Maryland Agreement to Redeem Interest of a Single Member in an LLC is a legal document drafted to outline the terms and conditions under which a single member of a Limited Liability Company (LLC) in Maryland may sell or redeem their ownership interest in the company. This agreement is crucial for organizing the buyout or redemption process and providing clarity on the rights and obligations of both the member seeking to sell their interest and the LLC. It helps prevent any disputes or misunderstandings that may arise during the redemption process. Keywords: Maryland Agreement to Redeem Interest, Single Member, LLC, legal document, ownership interest, terms and conditions, buyout, redemption process, disputes, misunderstandings. Types of Maryland Agreement to Redeem Interest of a Single Member in an LLC: 1. Traditional Redemption Agreement: This type of agreement sets forth the terms and conditions for the single member to sell their ownership interest back to the LLC according to the agreed-upon redemption price and timeline. 2. Installment Redemption Agreement: In some cases, a single member may prefer to sell their interest over a specified period rather than in a single transaction. An Installment Redemption Agreement allows for the gradual redemption of the member's interest, often in predetermined installments, as agreed upon by both parties. 3. Triggered Redemption Agreement: This type of agreement is contingent upon specific triggering events, such as the death, disability, retirement, or withdrawal of the single member. It outlines the provisions and terms for the LLC to redeem the member's interest upon the occurrence of these predetermined events. 4. Optional Redemption Agreement: Unlike traditional agreements where the LLC has an obligation to redeem the interest upon a member's request, an Optional Redemption Agreement grants the LLC the discretion to accept or reject the request for redemption based on certain conditions or criteria. It provides flexibility for the LLC to decide whether to redeem the single member's interest. 5. Hybrid Redemption Agreement: A Hybrid Redemption Agreement combines features of different types of redemption agreements to meet the specific needs and circumstances of both the single member and the LLC. It allows for customization and tailoring of the agreement based on the unique requirements of the parties involved. These various types of agreements may be used depending on the preferences, goals, and circumstances of the single member and the LLC in Maryland. It is essential to consult with an experienced attorney familiar with Maryland LLC laws to ensure that the agreement accurately reflects the intentions and protects the best interests of all parties involved.

Maryland Agreement to Redeem Interest of a Single Member in an LLC

Description

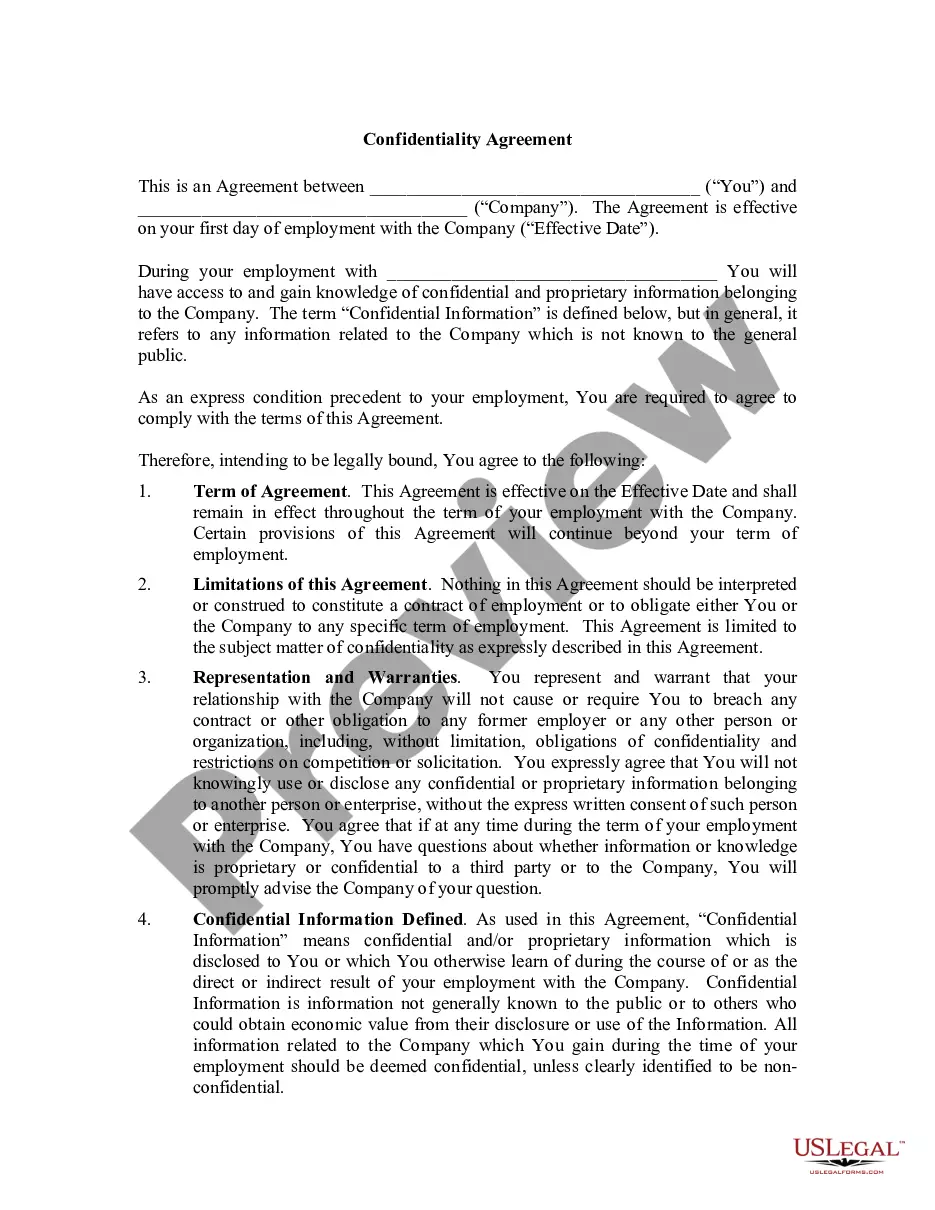

How to fill out Maryland Agreement To Redeem Interest Of A Single Member In An LLC?

If you have to comprehensive, download, or printing legal papers layouts, use US Legal Forms, the biggest variety of legal types, which can be found on-line. Utilize the site`s basic and convenient lookup to discover the papers you will need. A variety of layouts for organization and individual functions are categorized by classes and claims, or keywords. Use US Legal Forms to discover the Maryland Agreement to Redeem Interest of a Single Member in an LLC in just a number of mouse clicks.

Should you be previously a US Legal Forms client, log in for your account and then click the Download option to get the Maryland Agreement to Redeem Interest of a Single Member in an LLC. You can also gain access to types you in the past delivered electronically inside the My Forms tab of your respective account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that appropriate city/nation.

- Step 2. Use the Review method to look through the form`s articles. Do not overlook to read the description.

- Step 3. Should you be not satisfied together with the develop, use the Lookup industry at the top of the display screen to discover other variations from the legal develop design.

- Step 4. After you have identified the shape you will need, click the Purchase now option. Pick the prices program you like and add your references to register for the account.

- Step 5. Process the financial transaction. You can use your credit card or PayPal account to perform the financial transaction.

- Step 6. Find the formatting from the legal develop and download it on the product.

- Step 7. Complete, modify and printing or sign the Maryland Agreement to Redeem Interest of a Single Member in an LLC.

Each and every legal papers design you get is your own permanently. You possess acces to each develop you delivered electronically in your acccount. Go through the My Forms section and choose a develop to printing or download once again.

Contend and download, and printing the Maryland Agreement to Redeem Interest of a Single Member in an LLC with US Legal Forms. There are many professional and state-distinct types you may use to your organization or individual requirements.

Form popularity

FAQ

Do you need an operating agreement in Maryland? No, it's not legally required in Maryland under § 4A-402. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

A membership interest represents a member's ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC. Ownership in an LLC can be expressed by percentage ownership interest or membership units.

A membership interest purchase agreement includes how much of the seller's interest is being transferred, the sale price and how and when the funds will change hands, when the sale will close, and, if applicable, the consent of the other LLC members.

A membership interest purchase agreement, sometimes called a MIPA, is a contract between a seller and a buyer to transfer the ownership of an LLC. A MIPA transfers the whole company with all of its assets and liabilities being transferred by the contract.

A REDEMPTION AGREEMENT ALLOWS A DEPARTING SHAREHOLDER, PARTNER OR LLC MEMBER TO SELL OUT THEIR INTEREST IN THE BUSINESS TO THE COMPANY INSTEAD OF THEIR CO-OWNER.

A REDEMPTION AGREEMENT ALLOWS A DEPARTING SHAREHOLDER, PARTNER OR LLC MEMBER TO SELL OUT THEIR INTEREST IN THE BUSINESS TO THE COMPANY INSTEAD OF THEIR CO-OWNER.

To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail. The member in question of removal may need to get compensated for his share of membership interests.

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.