Maryland Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is a legal document that serves as proof of a charitable or educational institution's acknowledgment of receiving a pledged gift in Maryland. This acknowledgment is essential for both the institution and the donor to ensure compliance with Maryland state laws and for tax purposes. The Maryland Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift should contain certain key details. The document should clearly state that it is an acknowledgment and include the institution's full legal name, address, and contact information. It should also provide the donor's name, address, and donation amount, along with a statement confirming that the institution has received a pledged gift from the donor. To ensure the legality of the acknowledgment, the document should highlight the institution's tax-exempt status and emphasize that no goods or services were provided in exchange for the pledged gift. This is crucial for the donor to claim tax deductions and for the institution to maintain its tax-exempt standing. In Maryland, there are no specific types or variations of the Maryland Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift. However, it is important to mention that there might be different templates or formats used by various institutions while drafting this acknowledgment. The content and structure may vary slightly, but the essential information mentioned above should be included in any variant of the acknowledgment to ensure its validity. Keywords: Maryland, Acknowledgment, Charitable Institution, Educational Institution, Receipt, Pledged Gift, Legal Document, Compliance, Tax Deductions, Tax-Exempt Status.

Maryland Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

How to fill out Maryland Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

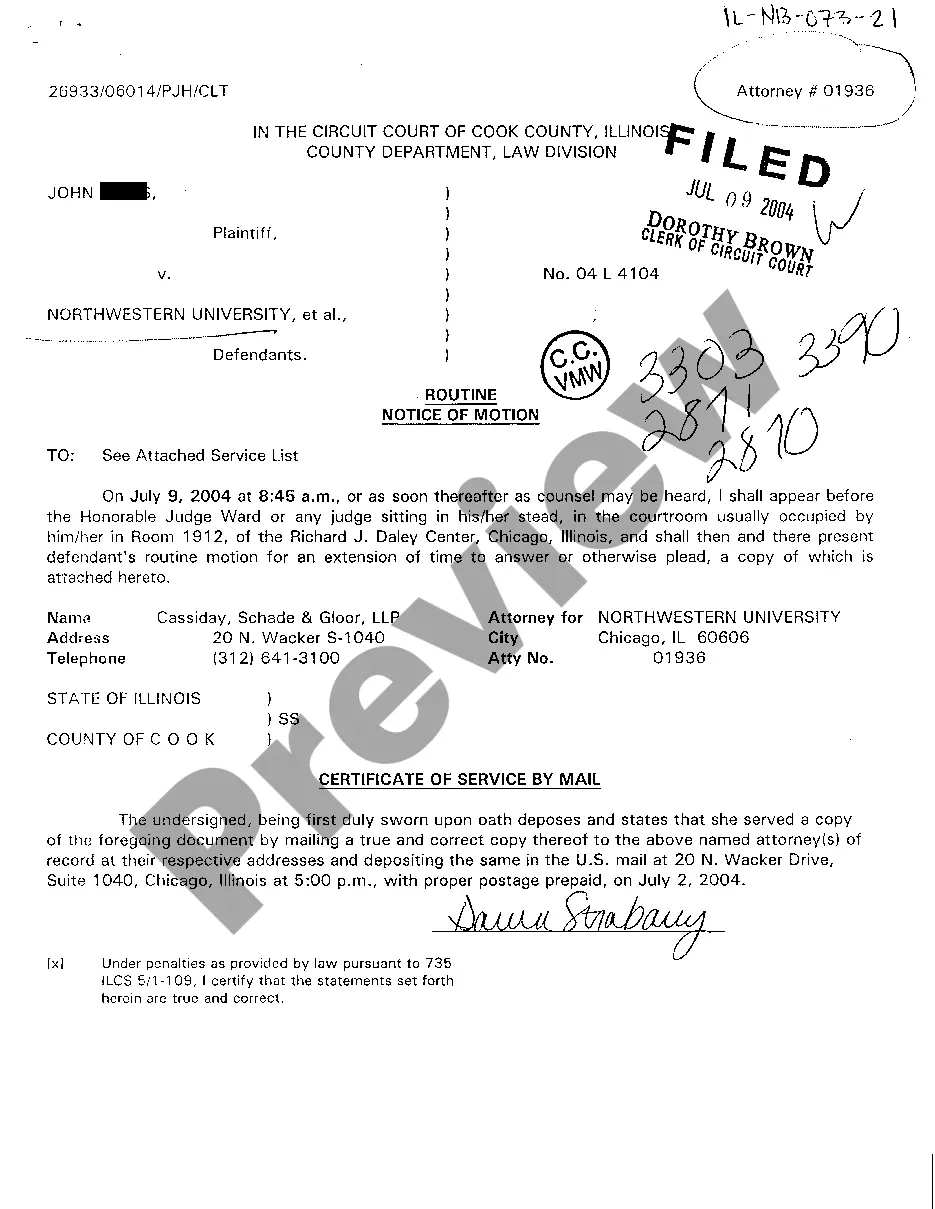

Are you presently inside a place where you require files for either organization or specific functions virtually every day? There are a variety of legitimate document themes available on the net, but getting types you can rely on is not effortless. US Legal Forms delivers 1000s of kind themes, just like the Maryland Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, that are written in order to meet state and federal specifications.

In case you are previously informed about US Legal Forms web site and also have a free account, merely log in. Next, you may acquire the Maryland Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift template.

Unless you come with an account and would like to begin using US Legal Forms, abide by these steps:

- Find the kind you require and make sure it is for the appropriate city/region.

- Utilize the Preview button to check the shape.

- Browse the description to actually have chosen the correct kind.

- When the kind is not what you`re searching for, use the Look for field to obtain the kind that meets your requirements and specifications.

- If you get the appropriate kind, simply click Buy now.

- Pick the pricing plan you would like, fill in the required details to generate your money, and pay money for the order with your PayPal or charge card.

- Pick a hassle-free file formatting and acquire your backup.

Find all of the document themes you may have bought in the My Forms food selection. You can obtain a more backup of Maryland Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift whenever, if required. Just click on the necessary kind to acquire or printing the document template.

Use US Legal Forms, by far the most substantial collection of legitimate varieties, to conserve some time and stay away from blunders. The services delivers professionally created legitimate document themes that can be used for a variety of functions. Produce a free account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

Dear [Donor Name], Today, I'm writing to ask you to support [cause]. By donating just [amount], you can [specific impact]. To donate, [specific action]. Thank you for joining [cause's] efforts during this [adjective] time?It's supporters like you that help us change the world every day.

Here are basic donation receipt requirements in the U.S.: Name of the organization that received the donation. A statement that the nonprofit is a public charity recognized as tax-exempt by the IRS under Section 501(c)(3) Name of the donor. The date of the donation. Amount of cash contribution.

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Each letter should include the following information: The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

10 Short Thank You Message For Donation Examples ?Your support means the world to us! ... ?We are so grateful for your donation and for being a part of our cause. ... ?Thank you for choosing to make a difference through your donation. ... ?From the bottom of our hearts, thank you for your generous contribution.

A donation acknowledgment letter (sometimes called a donation receipt or thank-you letter) is an email or paper that recognizes a charitable contribution. At a bare minimum, it's a confirmation receipt to your donors acknowledging you've received their donation.

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.