Maryland Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone

Description

How to fill out Maryland Credit Cardholder's Report Of Lost Or Stolen Credit Card After Notice By Telephone?

Have you been inside a position where you need to have papers for both organization or specific functions just about every day? There are tons of legitimate record templates available on the net, but locating kinds you can depend on is not easy. US Legal Forms offers 1000s of kind templates, such as the Maryland Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone, which are composed to satisfy federal and state requirements.

When you are currently familiar with US Legal Forms website and possess your account, just log in. After that, you may down load the Maryland Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone template.

Unless you offer an bank account and need to begin to use US Legal Forms, follow these steps:

- Discover the kind you want and make sure it is to the proper town/state.

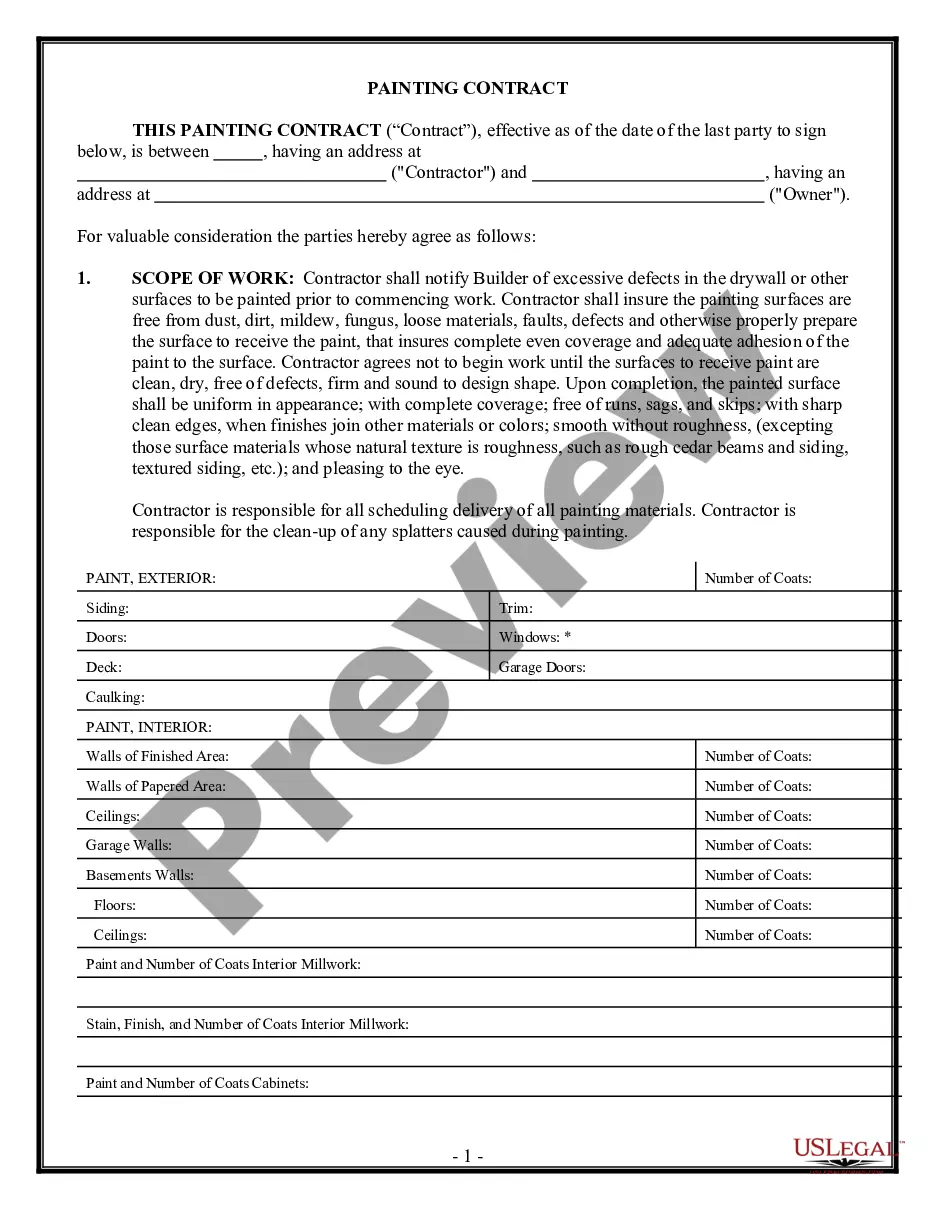

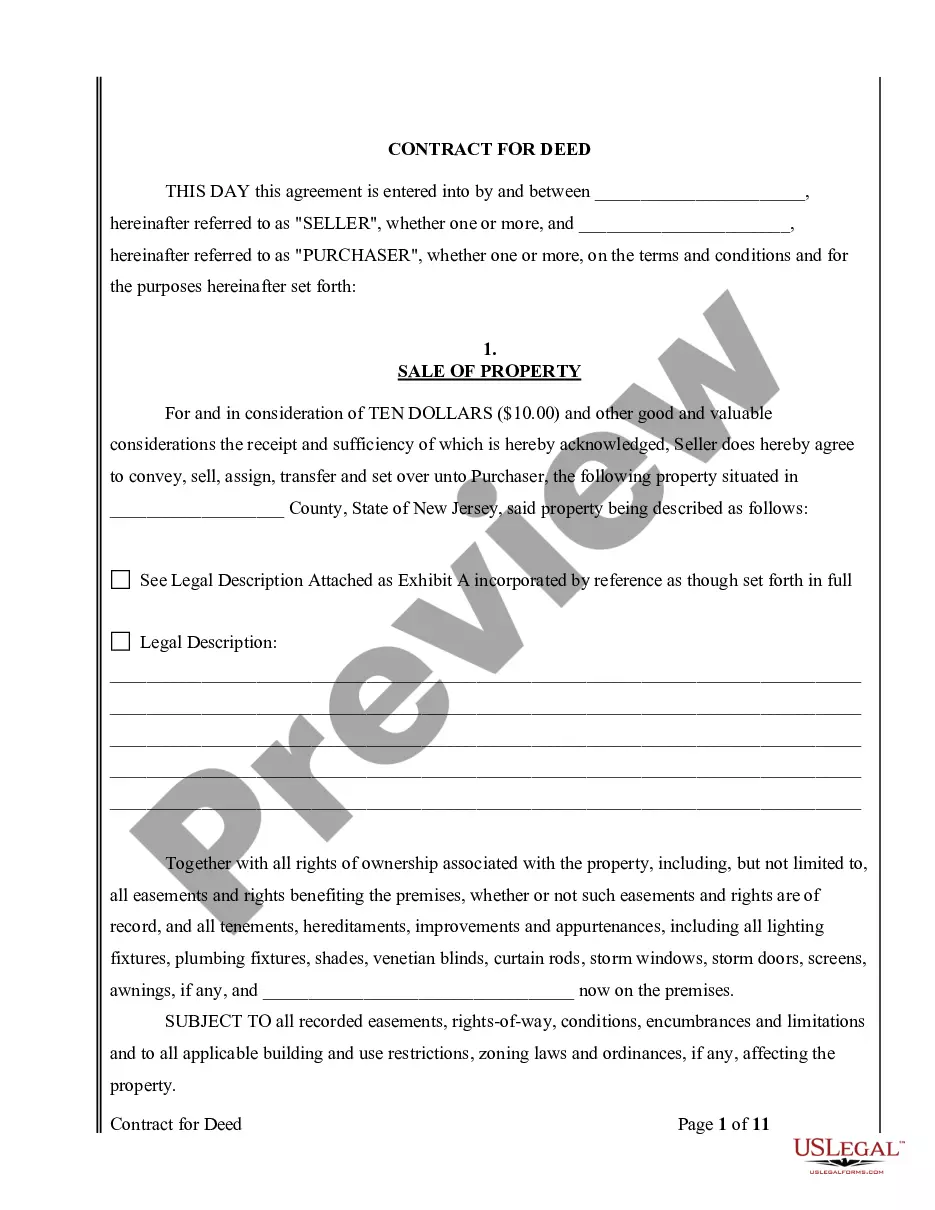

- Take advantage of the Review option to review the form.

- Browse the information to actually have chosen the correct kind.

- If the kind is not what you`re seeking, make use of the Search area to obtain the kind that fits your needs and requirements.

- Whenever you discover the proper kind, simply click Purchase now.

- Opt for the rates program you need, complete the required information to make your money, and pay money for your order utilizing your PayPal or charge card.

- Pick a practical paper formatting and down load your backup.

Locate all of the record templates you possess purchased in the My Forms menu. You can get a extra backup of Maryland Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone whenever, if necessary. Just go through the required kind to down load or print out the record template.

Use US Legal Forms, probably the most considerable selection of legitimate forms, in order to save time and prevent mistakes. The assistance offers professionally made legitimate record templates which you can use for an array of functions. Create your account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

The good news is, credit card companies are usually quick to reimburse you for fraudulent charges, and Rathner reassures you should get the money credited back to your account within days of reporting it. And if you've sent away for a new card, you can expect to get it in the mail within a few days.

It really depends on the actions taken by a cardholder after they notice a possible attack and the prevention methods a bank or card issuer takes to detect fraud. Some estimates say less than 1% of credit card fraud is actually caught, while others say it could be higher but is impossible to know.

Check your credit card statement carefully for purchases you didn't make and report any fraudulent transactions immediately. Carefully monitor your credit reports to make sure the theft of your card hasn't led to other instances of identity theft.

If you find your missing credit card, you can contact the card issuer at the number on the back of the card to let them know you've found it. Depending on timing, they may instruct you to destroy and dispose of the card and begin using the replacement card that they've arranged to be sent to your address.

Contact your credit card issuer When you speak to a representative, tell them that your account was compromised and list the fraudulent transactions. The bank will cancel the card (this doesn't mean your account is closed) and mail you a new card with a new account number, expiration date and security code.

Also, if an unauthorized charge to your ATM is reported to your bank statement, you are liable for the full amount unless you report the charge within 60 days of the date the statement is sent to you. In other words, report the loss/theft of your ATM card immediately.

Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

What to Do If Credit Card Theft Happens to You. In the event that your credit card is stolen in the United States, federal law limits the liability of cardholders to $50, regardless of the amount charged on the card by the unauthorized user.