Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners

Description

How to fill out Buy Sell Agreement Between Partners Of General Partnership With Two Partners?

US Legal Forms - one of the largest collections of authentic forms in the USA - offers a diverse assortment of legitimate document templates that you can obtain or print.

By utilizing the website, you can access thousands of forms for both business and personal uses, organized by categories, states, or keywords.

You can quickly obtain the latest versions of forms such as the Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners.

Check the form description to ensure you have chosen the right one.

If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you already have a subscription, Log In to retrieve the Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To get started with US Legal Forms, follow these simple instructions.

- Ensure you have selected the correct form for your city/state.

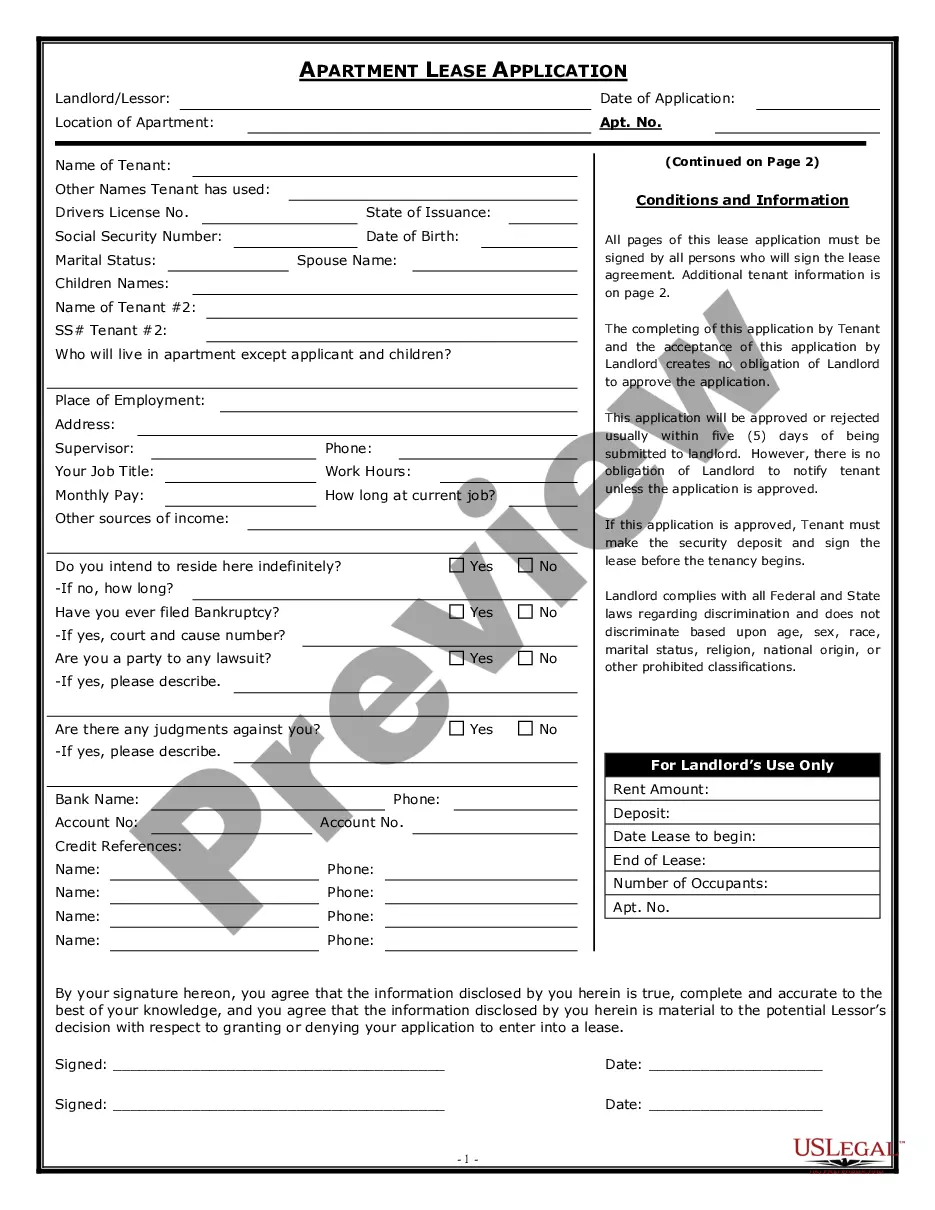

- Click the Preview button to review the form's content.

Form popularity

FAQ

Writing a relationship agreement involves laying out the expectations, roles, and responsibilities of each partner in the relationship. This agreement can include aspects such as financial obligations, boundaries, and plans for conflict resolution. A Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners provides a framework that underscores the importance of clarity and mutual respect, serving as a strong foundation for partnership.

To write a partnership agreement example, begin with a title that reflects the nature of the partnership. Clearly define the purpose, responsibilities, and financial contributions of each partner, while also incorporating terms for buying and selling interests. A detailed Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners can serve as a valuable reference, helping you structure your agreement effectively.

An agreement between partners should include the names of the partners, the partnership's purpose, the capital contributions from each partner, and the profit-sharing arrangement. It's essential to address management responsibilities, decision-making processes, and procedures for resolving disputes. This clarity can be achieved through a well-drafted Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners, ensuring all important aspects are covered.

To write an agreement between two people, start by clearly identifying the parties involved. Outline the terms, including the purpose of the agreement, obligations, and any deadlines. It is crucial to ensure that both parties fully understand their rights and responsibilities under the Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners. Using a template from uslegalforms can simplify this process, providing a clear structure for your agreement.

Writing an agreement between two partners requires outlining the partnership's terms, roles, responsibilities, and profit-sharing arrangements. It's beneficial to incorporate a Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners to cover specific scenarios like buyouts or dispute resolutions. Clear and precise language ensures both partners understand their commitments and safeguards their interests.

A general partnership must consist of at least two general partners, but there is no limit to how many can join. The collaborative nature of this arrangement encourages shared decision-making and resource pooling. To protect these relationships, implementing a Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners is advisable for clear expectations and obligations.

To create a buy-sell agreement, begin by determining its purpose and identifying the partners involved. Drafting a Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners usually includes valuation methods, triggering events, and payment terms. Consulting with a legal expert can provide clarity and ensure that the agreement is comprehensive and binding.

Yes, a general partnership can absolutely exist with two general partners. In this arrangement, both partners share responsibilities and liabilities as stated in their agreement. Establishing a Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners provides a framework for cooperation and conflict resolution, vital for the partnership's success.

The buyout formula typically involves calculating the partnership's value, assessing each partner's interest, and applying any agreed-upon terms from the buy-sell agreement. A well-structured Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners will detail how this process works. It offers a clear pathway, minimizing disputes and confusion during transitions.

Similar to the previous inquiry, a general partnership in Maryland can have two or more partners without an upper limit. Each partner shares in the profits and losses, making it vital to maintain harmony through a Maryland Buy Sell Agreement Between Partners of General Partnership with Two Partners. This agreement helps clarify responsibilities and decision-making processes.