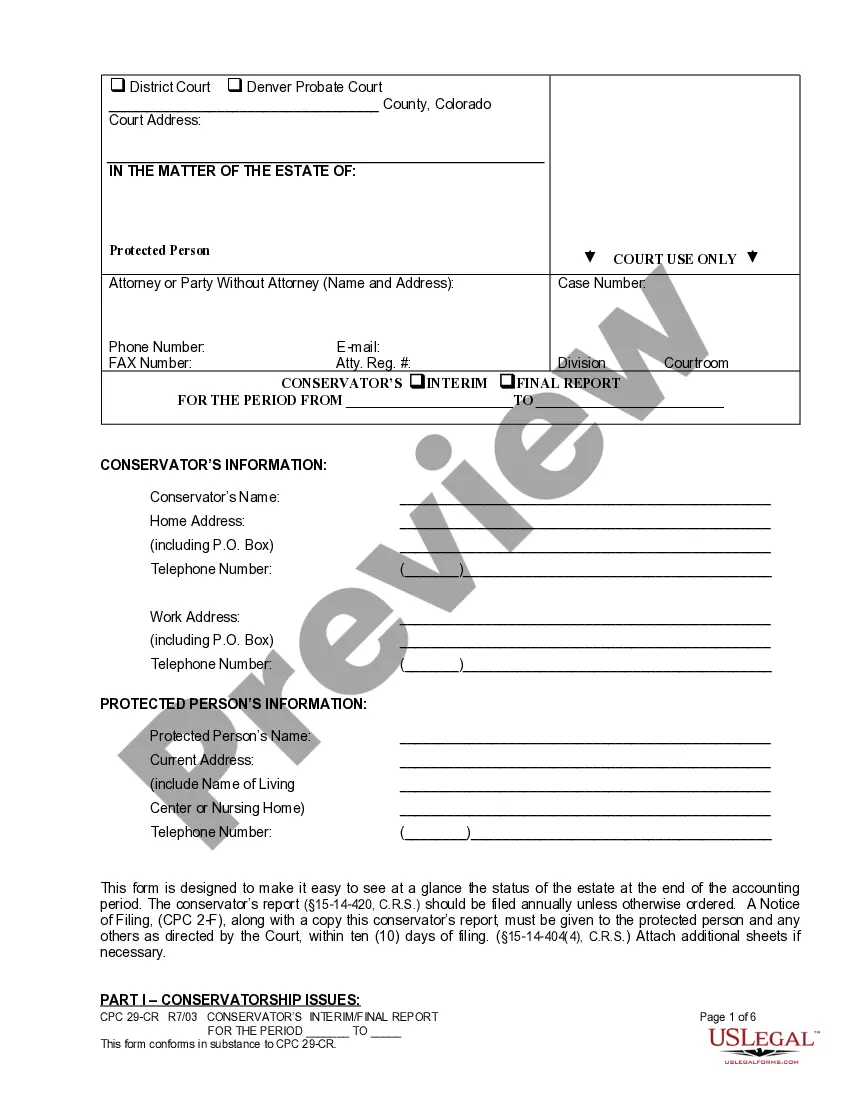

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

You may spend hours online searching for the legal document format that meets both state and federal standards you require.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can download or print the Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary through my service.

If available, use the Preview button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can fill out, modify, print, or sign the Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary.

- Every legal document format you purchase is yours forever.

- To get another copy of a purchased form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow these simple instructions.

- First, ensure that you have chosen the correct document format for the state/region of your choice.

- Review the form description to verify you have selected the right form.

Form popularity

FAQ

A beneficiary release form is a legal document that enables a beneficiary to formally acknowledge the receipt of assets or benefits from a trust or estate. In the context of a Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary, this form serves as proof that the beneficiary has received their allotted share from the trustee. It protected both the trustee and the beneficiary by documenting the transaction and preventing future claims. Using a reliable platform like US Legal Forms can simplify creating this essential document.

A receipt and release form PDF is a digital version of the traditional receipt and release document, available for easy access and printing. This format can streamline the process of obtaining signatures and maintaining records. You can find templates for these documents on platforms like uslegalforms, which can aid in effectively completing your Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary.

A receipt of beneficiary of a trust is a formal acknowledgment from a beneficiary that they have received their entitled distributions. This document is essential for maintaining clear records and safeguarding trustees from potential claims regarding the trust assets. It plays a significant role in the context of a Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary.

The primary purpose of a receipt and release is to document that beneficiaries have received their distributions from a trust or estate, thereby protecting trustees from any future claims. It serves as legal evidence of the transfer of assets and prevents misunderstandings between parties. Understanding this document is key when dealing with Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary situations.

Writing a trust distribution letter involves clearly outlining the details of the assets being distributed to beneficiaries. Start with a formal greeting, include the trust's name, specify what assets are being distributed, and mention the importance of signing a receipt and release. For those navigating the complexities of a Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary, using templates from platforms like uslegalforms can simplify this process.

A release form for inheritance is designed specifically for heirs to confirm that they have received their inherited assets. This document typically includes details about the distribution and protects the executor or trustee from any future disputes regarding that inheritance. It ensures a smooth transition during the estate settlement process, particularly during a Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary scenario.

A release form is a legal document that allows one party to relinquish their rights to claim assets or take legal action against another party. It is commonly used in various situations, including trusts, to protect the party distributing assets from future claims. In the context of Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary, this form helps ensure that the beneficiary acknowledges receipt and waives any potential claims.

A receipt and release form is a legal document used by beneficiaries to confirm they have received their distributions from a trust or estate. This form acts as a formal acknowledgment and provides protection for trustees by documenting that beneficiaries cannot later contest the distribution. Utilizing such a form is essential in the process of Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary.

A receipt release is a document that signifies a beneficiary has received assets from a trust or estate. By providing this document, the beneficiary acknowledges the receipt of their share and releases the trustee from any further claims related to that distribution. This process is often a crucial part of settling an estate and can simplify the finalization of trust distributions.

Distributing funds from a trust typically involves creating a clear plan based on the trust's terms and the beneficiaries' needs. Trustees should follow the stipulations laid out in the trust agreement while ensuring that all distributions are documented. The Maryland Release by Trustee to Beneficiary and Receipt from Beneficiary documents this process, providing a formal acknowledgment that safeguards both the trustee and the beneficiaries.