This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

If you desire to be thorough, obtain, or download official document templates, utilize US Legal Forms, the largest compilation of legal documents, accessible online.

Take advantage of the site's user-friendly and efficient search feature to locate the documents you require.

A variety of templates for corporate and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. After finding the form you need, click on the Download now option. Choose your preferred pricing plan and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Employ US Legal Forms to retrieve the Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download option to locate the Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the appropriate form for your region/country.

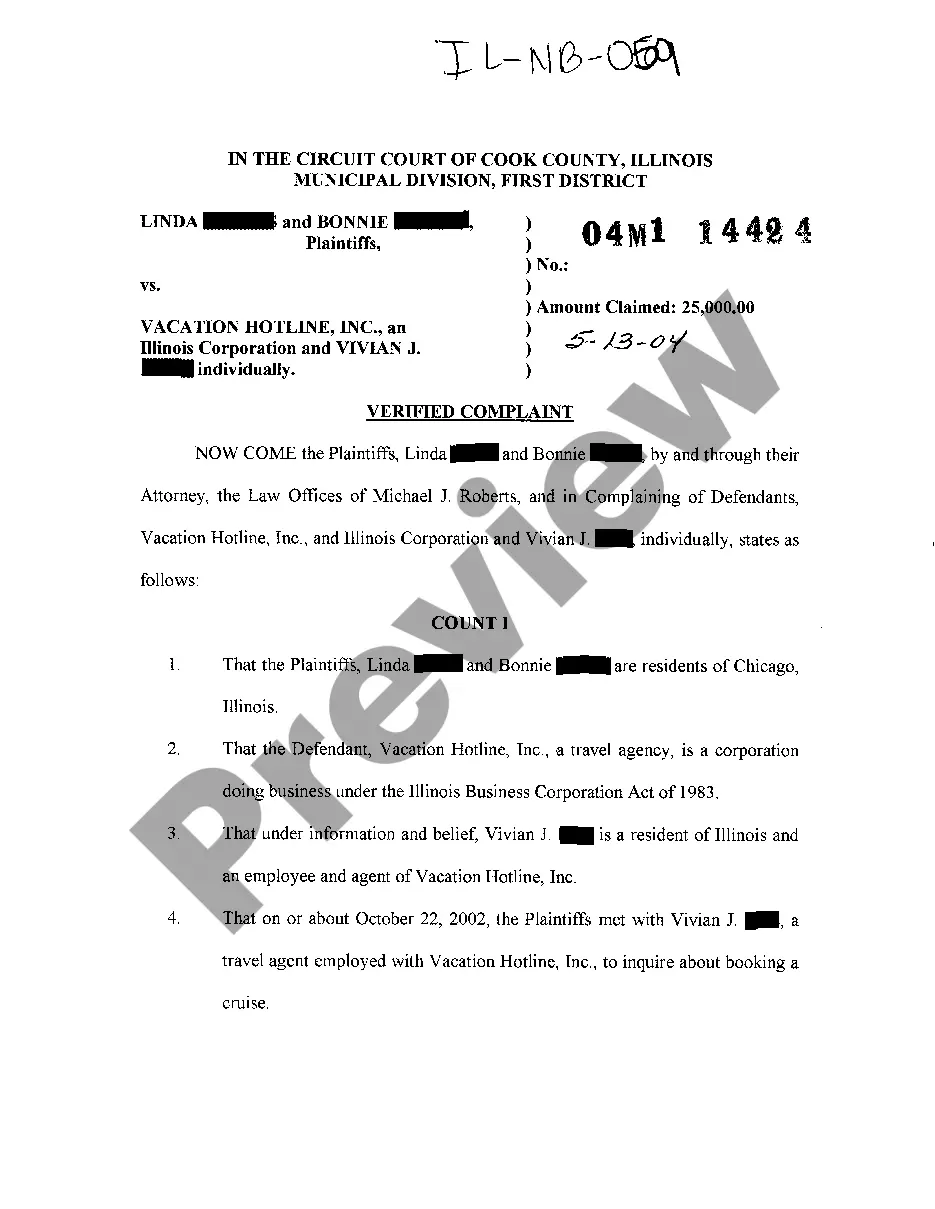

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Annual exclusion gifts are contributions made to individuals that fall under the annual exclusion limit set by the IRS. For 2023, this amount is $17,000 per recipient. By making such gifts, you can transfer wealth without incurring gift taxes, thereby preserving your estate. Incorporating strategies like a Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can optimize the management of these gifts for future generations.

Yes, gifts to a Spousal Lifetime Access Trust (SLAT) may qualify for the annual exclusion, allowing you to make contributions without incurring gift taxes. However, the specifics of the SLAT's structure can impact eligibility for this exclusion. When setting up a SLAT, consider the Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children to maximize benefits for your family.

Certain transfers are not categorized as gifts, such as payments made directly for someone's medical expenses or tuition. Additionally, loans that are expected to be repaid, with terms set forth, are generally not gifts. Understanding these distinctions is crucial in effectively utilizing strategies like the Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, as it aids in minimizing tax liabilities.

The annual exclusion for gifts to non US citizen spouses is a special amount that allows individuals to give gifts without incurring gift taxes. For 2023, this exclusion amount is $175,000. This means you can transfer this amount to your non US citizen spouse without affecting your annual gift tax exclusion. Utilizing a Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can help efficiently manage these gifts.

Gifts that qualify for the Generation-Skipping Transfer (GST) annual exclusion typically include direct gifts to grandchildren or others two or more generations below you. The annual exclusion amount may differ from the standard gift tax exclusion. Setting up a Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can provide opportunities for using the GST exemption effectively.

Typically, you do not need to report gifts under the annual exclusion, as long as they fall below the set limit. However, if you exceed the limit, you must file a gift tax return to report the amount over the exclusion. When creating a Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it’s wise to keep accurate records to simplify any reporting requirements.

Gift splitting allows married couples to combine their gift exclusions, effectively doubling the amount that can be gifted without incurring gift taxes. For the current year, the annual exclusion applies to gifts made to each individual up to a specific limit. This strategy can significantly benefit those creating a Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

The main difference between UTMA and 2503(c) trusts lies in how funds are managed and distributed. A UTMA trust allows for a broader range of assets to be transferred, while a 2503(c) trust restricts assets for a minor and must distribute the principal upon reaching age 21. Understanding these distinctions can aid in establishing a Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

The best type of trust for a minor often depends on your specific goals. A Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can offer flexibility and tax benefits. Options like a Uniform Transfers to Minors Act (UTMA) trust or a 2503(c) trust are popular, as they help manage the minor's assets until they reach adulthood.

Yes, you can write your own trust in Maryland, provided you follow the state's legal requirements. Creating a Maryland Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can be straightforward if you understand the terms and conditions. However, it's often beneficial to consult with a legal professional to ensure that your trust is valid and enforceable.