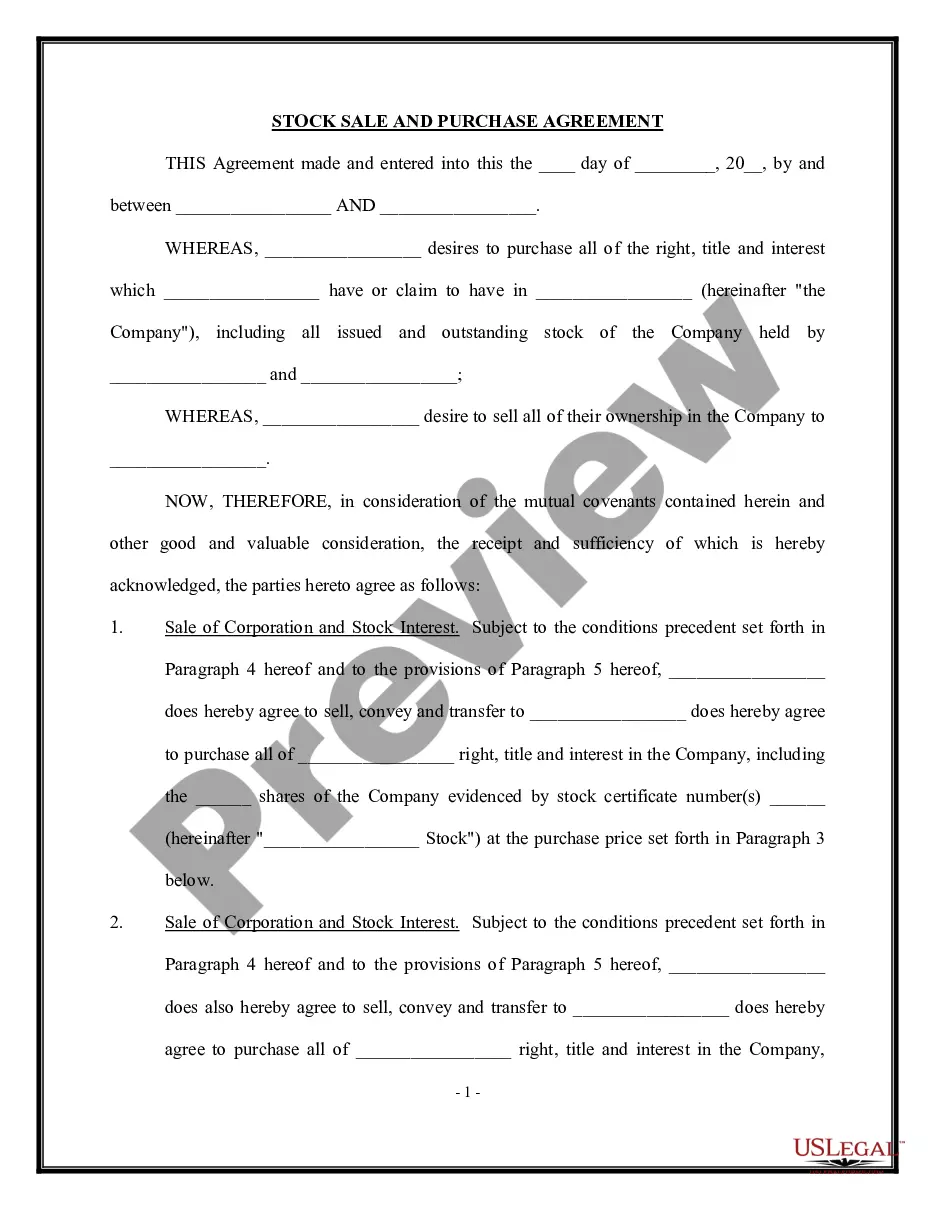

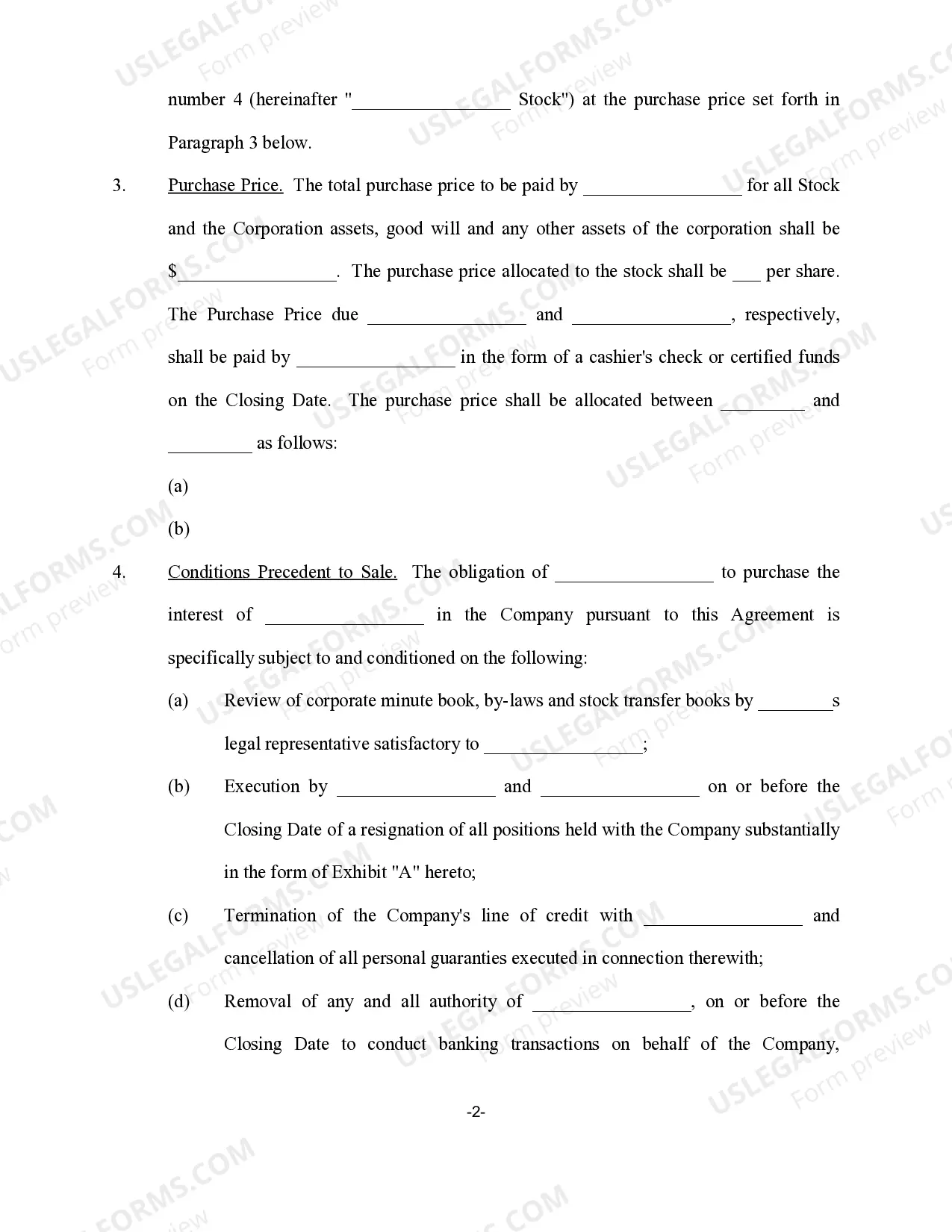

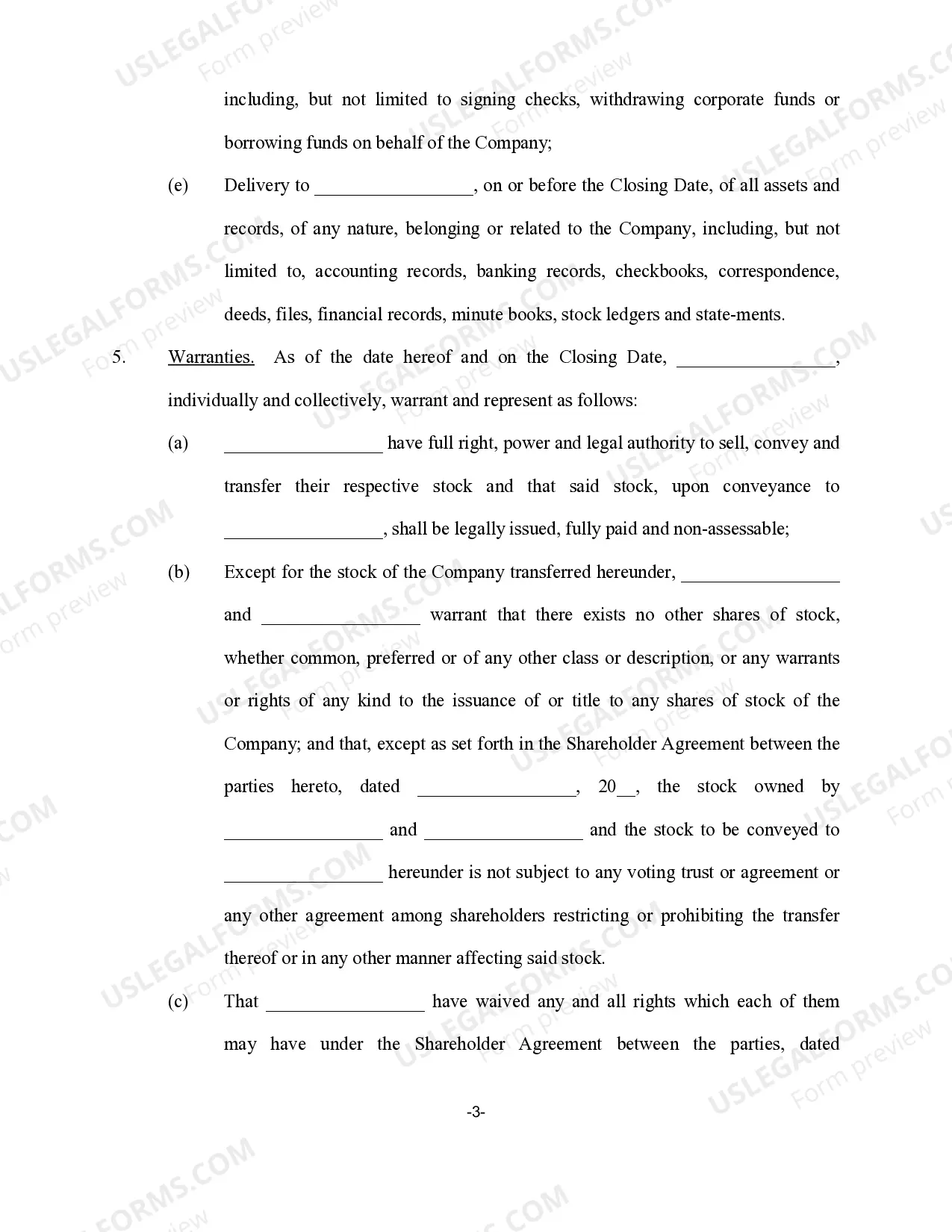

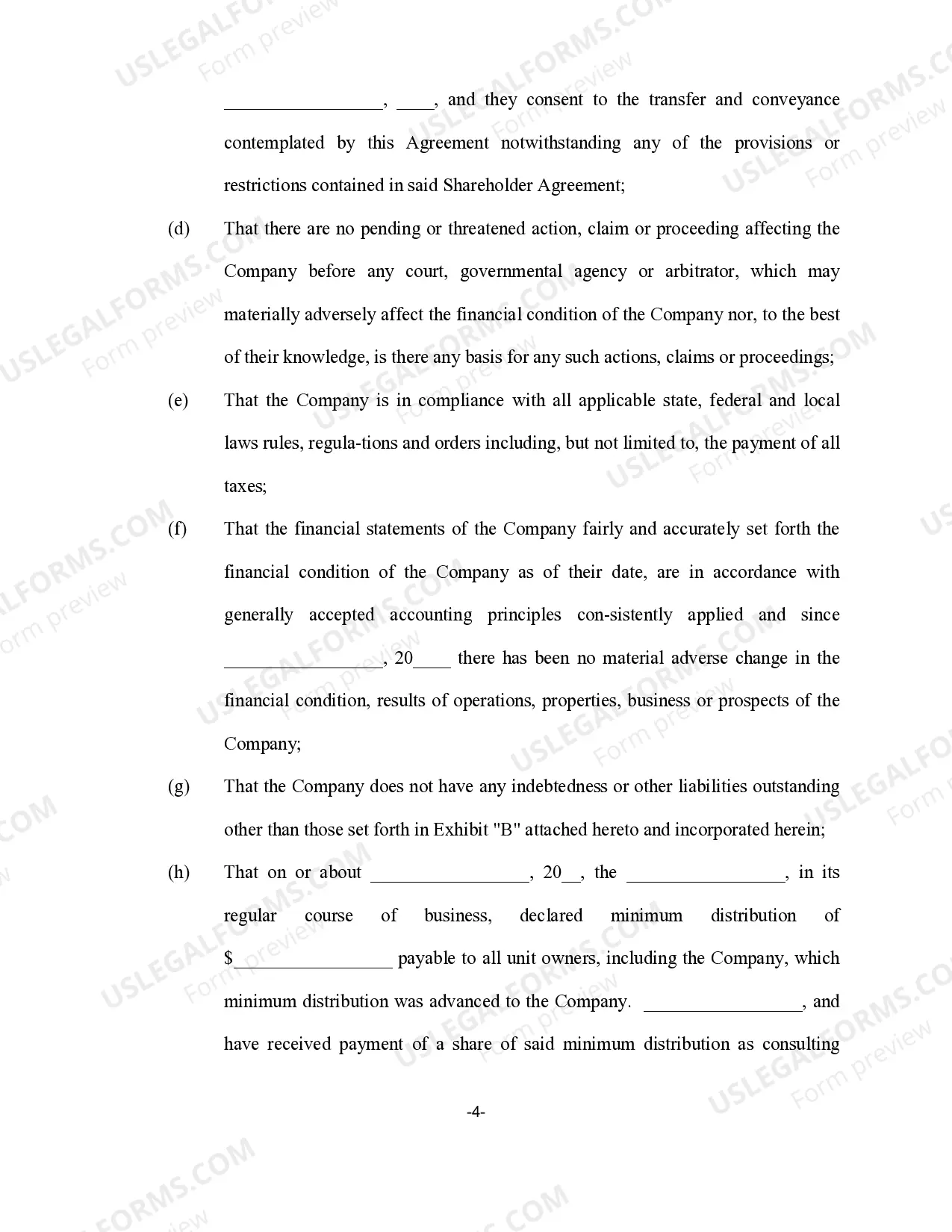

A Maryland Stock Sale and Purchase Agreement represents a legally binding contract between a seller (corporation) and a purchaser, outlining the terms and conditions for the sale and purchase of all the corporation's stock. It is crucial to have such an agreement in place to govern the transaction, protect the parties' interests, and ensure a smooth and lawful transfer of ownership. The Maryland Stock Sale and Purchase Agreement typically includes several key elements. Firstly, it identifies the involved parties: the selling corporation (the seller) and the buyer (the purchaser). The agreement will detail the exact number and class of shares being sold, including any restrictions or encumbrances on the stock. In addition, the agreement outlines the purchase price of the stock, indicating whether it will be paid in cash, installments, promissory notes, or a combination of payment methods. Where applicable, it may include provisions for adjustments based on the net asset value, working capital, or other financial metrics. The agreement should also specify any representations and warranties made by both parties regarding the stock and the corporation's financial condition. The Maryland Stock Sale and Purchase Agreement may include provisions for closing conditions, such as securing necessary approvals, consents, or permits. It might also address the transfer of licenses, contracts, leases, or other assets owned by the corporation. Any indemnification clauses protecting the parties from liabilities that may arise before or after closing may be included as well. Different types of Maryland Stock Sale and Purchase Agreements may exist based on specific circumstances or needs. For example, there might be agreements that focus on the sale of a controlling interest in the corporation rather than the entire stock. In some cases, a phased acquisition may occur, where the purchaser gradually acquires the corporation's stock over a specified period. Alternatively, parties may enter into an agreement that includes an earn-out provision, whereby the purchase price is contingent upon the corporation achieving certain future financial targets. The careful drafting and negotiation of a Maryland Stock Sale and Purchase Agreement is essential to safeguard the interests of both the selling corporation and the purchaser. The agreement should be reviewed by legal professionals with expertise in corporate law to ensure its compliance with Maryland state regulations and to adequately address any specific needs or concerns of the parties involved.

Maryland Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Maryland Stock Sale And Purchase Agreement - Sale Of Corporation And All Stock To Purchaser?

It is possible to spend several hours on-line looking for the legal papers web template which fits the federal and state needs you need. US Legal Forms offers 1000s of legal types which are reviewed by pros. You can easily down load or print out the Maryland Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser from the support.

If you already have a US Legal Forms profile, you are able to log in and then click the Down load key. After that, you are able to comprehensive, modify, print out, or signal the Maryland Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser. Each and every legal papers web template you purchase is yours forever. To obtain an additional duplicate for any obtained type, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms internet site for the first time, adhere to the straightforward directions under:

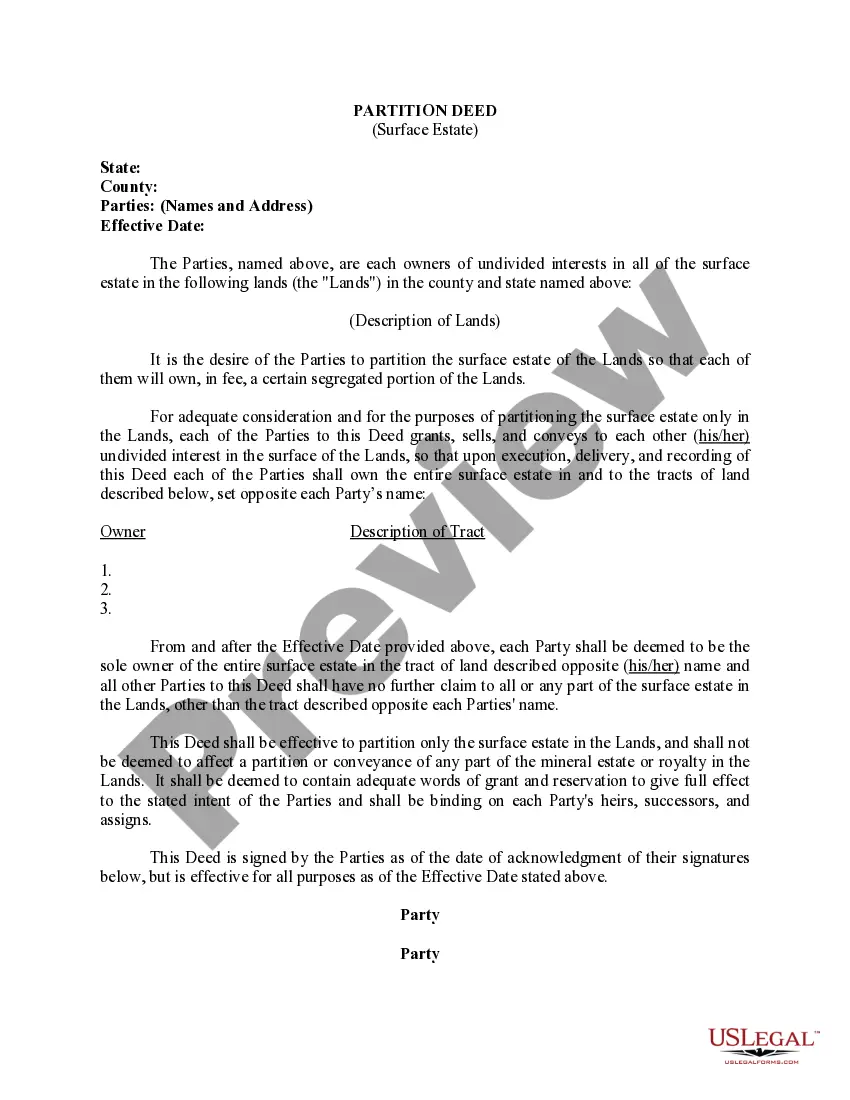

- Initially, ensure that you have selected the correct papers web template for the area/city of your liking. See the type description to make sure you have picked out the appropriate type. If readily available, take advantage of the Preview key to check through the papers web template as well.

- In order to get an additional edition from the type, take advantage of the Research area to discover the web template that fits your needs and needs.

- Upon having discovered the web template you need, click on Buy now to proceed.

- Select the prices plan you need, key in your credentials, and sign up for your account on US Legal Forms.

- Complete the deal. You may use your bank card or PayPal profile to fund the legal type.

- Select the formatting from the papers and down load it in your system.

- Make alterations in your papers if required. It is possible to comprehensive, modify and signal and print out Maryland Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser.

Down load and print out 1000s of papers themes making use of the US Legal Forms website, which provides the greatest variety of legal types. Use skilled and state-particular themes to tackle your small business or individual needs.