A broker is an agent who bargains and/or conducts negotiations for and on behalf of his or her principal as an intermediary between the principal and third persons in the acquisition of contractual rights. Such a broker normally receives a commission or brokerage fee for his or her services. While a broker's primary contractual duty is to procure prospects and negotiate with them on behalf of his or her principal, it is not uncommon for the broker to assume an advisory relationship to clients who are not knowledgeable in the types of contracts involved in the negotiations.

Maryland Exclusive Agreement Between Employer and Broker to Secure Group Insurance

Description

How to fill out Exclusive Agreement Between Employer And Broker To Secure Group Insurance?

Are you currently in a placement where you need to have documents for either company or specific purposes just about every time? There are plenty of lawful papers themes available on the net, but getting ones you can depend on isn`t easy. US Legal Forms offers a huge number of kind themes, like the Maryland Exclusive Agreement Between Employer and Broker to Secure Group Insurance, that are composed to fulfill federal and state demands.

If you are currently acquainted with US Legal Forms site and get a merchant account, just log in. Following that, you are able to down load the Maryland Exclusive Agreement Between Employer and Broker to Secure Group Insurance format.

Unless you offer an accounts and need to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is to the proper city/area.

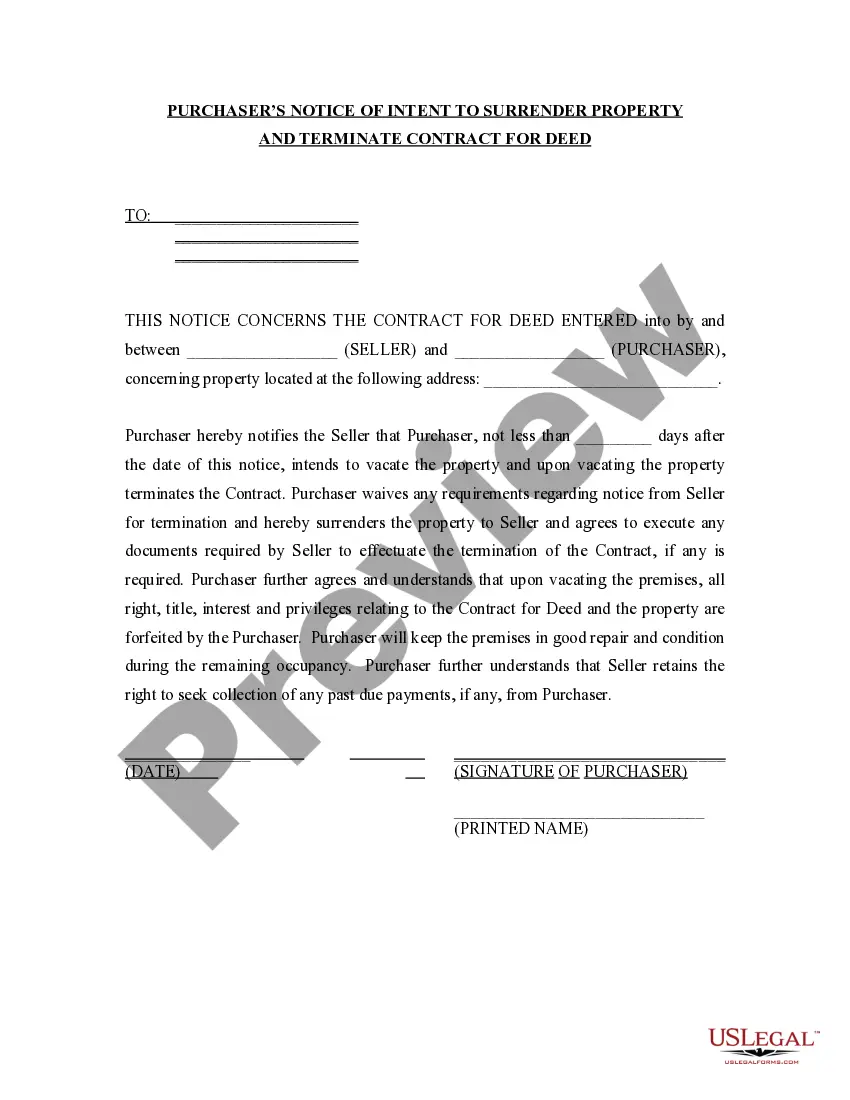

- Take advantage of the Preview switch to check the form.

- Read the explanation to actually have selected the correct kind.

- When the kind isn`t what you are seeking, use the Research discipline to find the kind that suits you and demands.

- Once you find the proper kind, simply click Acquire now.

- Pick the prices plan you want, fill out the required information and facts to generate your account, and pay money for your order using your PayPal or charge card.

- Decide on a convenient file structure and down load your duplicate.

Find every one of the papers themes you have bought in the My Forms food list. You can obtain a further duplicate of Maryland Exclusive Agreement Between Employer and Broker to Secure Group Insurance at any time, if possible. Just click on the needed kind to down load or print out the papers format.

Use US Legal Forms, by far the most substantial collection of lawful forms, to save lots of time and avoid mistakes. The service offers expertly created lawful papers themes that can be used for a selection of purposes. Generate a merchant account on US Legal Forms and start producing your life easier.