Maryland Receipt Template for Cash Payment refers to a document that acts as proof of a transaction involving cash payment in the state of Maryland. It serves as a record for both the payer and the recipient, ensuring transparency and accountability. A Maryland Receipt Template for Cash Payment typically includes essential information such as the date of the transaction, the name and contact details of the payer and recipient, a detailed description of the goods or services provided, the amount paid in cash, any applicable taxes, and the signature of both parties involved. Different types of Maryland Receipt Templates for Cash Payment may exist to cater to varied business needs and industries. Some common types include: 1. Retail Receipt Template: Primarily used in retail businesses, this template includes additional details such as product names, quantities, prices, and any applicable discounts or promotions. 2. Service Receipt Template: More suitable for service-based businesses, this template emphasizes the nature of the provided service, along with relevant details such as duration, hourly rate, or project-based costs. 3. Rent Receipt Template: Tailored for landlords and property managers, this template incorporates specific details related to rental agreements, including the property address, lease term, security deposit, and monthly rent amount. 4. Contractor Receipt Template: Specifically designed for contractors and freelance workers, this template might include sections for project milestones, hourly rates, or estimated completion dates. Regardless of the specific type, Maryland Receipt Templates for Cash Payment are crucial for accurate bookkeeping, tax purposes, and potential disputes. It is essential to retain copies of these receipts to maintain financial records and comply with legal requirements. In conclusion, a Maryland Receipt Template for Cash Payment is a comprehensive document that serves as a written confirmation of financial transactions involving cash. Different types of templates exist, such as retail, service, rent, and contractor receipts, each tailored to the specific needs of different industries and businesses. Proper utilization of these templates ensures compliance and transparency in financial matters.

Maryland Receipt Template for Cash Payment

Description

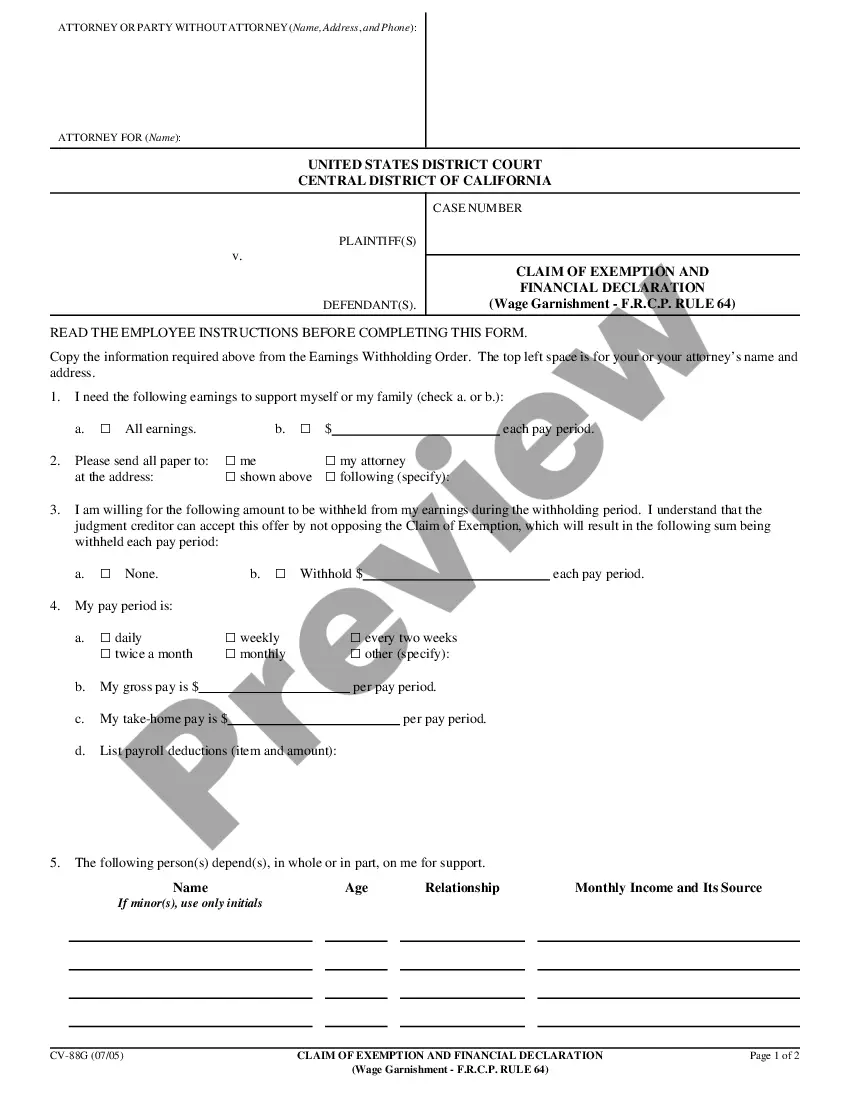

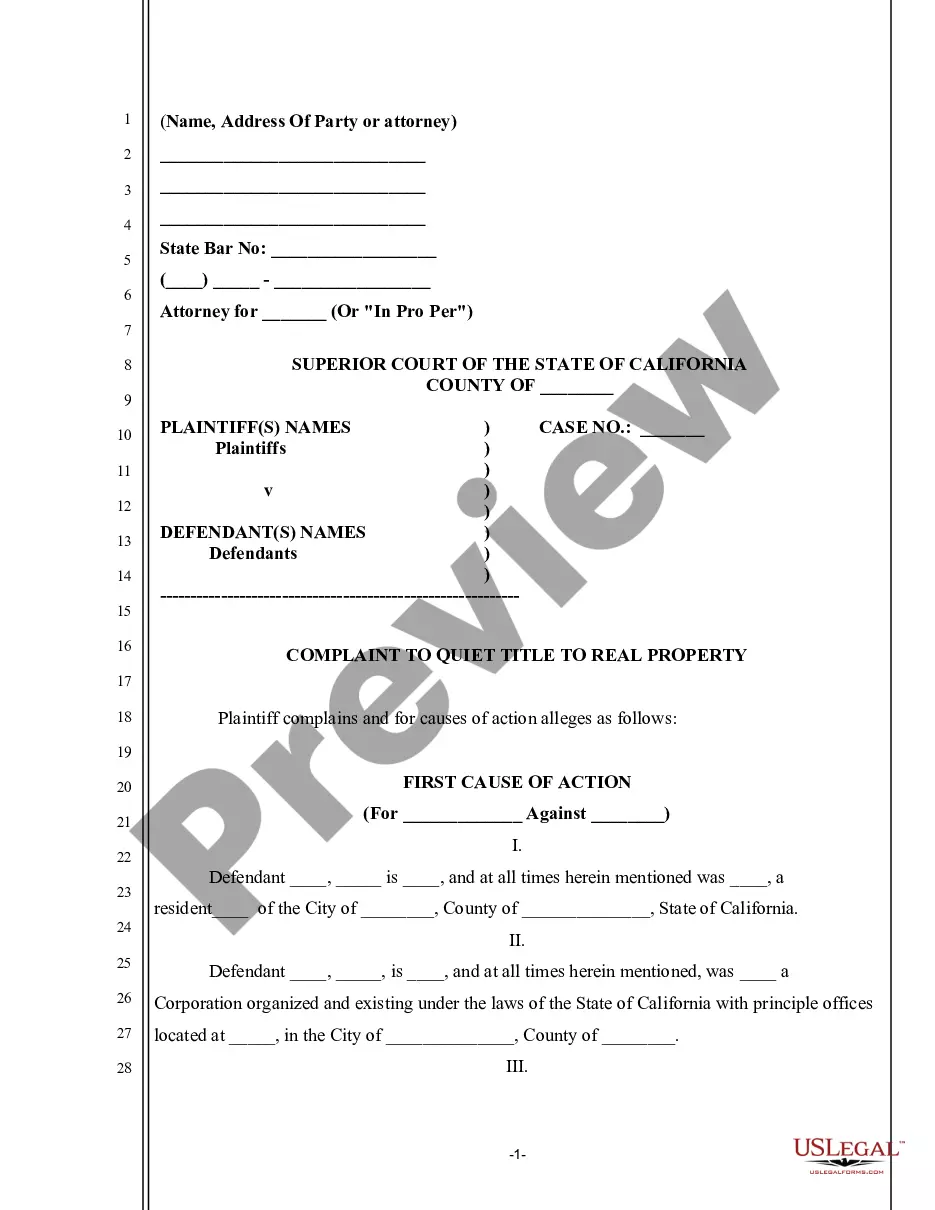

How to fill out Maryland Receipt Template For Cash Payment?

Have you been in a position in which you need paperwork for either business or personal functions nearly every working day? There are tons of legal papers themes accessible on the Internet, but finding kinds you can rely is not straightforward. US Legal Forms offers 1000s of kind themes, much like the Maryland Receipt Template for Cash Payment, that happen to be composed to meet federal and state demands.

In case you are previously familiar with US Legal Forms site and also have an account, merely log in. Afterward, you may obtain the Maryland Receipt Template for Cash Payment template.

Should you not provide an bank account and need to begin to use US Legal Forms, follow these steps:

- Obtain the kind you will need and make sure it is for that right city/region.

- Make use of the Preview button to examine the shape.

- Look at the outline to actually have selected the proper kind.

- When the kind is not what you`re searching for, make use of the Search industry to find the kind that meets your needs and demands.

- Whenever you get the right kind, click on Buy now.

- Opt for the prices plan you desire, fill in the required information to produce your money, and purchase an order with your PayPal or credit card.

- Select a handy data file structure and obtain your copy.

Locate all the papers themes you may have purchased in the My Forms food selection. You may get a further copy of Maryland Receipt Template for Cash Payment whenever, if possible. Just go through the required kind to obtain or printing the papers template.

Use US Legal Forms, one of the most extensive selection of legal varieties, to save time and prevent blunders. The service offers appropriately created legal papers themes which you can use for a selection of functions. Make an account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)

Receipts should be provided for every product or service purchased from your business, even if the customer is paying with cash. You can print the receipt as you sell the product or service and give it to the customer immediately after their purchase.

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

Format of Cash ReceiptThe date on which the transaction happened.The unique number assigned to the document for identification.The name of the customer.The amount of cash received.The method of payment, i.e., by cash, cheque, etc.;The signature of the vendor.

This is the information that should be included on a receipt: Your company's details including name, address, telephone number, and/or e-mail address. The date the transaction took place. List of products/services with a brief description of each along with the quantity delivered.

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

How to Write a ReceiptDate;Receipt Number;Amount Received ($);Transaction Details (what was purchased?);Received by (seller);Received from (buyer);Payment Method (cash, check, credit card, etc.);Check Number (if applicable); and.More items...?