Maryland Resolution Form for Corporation

Description

How to fill out Resolution Form For Corporation?

Selecting the finest valid document template can be a challenge. Clearly, there are numerous designs available on the Internet, but how do you find the correct format you require? Utilize the US Legal Forms website. This service provides thousands of templates, including the Maryland Resolution Form for Corporation, suitable for business and personal purposes. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, sign in to your account and click the Download button to access the Maryland Resolution Form for Corporation. Use your account to view the valid forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions that you can follow.

Choose the file format and download the valid document template to your device. Complete, modify, print, and sign the acquired Maryland Resolution Form for Corporation. US Legal Forms is the largest collection of legal forms where you can find various document templates. Take advantage of the service to obtain professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your location/region.

- You can preview the document using the Review option and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are sure the form is appropriate, click on the Purchase now option to acquire the form.

- Select the payment plan you prefer and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

MD Form 1 is the Maryland corporate income tax return form that corporations must file annually. This form reports a corporation's income, deductions, and tax liability to the state. By filing MD Form 1, you ensure that your corporation complies with state tax laws. For help with filling out this form, check out the resources on US Legal Forms, especially the Maryland Resolution Form for Corporation.

In Maryland, any business operating as a corporation must file necessary forms with the state. This includes both profit and non-profit entities. Compliance with the filing requirements is vital for maintaining good standing and avoiding legal issues. Use US Legal Forms to access the Maryland Resolution Form for Corporation, which can facilitate this process.

Any corporation that owns personal property in Maryland must file a personal property return. This includes items such as machinery, equipment, and furniture used in business operations. Filing ensures compliance with local tax laws and avoids penalties. To easily manage this requirement, consider using the Maryland Resolution Form for Corporation available on US Legal Forms.

Forming a corporation in Maryland involves several steps, beginning with choosing a unique name for your business. You will then need to file Articles of Incorporation with the Maryland State Department of Assessments and Taxation. Once approved, create organizational documentation, including a Maryland Resolution Form for Corporation, which establishes your corporation's structure and decision-making processes. For comprehensive assistance, US Legal Forms offers all necessary forms and guidance.

All corporations registered in Maryland must file an annual report, regardless of their business activity. This requirement ensures that the state has up-to-date information about your corporation. Failure to file the report can result in penalties or even dissolution. Utilize the resources at US Legal Forms to simplify the filing of your Maryland Resolution Form for Corporation.

Maryland Form 1 must be filed by every corporation operating in the state. This includes both domestic and foreign corporations that conduct business in Maryland. Filing this form ensures compliance with state tax regulations. If you need assistance in preparing this form, the Maryland Resolution Form for Corporation by US Legal Forms can help streamline the process.

You should send Maryland Form 510 to the Comptroller of Maryland. It is essential to ensure that you submit it to the correct address to avoid any processing delays. This form is crucial for reporting income tax for your corporation. For more details, you can also visit the official website or consult the US Legal Forms platform for guidance.

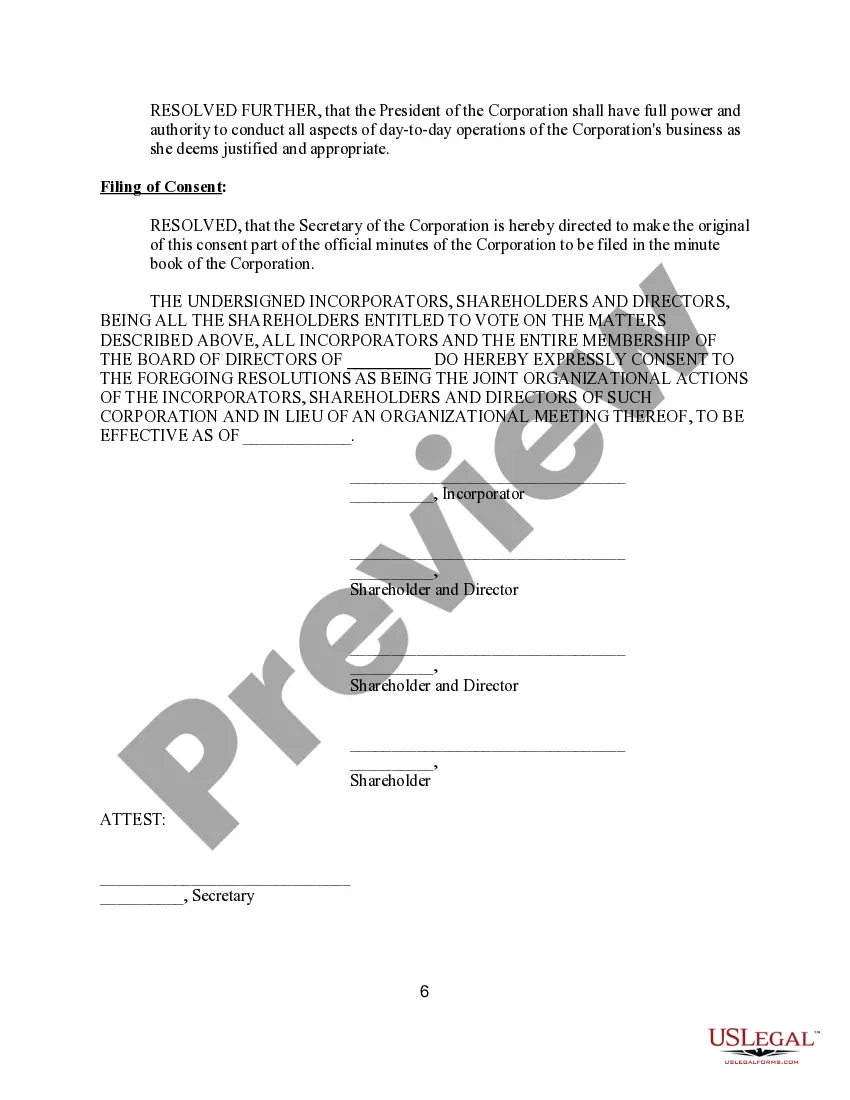

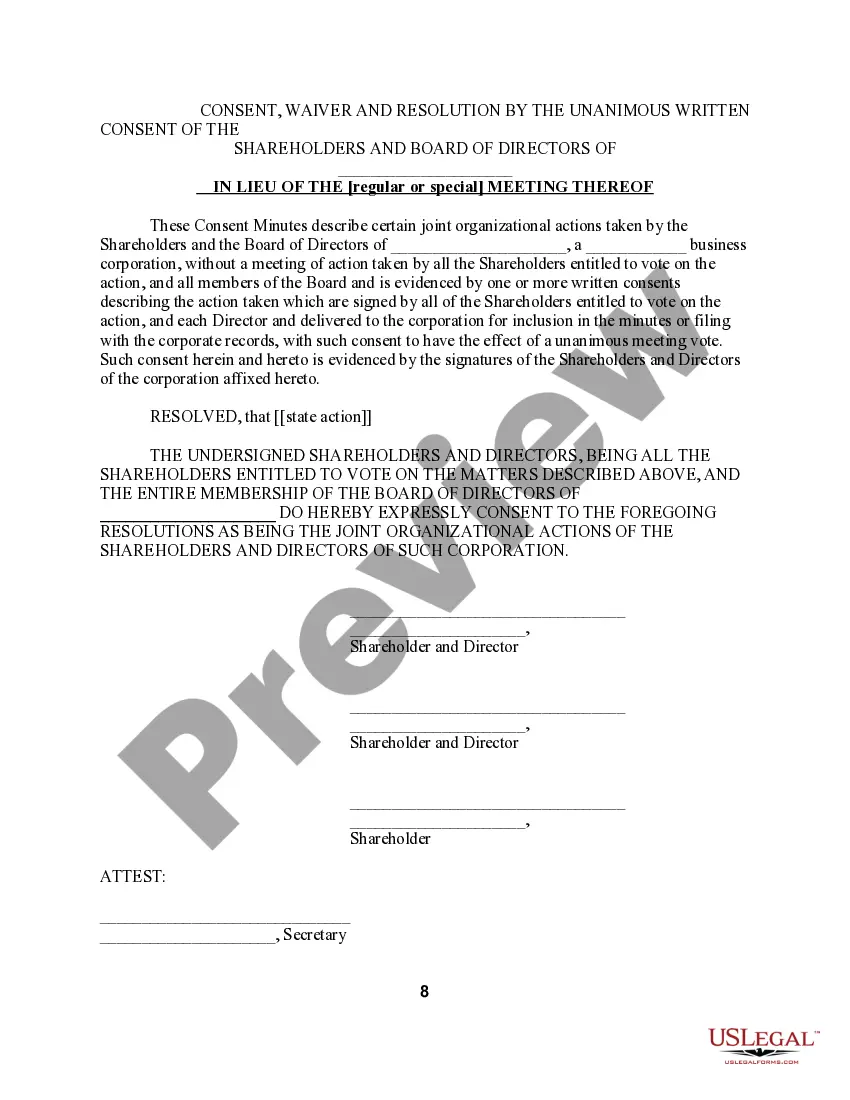

A corporate resolution formally documents decisions made by the corporation's board or members. It serves as evidence of authority and actions taken, such as opening bank accounts or making investments. Utilizing a Maryland Resolution Form for Corporation ensures that the resolution is comprehensive and legally binding, providing a reliable reference in case of disputes.

Writing a corporate resolution for an LLC involves similar steps as for a corporation. Begin with the LLC's name, the date, and identify the specific action being authorized. Clearly state who can act on behalf of the LLC. A Maryland Resolution Form for Corporation can assist in creating this document effectively, ensuring no vital details are overlooked.

When writing a corporate resolution example, start with the corporation's name, date, and a clear title for the resolution. Follow this with a statement that articulates the action to be taken, along with signatures from board members. The Maryland Resolution Form for Corporation serves as a useful guide to ensure you include all necessary components and meet legal standards.