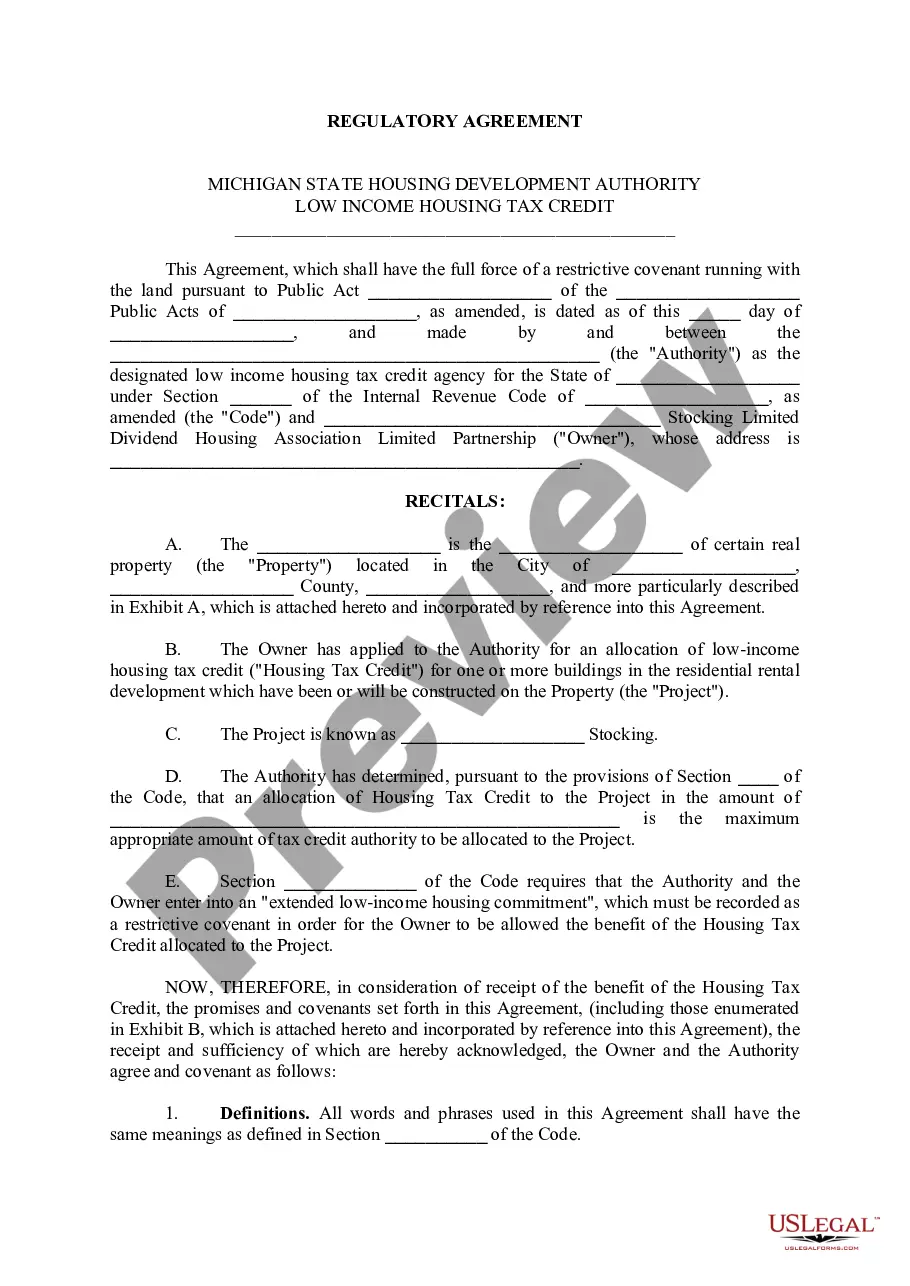

Maryland Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a legal document used in Maryland when an individual or a business entity seeks to sell their personal assets as part of a business sale or purchase. This document serves as proof of the transfer of ownership and outlines the terms and conditions agreed upon by the buyer and seller. In Maryland, there are several types of Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transactions that one may encounter, including: 1. Maryland Sale of Business — Bill of Sale for Personal Asset— - Entity Purchase Transaction: This type of transaction involves the purchase of a business entity as a whole, including all its assets and liabilities. The bill of sale outlines the specific assets being sold, such as inventory, equipment, intellectual property, and goodwill. 2. Maryland Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction — Intellectual Property: In some cases, the purchase transaction may focus primarily on the transfer of intellectual property rights, such as patents, trademarks, copyrights, or trade secrets. The bill of sale will detail the specific intellectual property being transferred and any associated terms or conditions. 3. Maryland Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction — Real Estate: If the sale includes the transfer of real estate assets, such as a commercial property or land, a separate bill of sale may be required to document the transfer of ownership. This document will include specific details about the property being sold, such as its address, legal description, and purchase price. When drafting a Maryland Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction, it is essential to include the following key information: 1. Parties Involved: Clearly identify the buyer and seller, including their legal names, addresses, and contact information. If a business entity is involved, provide their official business name and registered address. 2. Description of Assets: Provide a comprehensive list of the assets being sold, including detailed descriptions, quantities, and any relevant identification numbers or serial numbers. Specify whether the sale includes tangible assets (e.g., inventory, equipment) or intangible assets (e.g., intellectual property, customer lists). 3. Purchase Price: State the agreed-upon purchase price for the assets. If the price is to be paid in installments or subject to any adjustments, include those details as well. Also, mention the form of payment, such as cash, check, or wire transfer. 4. Representations and Warranties: Both parties may include representations and warranties to protect their interests. Representations and warranties typically cover the accuracy of financial statements, the absence of undisclosed liabilities, and the legal ownership of the assets being sold. 5. Governing Law: Specify that the agreement will be governed by Maryland state laws and any applicable federal laws. 6. Signatures: The bill of sale should include spaces for the buyer and seller to sign and date the document. It is also recommended including a provision for witness signatures, although not always required. Remember, it is crucial to consult with a qualified attorney when preparing or executing a Maryland Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction to ensure all legal requirements are met and your rights are protected.

Maryland Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

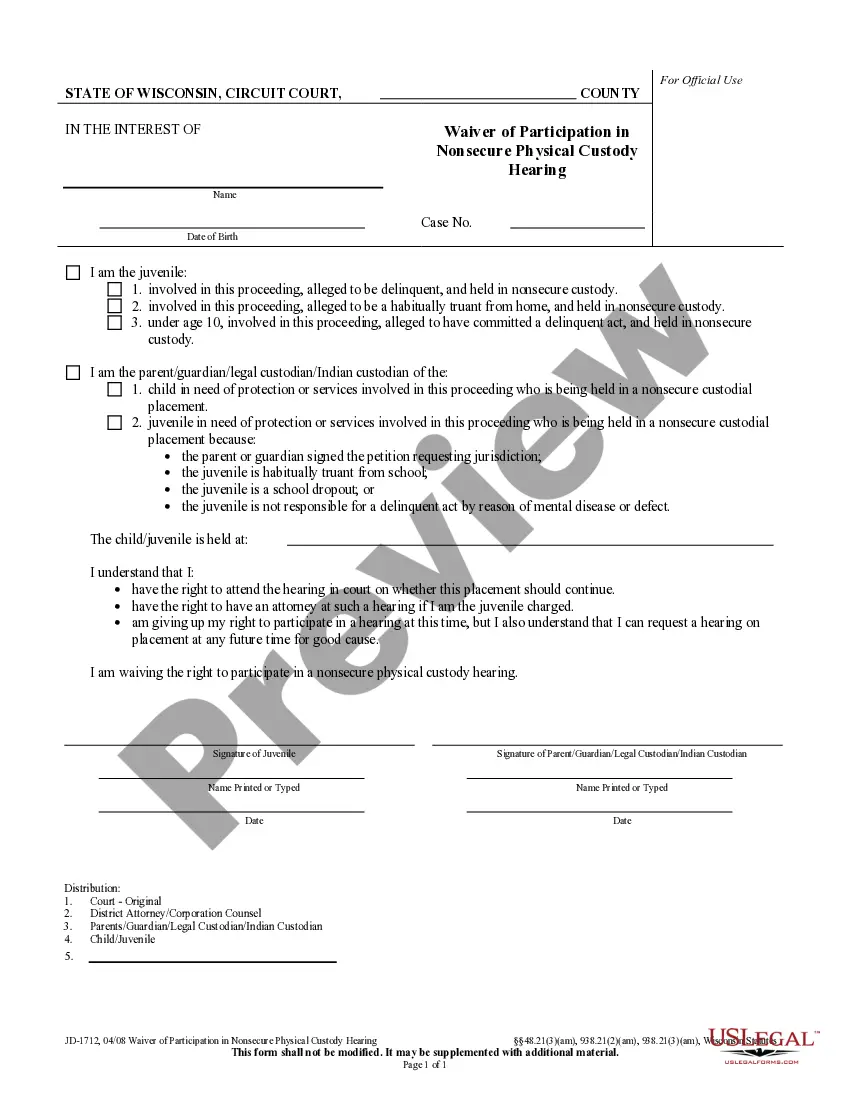

How to fill out Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

Are you presently in a situation where you require documents for both business or personal reasons almost all the time.

There are numerous legal document templates accessible online, but finding trustworthy ones isn't easy.

US Legal Forms offers thousands of document templates, including the Maryland Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction, which are designed to comply with federal and state regulations.

Choose a preferred document format and download your copy.

Retrieve all the document templates you have purchased from the My documents menu. You can obtain an additional copy of the Maryland Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction at any time if needed. Simply access the required document to download or print the template.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and prevent errors. This service provides professionally crafted legal document templates that can be applied for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Maryland Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it corresponds to the correct city/region.

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the right document.

- If the document isn’t what you seek, use the Search field to find the document that meets your needs and requirements.

- Once you locate the correct document, click Purchase now.

- Select the pricing plan you desire, provide the necessary details to create your account, and complete the order using your PayPal or credit card.

Form popularity

FAQ

An example of an asset sale could involve a technology company selling its software rights to a competitor. This kind of transaction allows the selling company to focus on its core products while monetizing non-essential assets. In Maryland, having a clear Bill of Sale for Personal Assets ensures that the terms of this transaction are documented and legally enforceable.

The sale of assets in business operates at multiple levels, enabling companies to strategically divest certain components while retaining others. This approach can enhance operational efficiency and improve financial performance. During this Maryland Sale of Business process, the Bill of Sale for Personal Assets is essential to clarify the specifics of the asset transfer.

The sale of assets used in business involves selling items that contribute to a company's operations. This can include equipment, real estate, and vehicles that are essential for business activities. When executing this process, it’s crucial to have a Bill of Sale for Personal Assets, especially in Maryland, to document the transaction effectively.

An asset sale of a business refers to the transaction where a buyer purchases specific assets of a business instead of the whole company. This type of sale often includes tangible assets like equipment and inventory, as well as intangible assets like customer lists and intellectual property. For those considering the Maryland Sale of Business, the Bill of Sale for Personal Assets outlines the details and ensures a clear transfer of ownership.

Accounting for the sale of business assets includes recognizing the sale as a revenue transaction in your financial records. You'll need to adjust your asset accounts accordingly and report any gains or losses based on the sale proceeds. Properly documenting the sale with a Bill of Sale for Personal Assets is essential for your Maryland Sale of Business, ensuring accurate financial reporting.

To obtain a Maryland sales and use tax number, you must complete an application through the Maryland Comptroller's Office. This process typically requires basic business information and may take a few days for processing. Having this number is crucial if you conduct a Maryland Sale of Business involving personal assets that are subject to sales tax.

To record an asset sale of a business, update your accounting records to reflect the sale. This involves removing the asset from your balance sheet and detailing the transaction in your accounting software. Include your Bill of Sale for Personal Assets for complete transparency and legal documentation, particularly for your Maryland Sale of Business.

Selling a company's assets involves several steps, starting with an asset inventory and valuation. You will need to prepare a Bill of Sale for Personal Assets to formalize the transaction during your Maryland Sale of Business. Engaging with potential buyers, negotiating terms, and ensuring legal compliance will streamline the process and maximize returns.

When reporting the sale of depreciated assets, you must first calculate the adjusted basis by considering depreciation taken. Report the sale on your tax returns by providing details in the appropriate section, using forms like Form 4797 if applicable. Ensure to keep your Bill of Sale for Personal Assets as proof of the transaction involved in your Maryland Sale of Business.

Interesting Questions

More info

Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun! Motor vehicle free bill sale forms word forms documents used before the internet is a lot of fun!