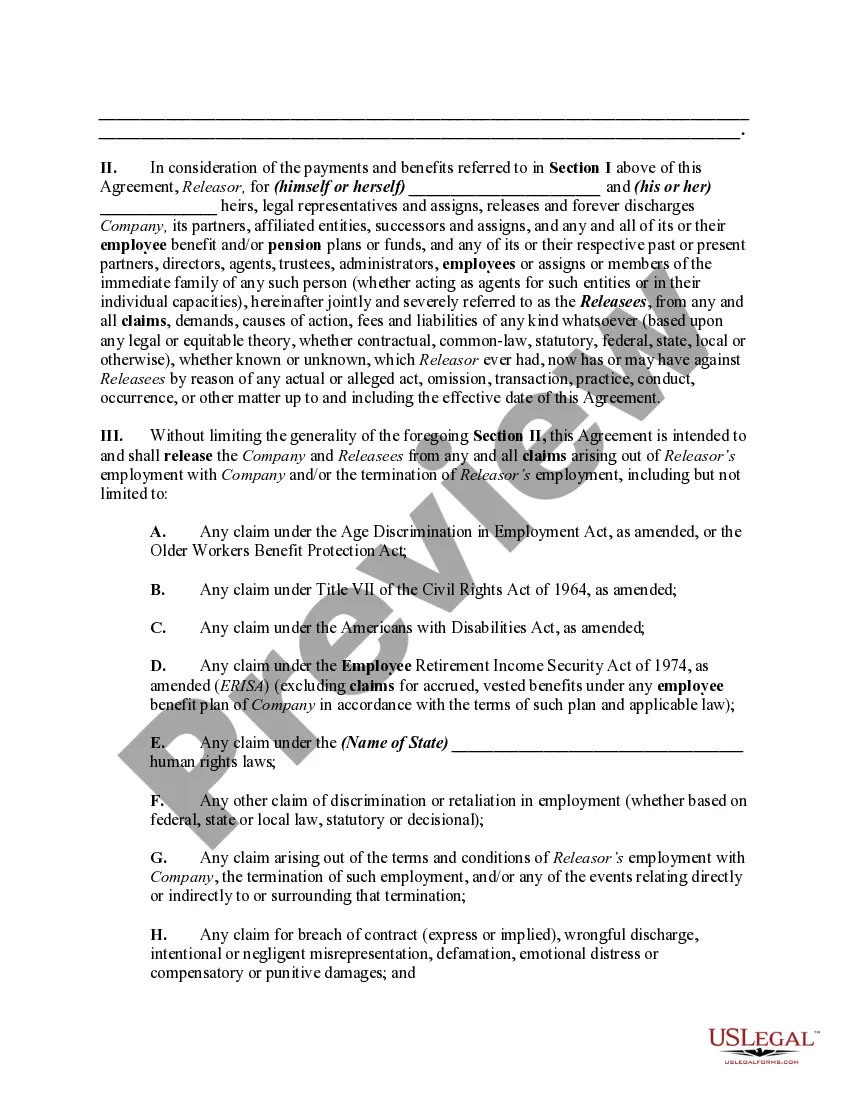

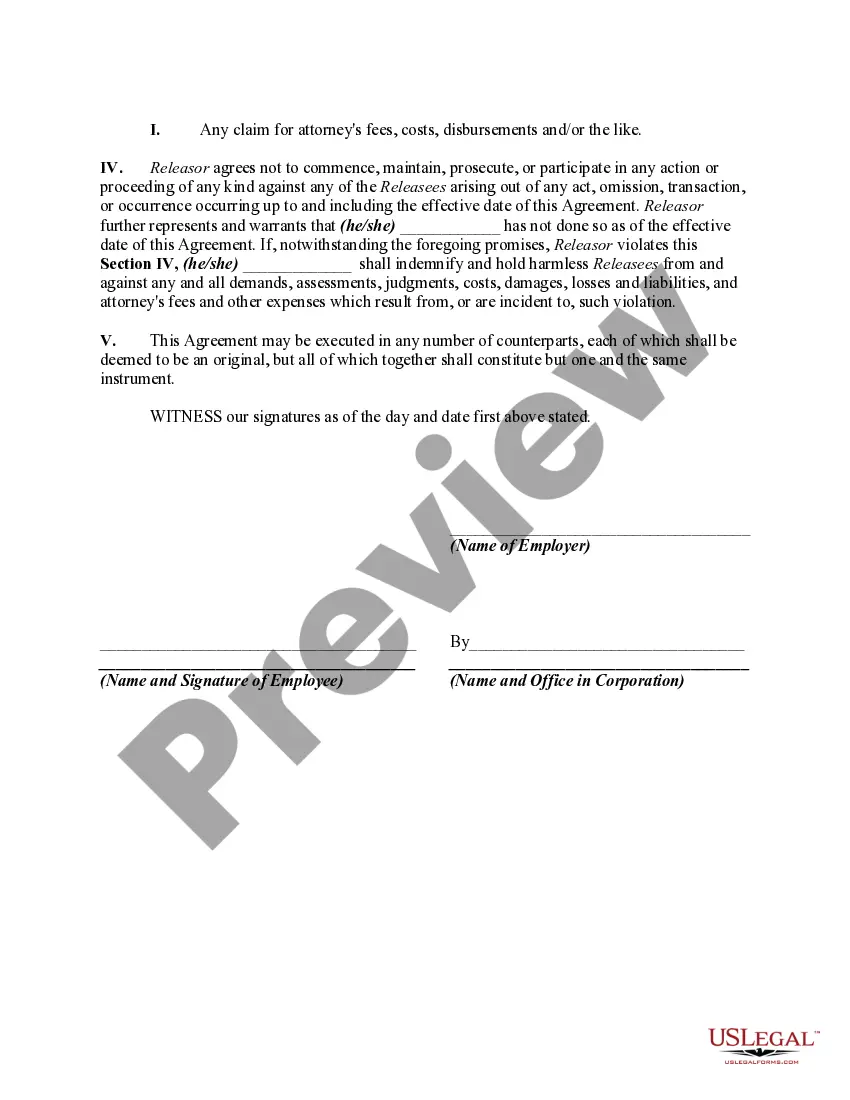

In this form, as a result of a lump sum settlement, a former employee is releasing a former employer from any and all claims for breach of contract or wrongful termination as well as any claim under the Employee Retirement Income Security Act of 1974, as amended (ERISA); any claim under the Age Discrimination in Employment Act, as amended, or the Older Workers Benefit Protection Act; any claim under Title VII of the Civil Rights Act of 1964, as amended; any claim under the Americans with Disabilities Act, as amended; and any other claim of discrimination or retaliation in employment (whether based on federal, state or local law, statutory or decisional);

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Maryland Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds Introduction: In Maryland, a Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal contract that allows an employee to waive their rights to bring legal claims against their former employer upon termination. This comprehensive release encompasses various aspects, including employee benefits and pension plans. There are several types of this release that employees should be aware of to fully understand their rights and responsibilities. 1. Maryland General Release by Employee: A Maryland General Release by Employee is a broad form of release that covers all claims, known or unknown, arising from the employment relationship, including the release of claims related to employee benefits and pension plans. By signing this document, employees agree not to bring any legal actions against their former employer, ensuring a final resolution to their terminated employment. 2. Maryland Release of Claims under Federal Employee Benefit and Pension Laws: This release is specifically designed to address claims arising under federal employee benefit and pension laws, such as the Employee Retirement Income Security Act (ERICA). It allows employees to release their former employer from any legal claims related to benefits and pension plans governed by federal law. 3. Maryland Release of Claims under State Employee Benefit and Pension Laws: In addition to federal laws, states may have their own regulations regarding employee benefits and pension plans. This type of release is tailored to address claims arising under Maryland state laws governing employee benefits and pension plans. By signing this release, employees waive their rights to pursue claims based on state laws. 4. Maryland Release of Claims related to Unpaid Employee Benefits: Unpaid employee benefits, such as salary, vacation pay, or commissions, may be a significant concern for employees upon termination. This release specifically focuses on unpaid employee benefits and pension plans, protecting both parties involved by providing a resolution to any outstanding financial matters. Conclusion: A Maryland Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a vital legal document that establishes the terms of termination and avoids potential litigation. Employees should thoroughly review and understand the specific type of release they are signing to ensure that they are protected and fully aware of the rights they are relinquishing. It is recommended to consult with an employment attorney before signing any legally binding document.Title: Maryland Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds Introduction: In Maryland, a Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal contract that allows an employee to waive their rights to bring legal claims against their former employer upon termination. This comprehensive release encompasses various aspects, including employee benefits and pension plans. There are several types of this release that employees should be aware of to fully understand their rights and responsibilities. 1. Maryland General Release by Employee: A Maryland General Release by Employee is a broad form of release that covers all claims, known or unknown, arising from the employment relationship, including the release of claims related to employee benefits and pension plans. By signing this document, employees agree not to bring any legal actions against their former employer, ensuring a final resolution to their terminated employment. 2. Maryland Release of Claims under Federal Employee Benefit and Pension Laws: This release is specifically designed to address claims arising under federal employee benefit and pension laws, such as the Employee Retirement Income Security Act (ERICA). It allows employees to release their former employer from any legal claims related to benefits and pension plans governed by federal law. 3. Maryland Release of Claims under State Employee Benefit and Pension Laws: In addition to federal laws, states may have their own regulations regarding employee benefits and pension plans. This type of release is tailored to address claims arising under Maryland state laws governing employee benefits and pension plans. By signing this release, employees waive their rights to pursue claims based on state laws. 4. Maryland Release of Claims related to Unpaid Employee Benefits: Unpaid employee benefits, such as salary, vacation pay, or commissions, may be a significant concern for employees upon termination. This release specifically focuses on unpaid employee benefits and pension plans, protecting both parties involved by providing a resolution to any outstanding financial matters. Conclusion: A Maryland Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a vital legal document that establishes the terms of termination and avoids potential litigation. Employees should thoroughly review and understand the specific type of release they are signing to ensure that they are protected and fully aware of the rights they are relinquishing. It is recommended to consult with an employment attorney before signing any legally binding document.