Maryland Mutual Release of Claims based on Real Estate Purchase Contract

Description

How to fill out Mutual Release Of Claims Based On Real Estate Purchase Contract?

Locating the correct authorized document template might be a challenge.

Clearly, there are numerous designs accessible online, but how can you acquire the authorized version you require.

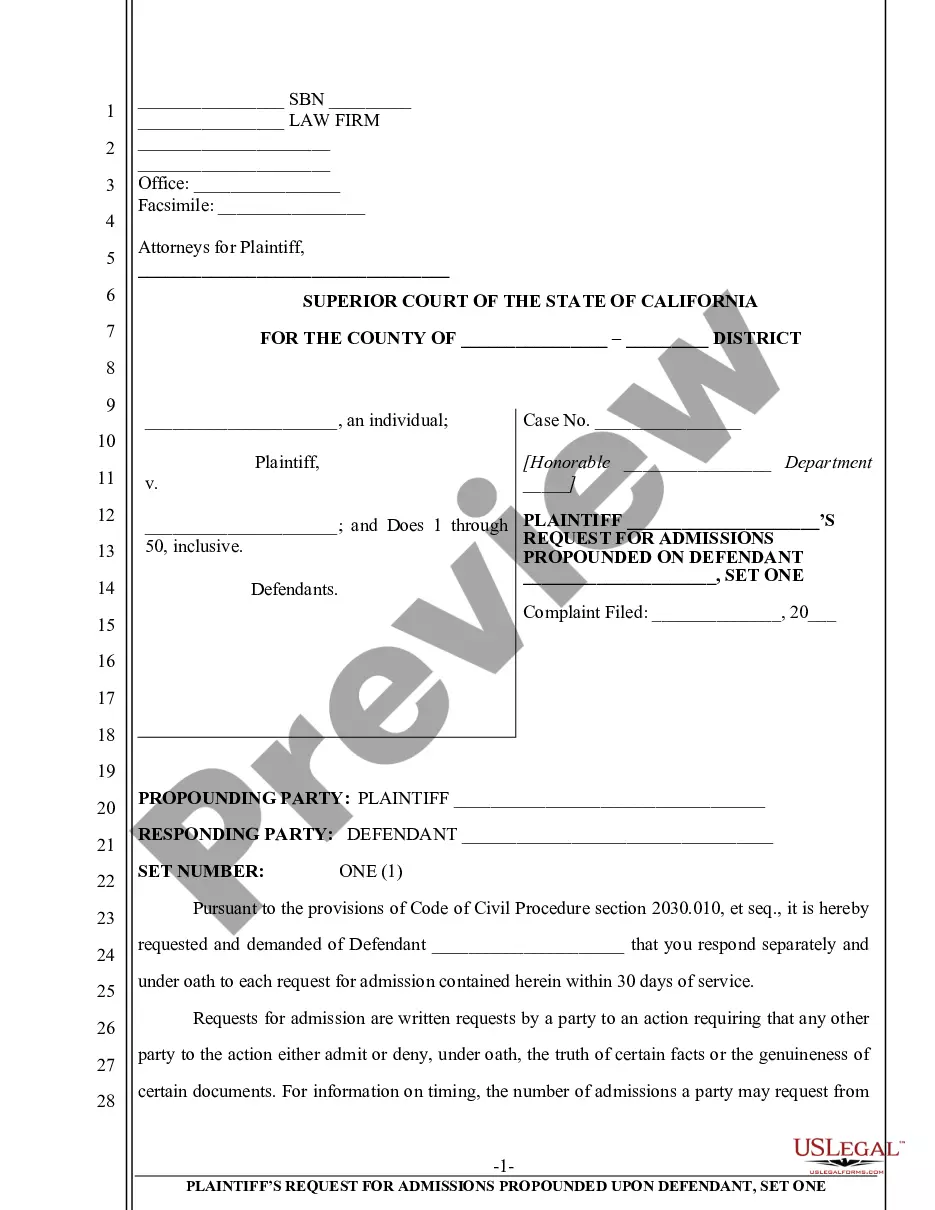

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Maryland Mutual Release of Claims related to Real Estate Purchase Agreement, which can be utilized for both business and personal purposes.

You can preview the document using the Preview button and read the document description to confirm it is right for you.

- All the documents are reviewed by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to obtain the Maryland Mutual Release of Claims related to Real Estate Purchase Agreement.

- Use your account to search through the legal documents you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct document for your city/county.

Form popularity

FAQ

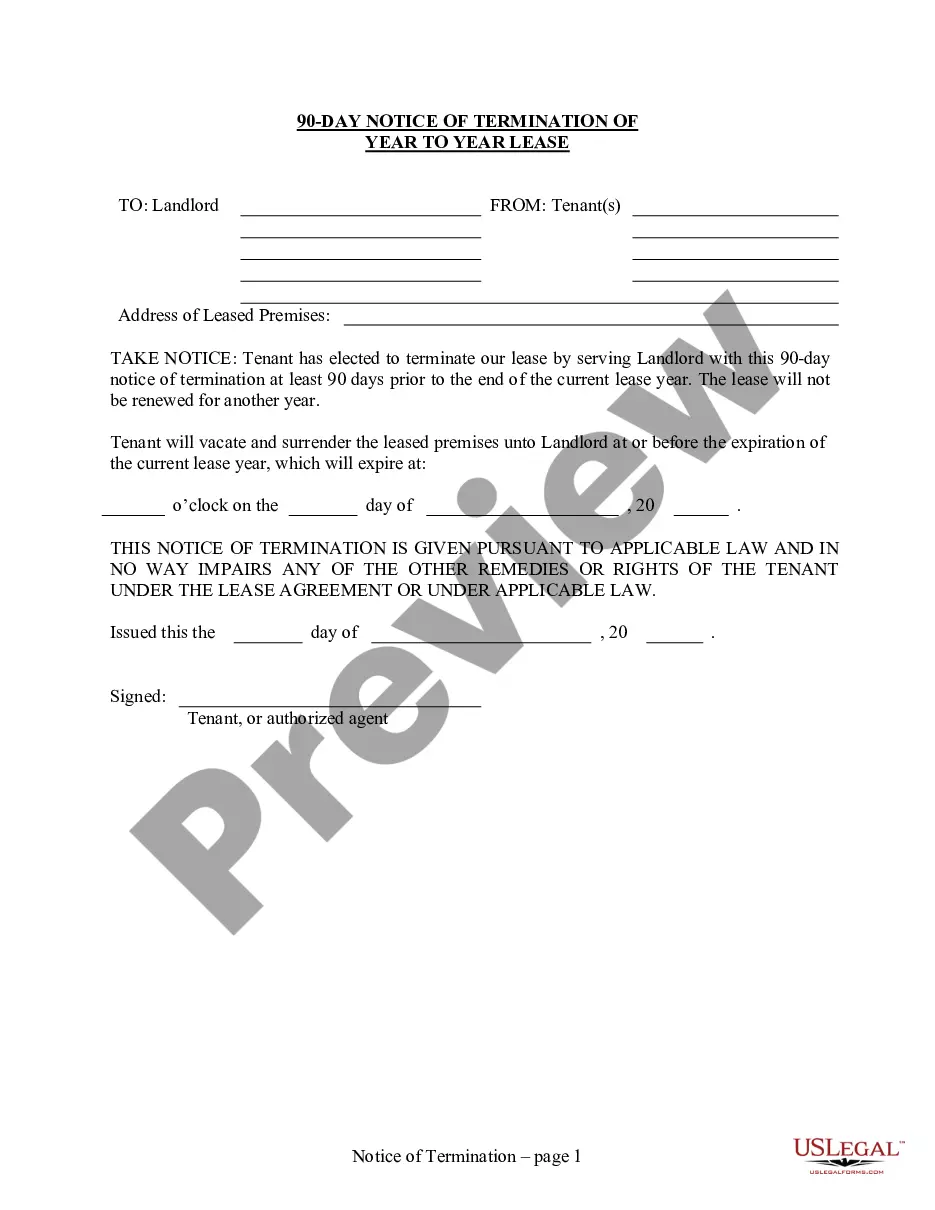

According to the Maryland Real Estate Brokers Act, sellers and buyers can unilaterally terminate the agency relationship with their agent before the expiration date a very consumer-friendly right. However, mutual agreement is required to terminate the contractual obligations.

The state Door-to-Door Sales Act provides that a seller must furnish a copy of a Notice of Cancellation to the buyer. The notice must state that the buyer may cancel the transaction within five business days seven business days if the buyer is over 65 years of age without penalty.

No. Many consumers mistakenly believe all contracts allow a 3-day cooling-off period to cancel. Generally, there's no cooling-off period after you sign a contract. (In Maryland, only a few types of transactions, such as door-to-door sales contracts, allow you a certain number of days to cancel.)

Conditional contractIf Contracts are conditionally exchanged with a Cooling-Off period, the buyer will pay a 0.25% deposit to the agent and if the buyer rescinds during the Cooling-Off period for any reason, the 0.25% deposit is forfeited to the seller.

However, a condition does not of itself grant a purchaser a right to cancel. The Agreement specifically requires each party to do all things reasonably necessary to satisfy a condition that is for their benefit.

Most contracts include financing, inspection and title contingencies to protect the buyers. If the buyers, after diligent effort, are unable to satisfy a contingency, they can usually withdraw from the contract without penalty and get their deposit money back.

A mutual release is a document designed to be signed by both the buyers and sellers to cancel an agreement of purchase and sale. When executed, this document cancels the agreement and releases all parties from any future liabilities or claims.

The Maryland Door-to-Door Sales Act provides for a 3-day right of rescission for certain contracts that resulted from door-to-door solicitations.

The buyer can cancel an offer to purchase, but doing so will be extremely costly. The buyer may lose their deposit. The seller may claim damages.

Typically, after contract acceptance, it may take weeks or months to finalize the transaction. During that time, the buyer, the seller and third parties work together to inspect the property, establish its title, obtain financing to close the sale.