The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

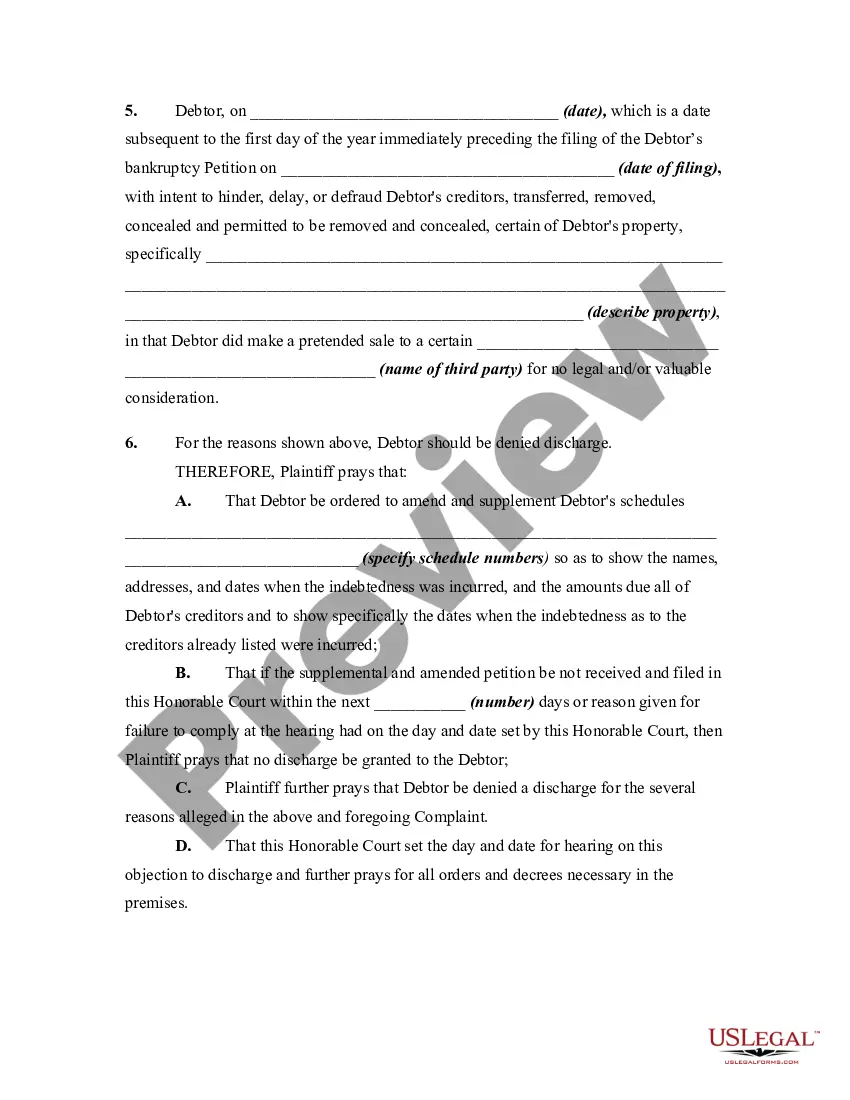

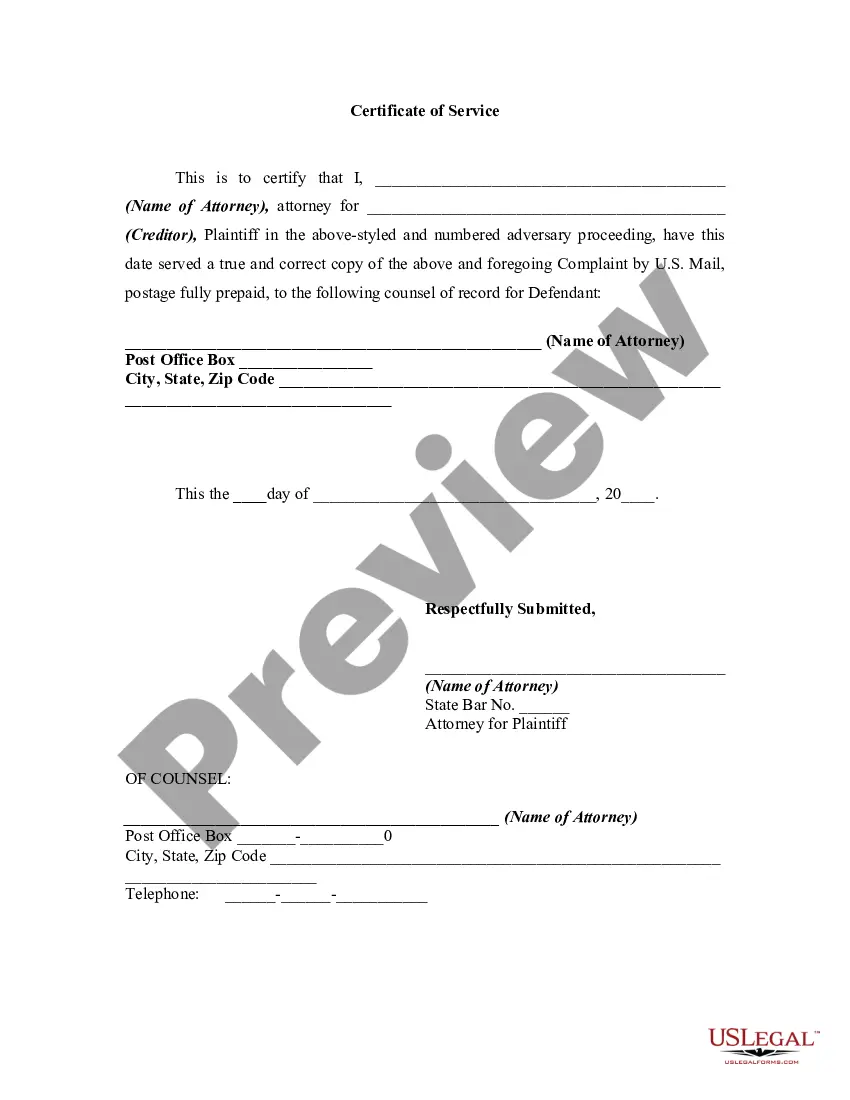

A Maryland Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property is a legal document used in bankruptcy cases to contest the debtor's discharge if they have engaged in actions that are fraudulent or unlawful. This complaint is filed by a creditor or the bankruptcy trustee to protect the rights of the creditors and ensure that the debtor does not improperly retain assets or hide property. Keywords: Maryland, complaint, objecting, discharge, bankruptcy proceeding, transfer, removal, destruction, concealment, property. Types of Maryland Complaint Objecting to Discharge: 1. Transfer of Property: This type of complaint is used when the debtor has fraudulently transferred property or assets to another person or entity in order to avoid having them included in the bankruptcy estate. The complaint will seek to recover these assets for the benefit of the creditors. 2. Removal of Property: If the debtor has intentionally removed property from their estate to hinder, delay, or defraud creditors, a complaint objecting to discharge can be filed. This may include situations where the debtor has sold or transferred assets shortly before filing for bankruptcy to avoid including them in the bankruptcy estate. 3. Destruction of Property: In some cases, a debtor may destroy or damage assets intentionally to prevent their inclusion in the bankruptcy estate. This complaint focuses on such situations and aims to prevent the debtor from discharging debts when they have engaged in destructive acts to jeopardize the creditors' rights. 4. Concealment of Property: This type of complaint is filed when the debtor has intentionally concealed or hidden assets from the bankruptcy estate. Examples may include failing to disclose bank accounts, property titles, valuable items, or income-generating assets. The complaint seeks to uncover these hidden assets and ensure that they are properly distributed among the creditors. In summary, a Maryland Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property is a legal tool used to challenge a debtor's discharge when they have engaged in fraudulent or unlawful activities involving their assets. By filing such a complaint, creditors and trustees work together to protect the integrity of the bankruptcy process and ensure fair treatment for all parties involved.