Maryland Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

Discovering the right authorized document design might be a struggle. Of course, there are plenty of themes accessible on the Internet, but how can you obtain the authorized develop you need? Use the US Legal Forms website. The support provides thousands of themes, including the Maryland Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts, which you can use for company and personal needs. Each of the types are checked out by experts and meet up with federal and state specifications.

In case you are already listed, log in to the bank account and click the Download button to get the Maryland Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts. Utilize your bank account to appear through the authorized types you might have acquired earlier. Proceed to the My Forms tab of your own bank account and have one more duplicate of your document you need.

In case you are a brand new end user of US Legal Forms, listed here are simple instructions so that you can adhere to:

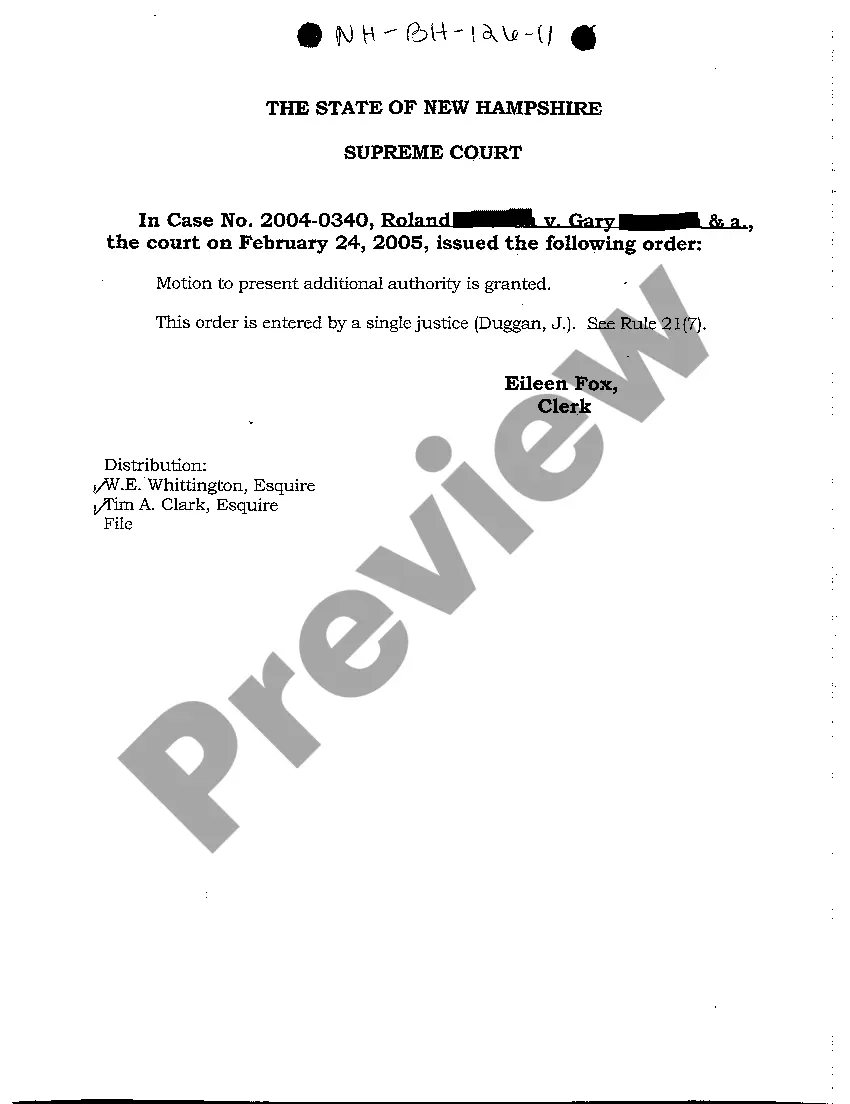

- Initial, be sure you have selected the correct develop for your personal city/area. It is possible to examine the shape while using Review button and study the shape explanation to ensure it is the best for you.

- When the develop is not going to meet up with your expectations, use the Seach industry to get the proper develop.

- Once you are positive that the shape would work, click the Acquire now button to get the develop.

- Select the prices prepare you desire and enter in the required information and facts. Make your bank account and pay money for an order using your PayPal bank account or bank card.

- Opt for the document format and down load the authorized document design to the product.

- Full, revise and produce and indication the received Maryland Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

US Legal Forms is the greatest local library of authorized types in which you can see various document themes. Use the service to down load skillfully-made paperwork that adhere to condition specifications.

Form popularity

FAQ

Reporting Identity Theft to the Police Step 1: Obtain a Copy of Your FTC Identity Theft Report. After filing a report with the FTC, give the police a copy when you file a police report. ... Step 2: Provide a Photo ID. ... Step 3: Provide Your Address. ... Step 4: Provide Proof of Identity Theft.

At 3010. In 1998, Congress enacted the Identity Theft and Assumption Deterrence Act (?the Identity Theft Act? or ?the Act?),1 directing the Federal Trade Commission to establish the federal government's central repository for identity theft complaints and to provide victim assistance and consumer education.

Know the signs of identity theft You get a letter from the IRS inquiring about a suspicious tax return that you did not file. You can't e-file your tax return because of a duplicate Social Security number. You get a tax transcript in the mail that you did not request.

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. ... The fraud department at your credit card issuers, bank, and other places where you have accounts.

Write a letter to each creditor where an account was opened or used in your name. Repeat what you said in your telephone call. Send a copy of your police report. Black out the account number of any accounts with other creditors on a copy of your completed ID Theft Affidavit and send it.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. ... The fraud department at your credit card issuers, bank, and other places where you have accounts.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

We understand that you are in a difficult situation, and will do our best to provide you with assistance to help you restore your good name and your credit record. If you have questions, please contact the Attorney General's Identity Theft Unit at (410) 576-6491 or by e-mail at idtheft@oag.state.md.us.