Title: Maryland Sample Letter to City Clerk regarding Ad Valor em Tax Exemption Introduction: A Maryland Sample Letter to City Clerk regarding Ad Valor em Tax Exemption is a formal correspondence that individuals or organizations can send to their city's clerk office seeking exemption from ad valor em taxes. Ad valor em taxes are property taxes that are based on the value of the property being taxed. This letter can be customized to suit different situations, such as requesting exemption for non-profit organizations or individuals meeting specific criteria. Keywords: Maryland, sample letter, city clerk, ad valor em tax exemption, property taxes, formal correspondence, non-profit organizations, individuals, specific criteria 1. Sample Letter for Non-Profit Organizations: Subject: Request for Ad Valor em Tax Exemption for Non-Profit Organization [Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [City Clerk's Name] [City Clerk's Office] [City Hall Address] [City, State, ZIP Code] Dear [City Clerk's Name], I am writing to formally request an ad valor em tax exemption for [Name of Non-Profit Organization], a registered non-profit organization located at [Organization's Address], within the boundaries of [City Name]. The purpose of this exemption is to acknowledge the positive impact our organization has on the local community and to further our charitable initiatives without a financial burden. [Provide a brief overview of the organization's mission, services, and contributions to the community.] According to the Maryland legislature, non-profit organizations meeting specific criteria can be considered for ad valor em tax exemption. We believe that [Name of Non-Profit Organization] meets all the necessary qualifications for this exemption, including but not limited to [mention specific criteria such as being IRS-approved, providing essential services, etc.]. [Explain how the organization's resources are predominantly utilized for charitable purposes rather than generating profits.] We kindly request that you consider granting ad valor em tax exemption to [Name of Non-Profit Organization] in line with Section [Relevant Section Number] of the Maryland law, which provides incentives to non-profit organizations that positively impact their community. Attached to this letter, you will find [include necessary supporting documents such as the organization's IRS determination letter, financial statements, and any other required paperwork]. We assure you that our organization will continue to be transparent and cooperative throughout the application process. If you require any additional information or documentation, please do not hesitate to contact me at [Phone Number] or via email at [Email Address]. We appreciate your attention to this matter and look forward to a favorable response. Thank you for your time and consideration. Sincerely, [Your Name] [Organization's Name] 2. Sample Letter for Individuals Meeting Specific Criteria: Subject: Request for Ad Valor em Tax Exemption for Residential Property [Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [City Clerk's Name] [City Clerk's Office] [City Hall Address] [City, State, ZIP Code] Dear [City Clerk's Name], I am writing to formally request an ad valor em tax exemption for my residential property located at [Property Address], within the boundaries of [City Name]. As an individual who meets the required criteria outlined by the Maryland law, I believe I am eligible for this exemption and would like to avail myself of the benefits provided. [Explain why you meet the specific criteria for the ad valor em tax exemption, such as age, disability, or low-income status.] The Maryland legislature has recognized the need to provide relief for individuals meeting certain conditions, and it is my understanding that I meet all the necessary qualifications in line with Section [Relevant Section Number] of the Maryland law. [Provide any supporting documentation or evidence required to demonstrate eligibility for the exemption.] I request that you review my case and consider granting me the ad valor em tax exemption for my residential property. I have enclosed all the necessary documentation, including [list all supporting documents], to support my eligibility for this exemption. Should you require any additional information or clarification, please do not hesitate to contact me at [Phone Number] or via email at [Email Address]. I greatly appreciate your attention to this matter and hope for a positive resolution. Thank you for your time and consideration. Sincerely, [Your Name] [Property Owner]

Maryland Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

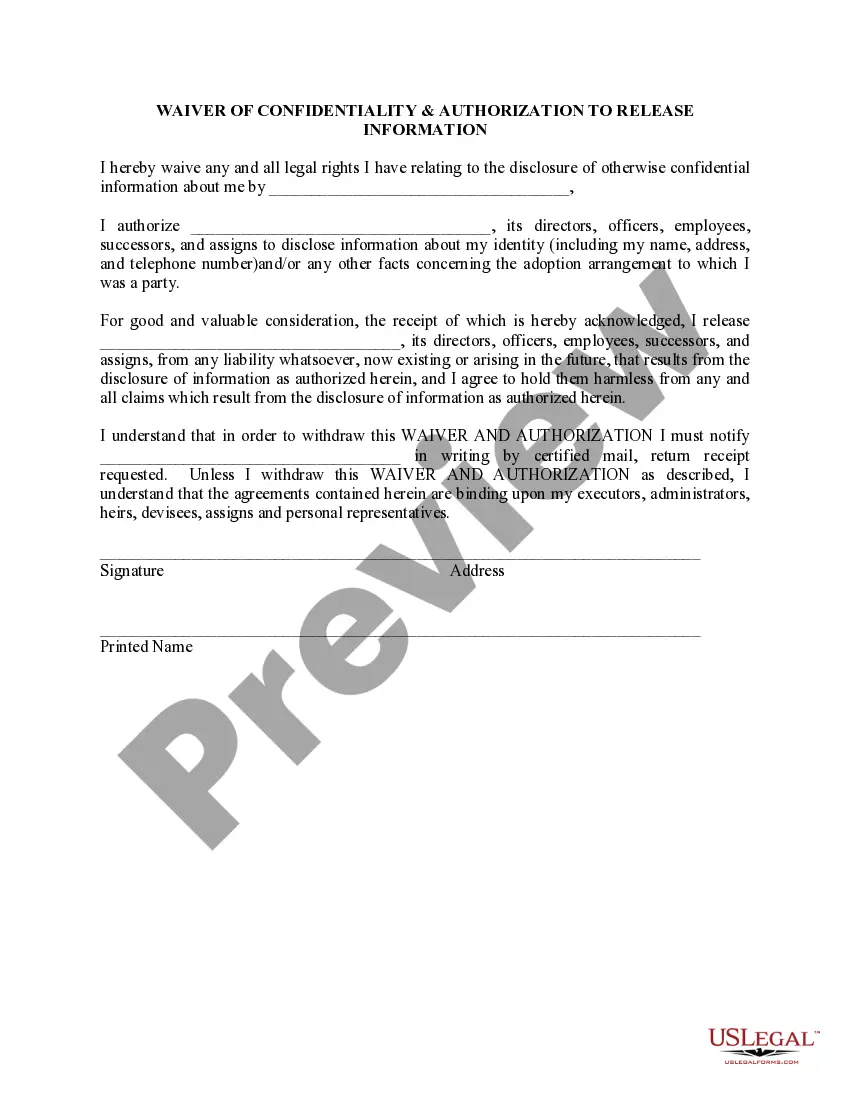

Description

How to fill out Maryland Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

Are you in a placement the place you require paperwork for sometimes enterprise or specific reasons virtually every working day? There are a lot of legitimate record layouts accessible on the Internet, but locating versions you can depend on isn`t easy. US Legal Forms offers thousands of type layouts, like the Maryland Sample Letter to City Clerk regarding Ad Valorem Tax Exemption, that happen to be published to satisfy state and federal specifications.

Should you be previously familiar with US Legal Forms web site and also have an account, simply log in. Next, it is possible to obtain the Maryland Sample Letter to City Clerk regarding Ad Valorem Tax Exemption template.

Should you not have an profile and would like to start using US Legal Forms, adopt these measures:

- Get the type you need and make sure it is to the appropriate area/state.

- Make use of the Preview switch to examine the form.

- Look at the description to ensure that you have chosen the right type.

- In case the type isn`t what you are trying to find, make use of the Look for field to get the type that meets your needs and specifications.

- When you discover the appropriate type, click on Acquire now.

- Pick the costs prepare you want, submit the desired information and facts to generate your bank account, and purchase an order with your PayPal or bank card.

- Select a practical file format and obtain your duplicate.

Get every one of the record layouts you might have bought in the My Forms food list. You can aquire a additional duplicate of Maryland Sample Letter to City Clerk regarding Ad Valorem Tax Exemption whenever, if possible. Just select the needed type to obtain or printing the record template.

Use US Legal Forms, one of the most comprehensive selection of legitimate types, in order to save time and prevent mistakes. The support offers appropriately produced legitimate record layouts which can be used for a variety of reasons. Produce an account on US Legal Forms and begin creating your daily life easier.