Maryland Rental Lease Agreement for Business: A Comprehensive Guide A Maryland Rental Lease Agreement for Business is a legally binding document that outlines the terms and conditions between a landlord and a business tenant for the rental of a commercial property in the state of Maryland. This agreement serves as a vital tool to ensure a smooth and harmonious landlord-tenant relationship by clearly defining each party's rights, responsibilities, and obligations. Keywords: Maryland, rental lease agreement, business, commercial property, landlord, tenant, terms and conditions, rights, responsibilities, obligations. Different Types of Maryland Rental Lease Agreements for Business: 1. Gross Lease Agreement: In this type of agreement, the tenant pays a fixed rental amount, and the landlord is responsible for all property-related expenses, including property taxes, insurance, maintenance, and repairs. 2. Net Lease Agreement: Under a net lease agreement, the tenant pays a base rent along with additional expenses such as property taxes, insurance, utilities, and maintenance costs. These expenses are typically prorated based on the tenant's share of the overall square footage. 3. Modified Gross Lease Agreement: This agreement combines elements of both gross and net leases. The tenant and landlord negotiate to determine which expenses will be the responsibility of each party, providing greater flexibility in terms of cost allocation. 4. Percentage Lease Agreement: In certain commercial rental agreements, a percentage lease may be used. This lease structure requires the tenant to pay a base rent plus a percentage of their gross sales as additional rent. This type of agreement is often used in retail businesses and helps landlords share in the success of their tenants. 5. Triple Net (NNN) Lease Agreement: In a triple net lease agreement, the tenant is responsible for paying the base rent, as well as all property-related expenses, including property taxes, insurance, and maintenance costs. This places a significant financial burden on the tenant but provides them more control over the property. When entering into a Maryland Rental Lease Agreement for Business, it is crucial for both the landlord and tenant to consider various factors such as the lease term, rent amount, security deposit, property use restrictions, maintenance responsibilities, renewal options, and dispute resolution procedures. Consulting with an attorney or legal professional is recommended to ensure the agreement meets the specific needs of both parties and complies with Maryland state laws. In conclusion, a Maryland Rental Lease Agreement for Business is a vital document that protects the interests of both landlords and tenants in commercial real estate transactions. Different types of lease agreements offer various benefits and obligations, depending on the specific business needs and circumstances. Understanding the key elements and types of lease agreements is essential for successful business leasing in Maryland.

Maryland Rental Lease Agreement for Business

Description

How to fill out Maryland Rental Lease Agreement For Business?

If you desire to total, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Download now button. Choose the pricing plan you prefer and enter your information to sign up for the account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction. Step 6. Choose the format of your legal form and download it onto your device. Step 7. Fill out, edit, and print or sign the Maryland Rental Lease Agreement for Business.

- Use US Legal Forms to locate the Maryland Rental Lease Agreement for Business with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to get the Maryland Rental Lease Agreement for Business.

- You can also access forms you have previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Review option to examine the form’s content. Don't forget to read the description.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find alternative versions of the legal template.

Form popularity

FAQ

Writing a business proposal for a lease involves outlining your business needs, property requirements, and proposed terms. Your proposal should also include a clear explanation of how it aligns with a Maryland Rental Lease Agreement for Business. Utilizing tools like uslegalforms can assist you in crafting a professional, compliant proposal that captures necessary details and addresses both your interests and those of the landlord.

Maryland is generally considered a tenant-friendly state due to its strong tenant protection laws. This environment means that tenants have rights that must be maintained in a Maryland Rental Lease Agreement for Business. Understanding these rights not only promotes fair housing practices but also ensures your lease is in alignment with state laws.

The new Maryland landlord-tenant law in 2024 introduces several changes that impact how rental agreements are structured. These laws may affect the terms outlined in a Maryland Rental Lease Agreement for Business, especially concerning tenant rights and responsibilities. Staying informed about these changes helps you draft a compliant lease that protects both parties.

The most common lease used by businesses is the commercial lease. This type of lease is designed specifically for commercial properties and often appears in Maryland Rental Lease Agreements for Business. Commercial leases can vary based on the property usage, so understanding the specifics is crucial.

The most common type of leasehold is a periodic tenancy, which can be established through a Maryland Rental Lease Agreement for Business. This arrangement continues until either party decides to terminate it. Businesses often favor this flexibility as it allows for easy adjustments based on changing needs.

The three main types of leases in relation to a Maryland Rental Lease Agreement for Business include gross leases, net leases, and modified gross leases. A gross lease typically covers all expenses, while a net lease passes some costs onto the tenant. Understanding these types helps you choose the best option for your business needs.

Yes, a landlord can terminate a lease in Maryland, but they must follow the legal requirements for notice and justification. Common reasons for termination include non-payment of rent or lease violations. It’s essential to review the terms of the lease for any specific conditions related to termination. For thorough insights and guidance, look into USLegalForms when dealing with a Maryland Rental Lease Agreement for Business.

The notice period a landlord must provide to a tenant in Maryland varies based on the type of rental agreement. For month-to-month agreements, a 30-day notice is standard. For leases with specific end dates, follow the terms outlined in the lease. To simplify navigating these rules, consult USLegalForms for assistance with your Maryland Rental Lease Agreement for Business.

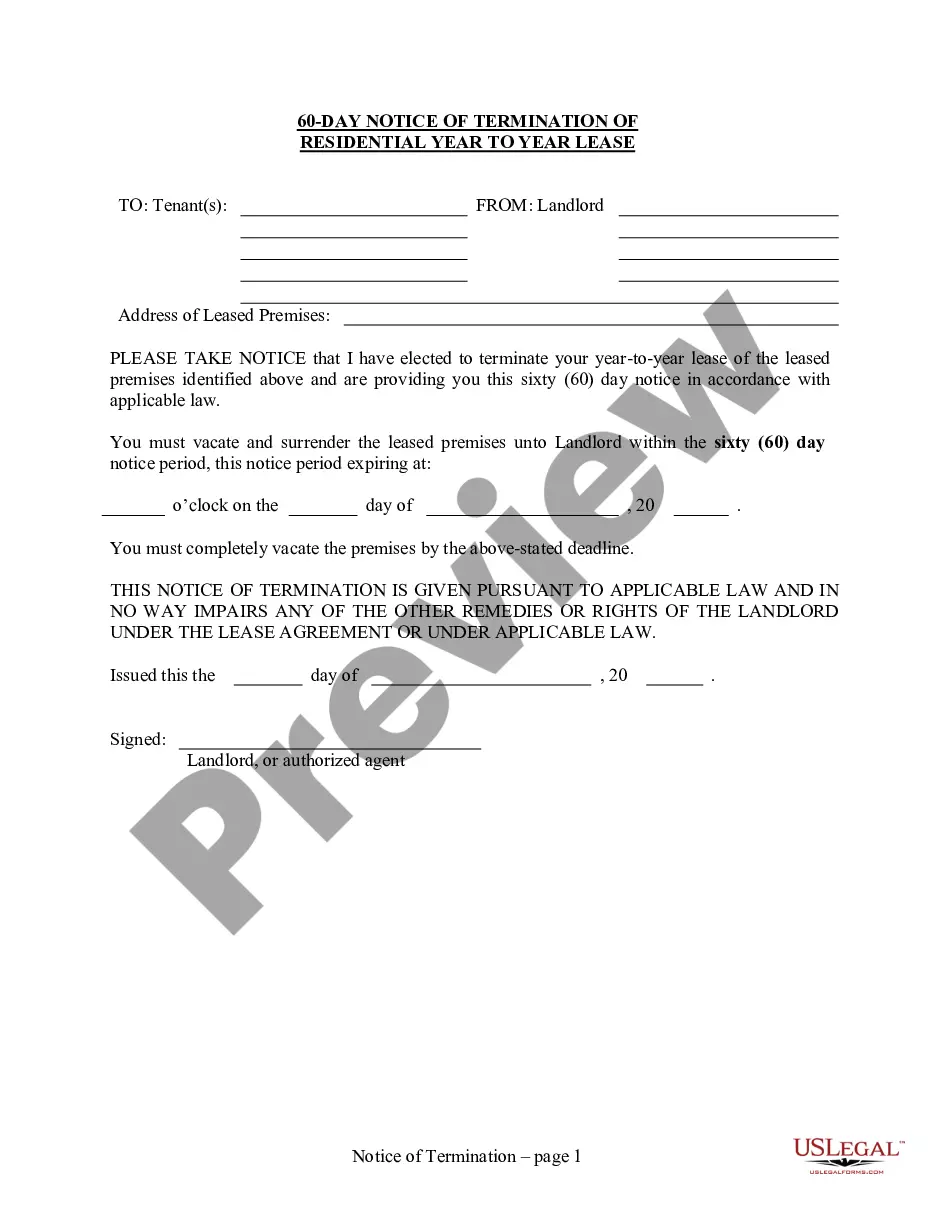

When a landlord decides not to renew a lease in Maryland, they must notify the tenant before the lease ends. Generally, this notice is at least one month for year-to-year leases and a few days for week-to-week rentals. Always verify the specific details in your lease contract. For more streamlined processes, consider utilizing USLegalForms for your Maryland Rental Lease Agreement for Business.

In Maryland, a landlord must provide a tenant with proper notice before they move out. Usually, this notice should be at least 30 days, especially for month-to-month tenants. For leases that have longer terms, check the specific lease agreement. It's crucial to refer to comprehensive resources like USLegalForms for guidance on Maryland Rental Lease Agreement for Business to ensure compliance.