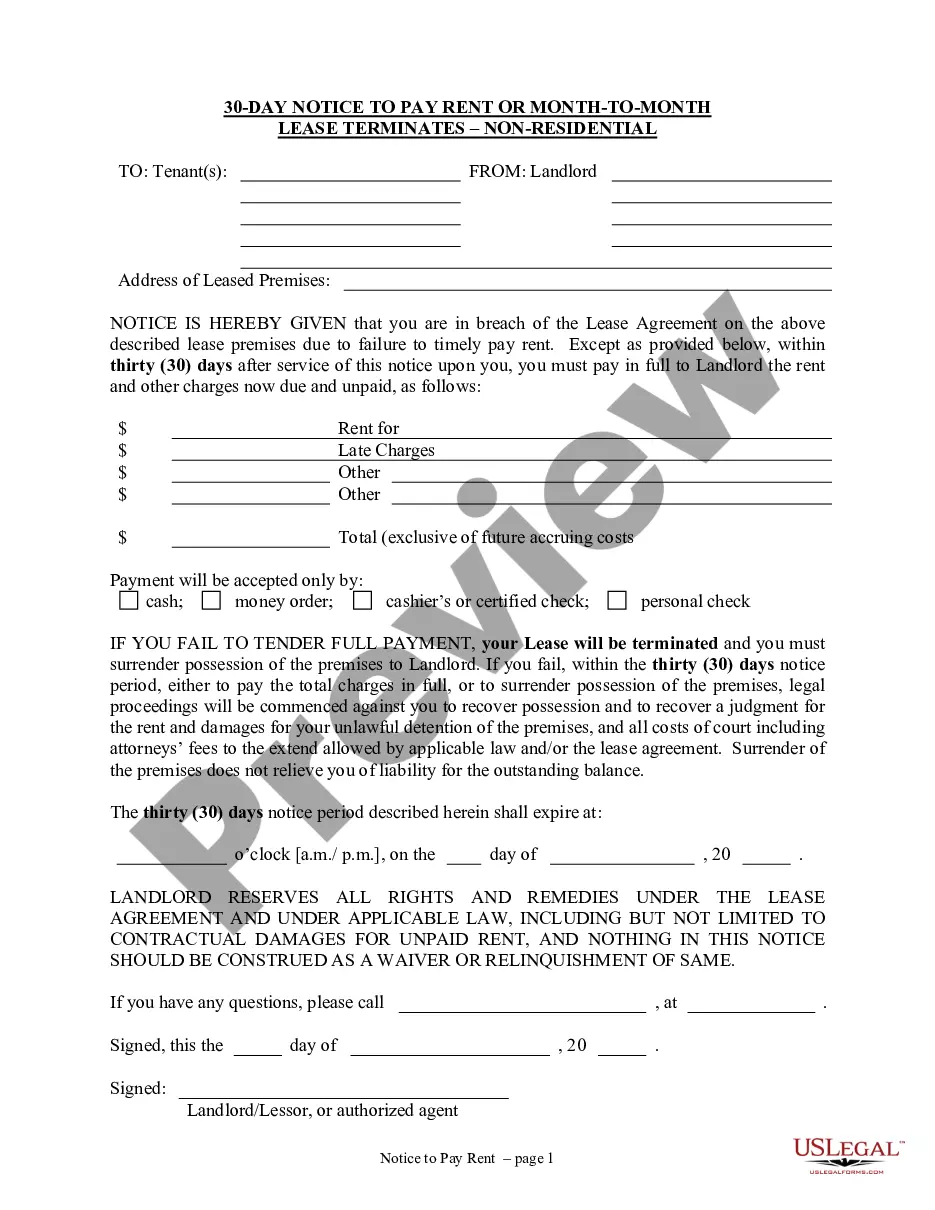

- Utilize the Review button to verify the form.

- Check the description to ensure that you have selected the correct form.

- If the form is not what you're looking for, use the Search area to find the form that fits your requirements.

- When you locate the correct form, simply click Purchase now.