A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

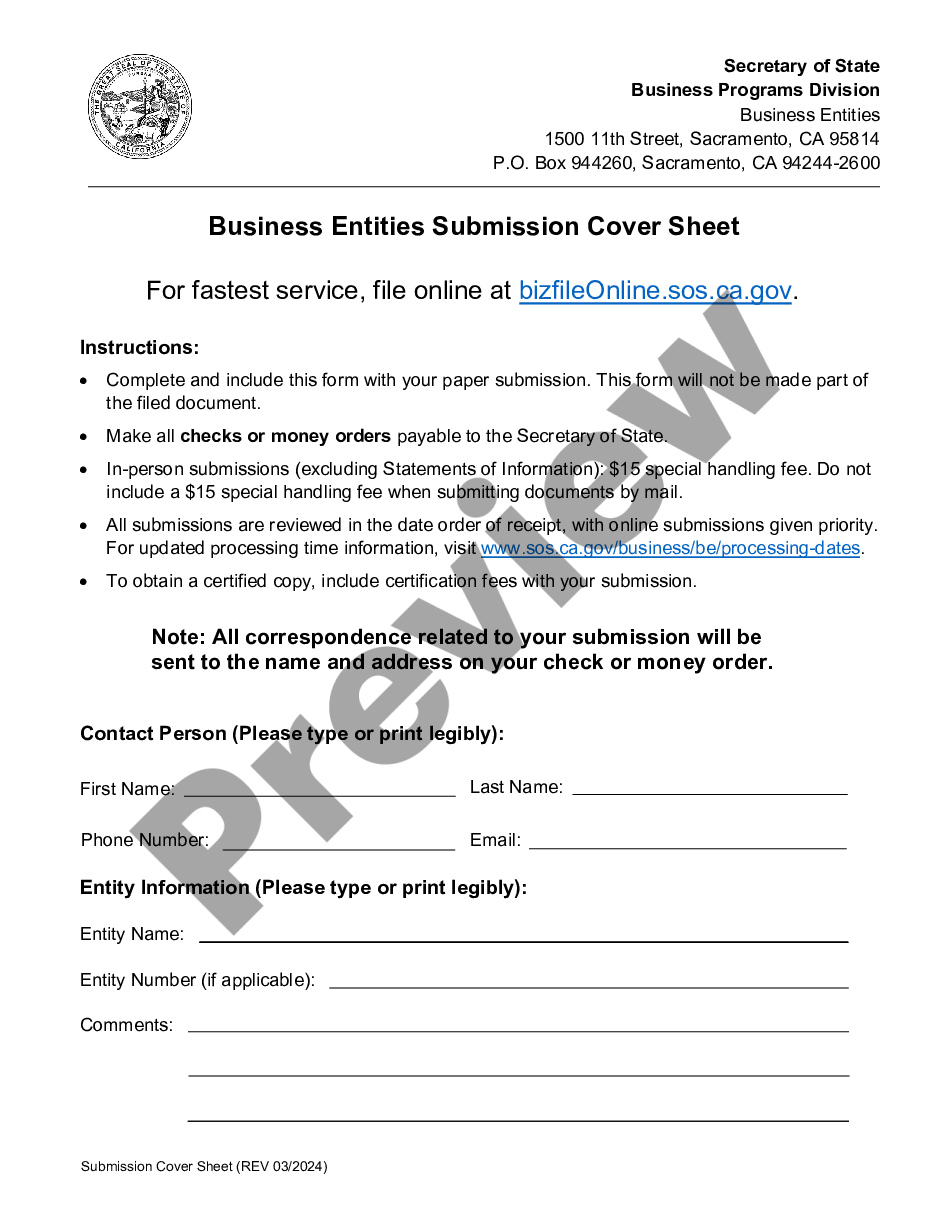

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

You can spend multiple hours online searching for the valid document template that meets state and federal requirements you need.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can download or print the Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability from our platform.

If available, use the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- Then, you may complete, modify, print, or sign the Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

- Each valid document template you purchase is yours forever.

- To obtain another copy of any acquired form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the area/city that you choose.

- Review the form details to verify you have selected the correct template.

Form popularity

FAQ

The guarantor of a company is typically an individual or entity that signs a guaranty agreement, assuring the company’s debts will be met. This could be a business owner, an executive, or a related business entity. The guarantor plays a vital role in helping the company access credit and improve its financial standing. Understanding the features of a Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is crucial for identifying the risks involved.

A guarantor in business is someone who promises to be liable for the business’s debts if it cannot meet its obligations. This role enhances the business's credibility and helps secure financing, especially for startups or companies with limited credit histories. The guarantor provides a safety net for lenders, encouraging them to lend more freely. Knowledge of the Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can provide additional protection in such situations.

To qualify as a guarantor, an individual or entity usually needs to have a strong credit history and sufficient financial resources. Lenders often look for guarantors who can demonstrate their ability to repay debts if necessary. Individuals with a vested interest in the business, like owners or major stakeholders, often serve as guarantors. Understanding the nuances of the Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can clarify responsibilities and expectations.

An unlimited continuing guaranty is a legal agreement where a guarantor agrees to assume liability for a business’s debts without any limit. This means that the guarantor may have to cover all obligations incurred by the business until the guaranty is revoked. This form of guaranty provides critical support for businesses seeking financing or credit. In Maryland, understanding the implications of a Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is essential for both creditors and debtors.

Different types of guarantors include personal guarantors, corporate guarantors, and joint guarantors. Each type comes with its own advantages and limitations, especially within the context of a Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Understanding these distinctions allows business owners like you to tailor your financing strategies effectively.

The three types of guarantees are unconditional guarantees, limited guarantees, and performance guarantees. An unconditional guarantee requires payment without conditions, while a limited guarantee offers restrictions on liability. In the realm of a Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, navigating these options can significantly influence your business’s financial strategy.

A personal guarantor is an individual who provides a guarantee based on their personal financial standing, while a corporate guarantor is a business entity that offers a guarantee. In a Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, the distinction is crucial, as a corporate guarantor may have more resources and liability limitations. Ultimately, your choice may depend on the financial health and structure of your business.

Being a guarantor carries several risks, including the possible impact on your credit score and personal finances. If the business defaults on its loans, you are responsible for repayment, which can strain your resources. The Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability may offer some limitations, but understanding the full scope of your risks is vital. Conduct thorough research and consider legal advice before stepping in as a guarantor.

The liabilities of a guarantor include being responsible for the debts owed by the borrower if they default. This means that if the company cannot meet its obligations, you may need to fulfill those financial responsibilities. Under the Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, certain liabilities can be limited. Therefore, it's important to read the agreement carefully to understand your obligations.

Yes, individuals can serve as guarantors for companies. When you sign as a guarantor, you agree to take responsibility for the company's debts under the Maryland Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. This arrangement allows businesses to secure financing while relying on individual support. Understanding the implications of this role is crucial for your financial health.