Maryland Stock Retirement Agreement

Description

How to fill out Stock Retirement Agreement?

Have you found yourself in a situation where you require documentation for possibly professional or personal activities almost every day.

There are numerous authentic form templates accessible online, but finding forms you can trust isn't straightforward.

US Legal Forms provides thousands of form templates, such as the Maryland Stock Retirement Agreement, designed to comply with state and federal regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Maryland Stock Retirement Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it's for your appropriate city/state.

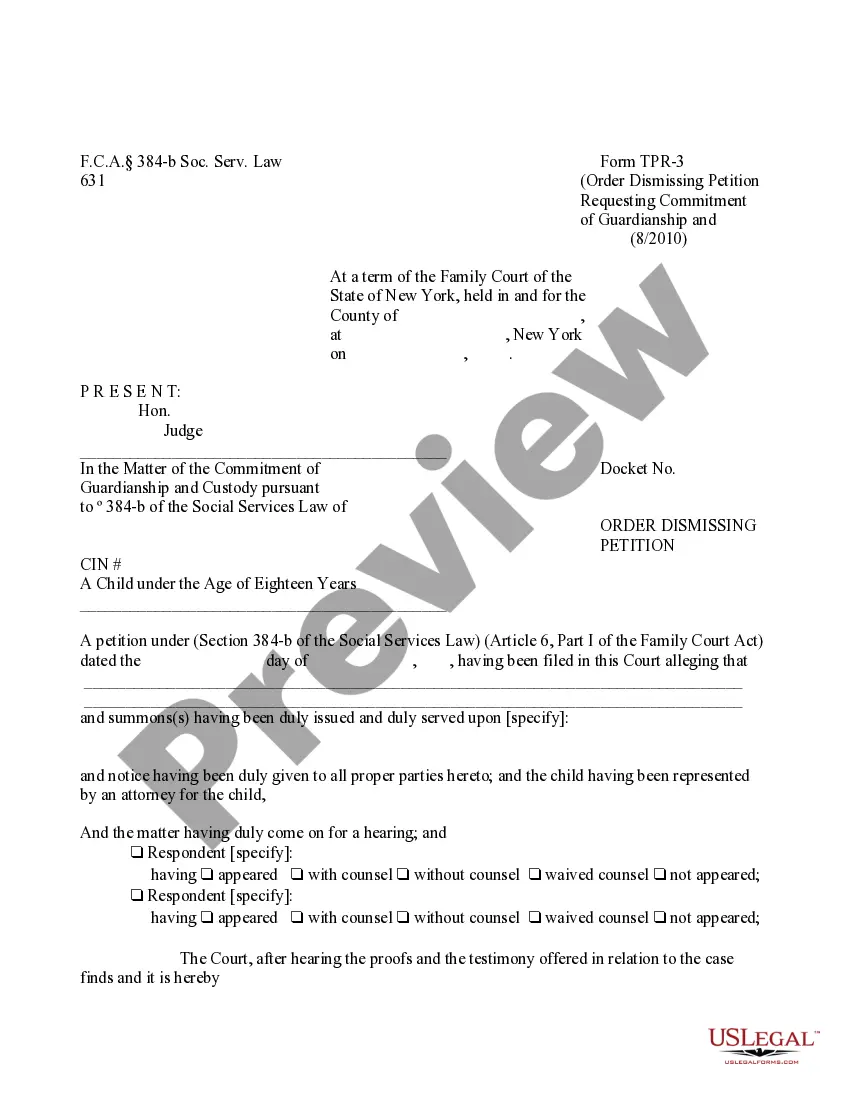

- Use the Preview button to view the form.

- Review the description to confirm you have selected the right form.

- If the form is not what you're looking for, utilize the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

To be vested in Maryland state retirement benefits, an employee generally needs to work at least five years. Vesting means you are entitled to your earned retirement benefits, even if you leave your job. This security is essential for long-term financial planning. The Maryland Stock Retirement Agreement is an essential tool that can help you understand and manage your vesting process effectively.

Recent changes to retirement laws in Maryland include updates that enhance benefits and modify eligibility criteria. These updates aim to make retirement planning more accessible and beneficial for state employees. Staying informed about the changes can help you adapt and take full advantage of your retirement options. Using the Maryland Stock Retirement Agreement can help clarify how these new laws affect your planning.

The rule of 90 for Maryland pension signifies that if your age combined with years of service equals 90, you can retire with full benefits. This rule applies to state employees vested under the Maryland Stock Retirement Agreement. Understanding how this works can significantly impact your retirement planning, allowing for more strategic decisions regarding your career and pension.

Maryland state retirement rules involve eligibility requirements based on age and years of service. To qualify for full retirement benefits, you usually need to meet specific criteria, ensuring a secure financial future. It's beneficial to familiarize yourself with these rules to maximize your benefits. The Maryland Stock Retirement Agreement serves as a vital resource in navigating these regulations.

Yes, Maryland state retirement benefits are typically subject to state taxation. However, the exact tax implications can vary based on your total income and other factors. It is important to plan accordingly to ensure you understand how taxes might affect your retirement funds. The Maryland Stock Retirement Agreement can provide guidance on structuring withdrawals to minimize tax impacts.

The 90 factor refers to a method used in calculating retirement benefits. In Maryland, if your age plus your years of service equals 90 or more, you may qualify for unreduced benefits. This calculation encourages longevity in service while providing a clear path to financial security. Understanding the Maryland Stock Retirement Agreement helps employees see how they can optimize their retirement benefits.

The Maryland pension exclusion allows certain amounts of retirement income, including pensions, to be exempt from state taxes. To qualify, you must meet age and income criteria outlined in Maryland tax regulations. Leveraging the Maryland Stock Retirement Agreement can provide insights into maximizing pension exclusions and enhancing your tax efficiency during retirement.

Nonresidents who earn income in Maryland must file a nonresident tax return. This includes individuals who may have retirement income sourced from Maryland. The Maryland Stock Retirement Agreement can clarify your obligations, helping you determine the necessity of filing based on your retirement income.

The Maryland form 502R is a tax form specifically designed for reporting retirement income. It helps retirees calculate their Maryland taxable income properly. Using the Maryland Stock Retirement Agreement, you can better understand how to fill out this form and ensure you claim all eligible deductions.

As of now, Maryland has not announced plans to eliminate taxes for retirees, although discussions about potential reforms continue. Tax laws can affect your retirement income, so it’s essential to stay informed. The Maryland Stock Retirement Agreement might provide beneficial strategies for minimizing your tax liabilities and maximizing your retirement funds.