Title: Maryland Letter to Credit Card Companies and Financial Institutions Notifying Them of Death: A Comprehensive Guide Introduction: When a loved one passes away, there are numerous tasks to handle, including informing credit card companies and financial institutions about their death. This article provides a detailed description of the process and offers essential keywords related to the specific types of Maryland letters used in these notifications. 1. Maryland Letter to Credit Card Companies: The Maryland Letter to Credit Card Companies is a formal communication sent by the executor or personal representative of the deceased's estate to inform credit card companies about the individual's passing. This letter seeks to close the credit card account, prevent any unauthorized usage, and initiate the necessary steps for settling outstanding balances and distributing assets properly. The executor should mention the deceased's full name, account numbers, and relevant account details. Keywords: Maryland, letter, credit card companies, estate, executor, personal representative, account closure, outstanding balance. 2. Maryland Letter to Financial Institutions: In addition to notifying credit card companies, it is crucial to inform other financial institutions like banks, mortgage lenders, and investment firms. The Maryland Letter to Financial Institutions serves as a formal request from the executor to close the deceased's accounts, transfer assets, remove the deceased's name from joint accounts, and begin the probate process, if necessary. Keywords: Maryland, letter, financial institutions, banks, mortgage lenders, investment firms, executor, joint accounts, probate. 3. Maryland Letter to Banks: A Maryland Letter to Banks is specifically tailored to inform banks and financial institutions about the death of an account holder. This letter is usually sent by the executor or a family member of the deceased and includes the necessary information to close the account, provide instructions for transferring funds, and ensure any linked services, such as safe deposit boxes, are appropriately managed. Keywords: Maryland, letter, banks, financial institutions, account holder, executor, family member, account closure, funds transfer, safe deposit boxes. 4. Maryland Letter to Mortgage Lenders: When notifying mortgage lenders in Maryland about a person's death, a Maryland Letter to Mortgage Lenders is used. This letter outlines the name of the deceased, mortgage account number, and property address. The executor or family member requests information on the mortgage payoff balance, provides contact details for finalizing the account, and inquires about any potential insurance claims related to the mortgage. Keywords: Maryland, letter, mortgage lenders, deceased, executor, family member, mortgage payoff, property address, insurance claims. Conclusion: Informing credit card companies and financial institutions about the death of a loved one is an essential part of estate administration and settlement. Maryland letters cater to specific needs, whether it involves credit card companies, financial institutions, banks, or mortgage lenders. Properly executed notifications will help ensure a smooth transition and assist in managing the deceased's assets and liabilities according to Maryland state laws.

Maryland Letter to Credit Card Companies and Financial Institutions Notifying Them of Death

Description

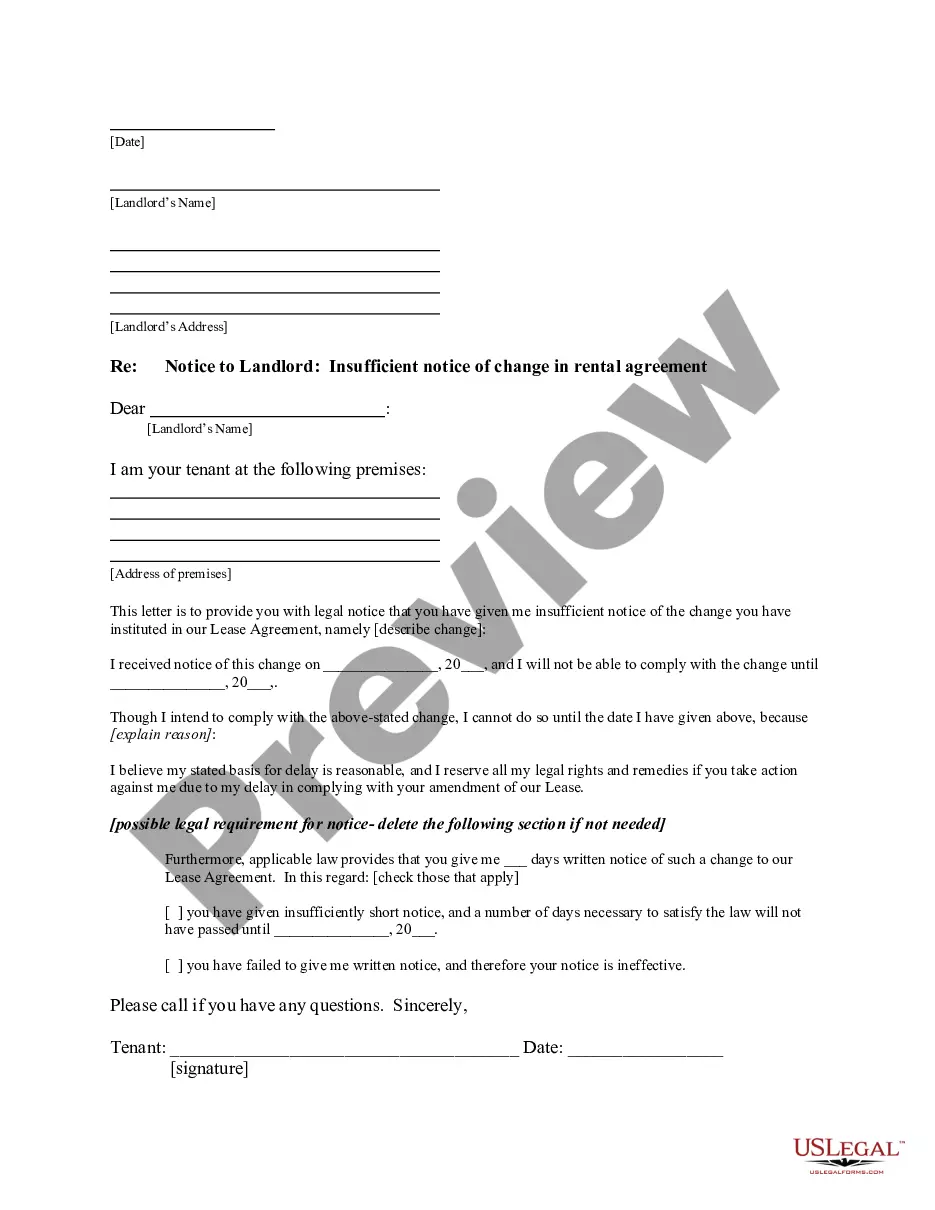

How to fill out Maryland Letter To Credit Card Companies And Financial Institutions Notifying Them Of Death?

Are you presently in a position where you need to have papers for either company or specific uses almost every day time? There are tons of authorized file layouts available on the net, but getting types you can trust is not easy. US Legal Forms delivers a large number of type layouts, much like the Maryland Letter to Credit Card Companies and Financial Institutions Notifying Them of Death, which are created to meet federal and state requirements.

In case you are already informed about US Legal Forms internet site and have a merchant account, simply log in. Next, it is possible to acquire the Maryland Letter to Credit Card Companies and Financial Institutions Notifying Them of Death template.

Unless you come with an account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the type you will need and ensure it is for the proper town/area.

- Use the Preview key to review the shape.

- Browse the outline to actually have chosen the right type.

- In the event the type is not what you are searching for, utilize the Research field to obtain the type that suits you and requirements.

- Whenever you discover the proper type, just click Acquire now.

- Pick the costs plan you want, submit the necessary info to create your money, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Select a handy data file structure and acquire your backup.

Get all of the file layouts you may have purchased in the My Forms food list. You can obtain a additional backup of Maryland Letter to Credit Card Companies and Financial Institutions Notifying Them of Death whenever, if needed. Just click on the necessary type to acquire or print out the file template.

Use US Legal Forms, by far the most extensive variety of authorized forms, to conserve time as well as steer clear of blunders. The support delivers expertly produced authorized file layouts that you can use for a variety of uses. Make a merchant account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

Credit reporting companies regularly receive notifications from the Social Security Administration about individuals who have passed away, but it's better to also notify them on your own to ensure no one applies for credit in the deceased's name in the meantime.

Your loved ones or the executor of your will should notify creditors of your death as soon as possible. To do so, they'll need to send each creditor a copy of your death certificate. Creditors generally pause efforts to collect on unpaid debts while your estate is being settled.

You can call the number on the back of the card and speak with a customer service representative about your situation. Note that the credit card companies may ask for an official copy of the death certificate and may also need the deceased's Social Security number.

Write a letter to one of the nationwide credit reporting agencies. Whichever agency you contact ? TransUnion, Equifax or Experian ? will then notify the other two on your behalf. Along with a copy of the death certificate, please also include the following for the deceased: Legal name.

When a loved one passes away, you'll have a lot to take care of, including their finances. It's important to remember that credit card debt does not automatically go away when someone dies. It must be paid by the estate or the co-signers on the account.

Dear [name of credit bureau]: I am writing to request that a formal death notice be placed on the credit file of: Deceased's full name (with middle initial if used): Most recent address: Social Security number: Birthdate: Enclosed please find one copy of decedant's death certificate.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.