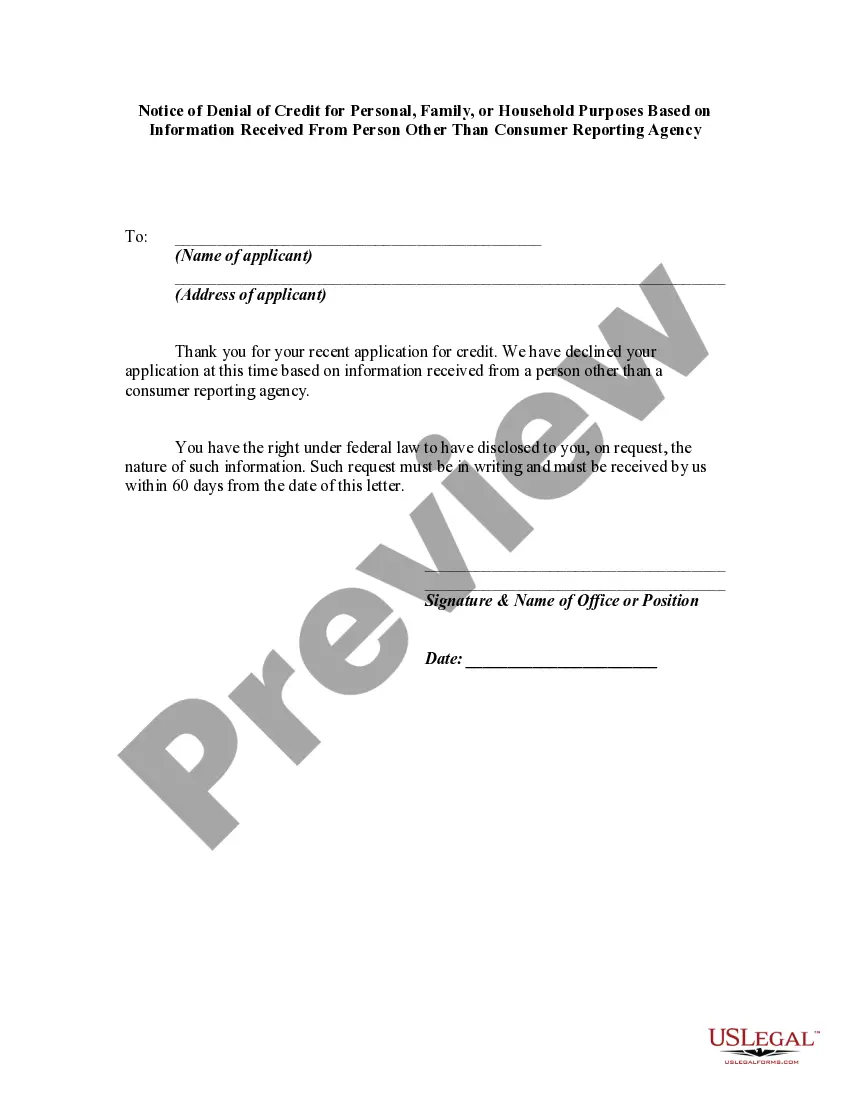

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

Maryland Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency is a document that serves as a formal notification to individuals who have been denied credit for personal, family, or household purposes due to information obtained from sources other than consumer reporting agencies. This notice is governed by Maryland law and ensures that consumers have access to accurate and fair credit decisions. When it comes to different types of Maryland Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency, they can vary based on the specific circumstances or information that led to the denial. Some possible variations include: 1. Denial based on employment information: This type of notice is issued when the denial of credit is a result of information provided by the applicant's current or previous employers. It may include details such as job history, income stability, or employment verification. 2. Denial based on personal references: If the credit application was rejected due to references provided by the applicant, this type of notice would be issued. It could include information related to the credibility or financial stability of the references. 3. Denial based on financial statements or documents: When credit is denied based on financial information submitted by the applicant, such as bank statements, tax returns, or asset declarations, this type of notice would be given. 4. Denial based on character references: In some cases, credit denials can occur due to character references provided by individuals who may have knowledge of the applicant's financial behavior or trustworthiness. This type of notice would outline the reasons for denial based on such references. Regardless of the specific type of Maryland Notice of Denial of Credit for Personal, Family, or Household Purposes, the document should contain essential information such as: — The name and contact information of the creditor or lending institution — The name and contact information of the consumer who applied for credit — The specific reason(s) for the denial of credit based on information received — The date on which the denial decision was made — Contact information for the person or entity providing the information leading to the denial — A statement informing the consumer of their right to obtain a free copy of their credit report from a consumer reporting agency within a specified timeframe — Instructions on how to dispute the accuracy or completeness of the information provided by the person other than a consumer reporting agency. — A statement highlighting the consumer's rights under the Fair Credit Reporting Act and the Maryland law — Any additional state-mandated disclosures or requirements that may apply. It is important to consult with legal professionals or credit experts to ensure the accuracy and compliance of the Maryland Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency, as the specific requirements may vary depending on the jurisdiction and individual circumstances.Maryland Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency is a document that serves as a formal notification to individuals who have been denied credit for personal, family, or household purposes due to information obtained from sources other than consumer reporting agencies. This notice is governed by Maryland law and ensures that consumers have access to accurate and fair credit decisions. When it comes to different types of Maryland Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency, they can vary based on the specific circumstances or information that led to the denial. Some possible variations include: 1. Denial based on employment information: This type of notice is issued when the denial of credit is a result of information provided by the applicant's current or previous employers. It may include details such as job history, income stability, or employment verification. 2. Denial based on personal references: If the credit application was rejected due to references provided by the applicant, this type of notice would be issued. It could include information related to the credibility or financial stability of the references. 3. Denial based on financial statements or documents: When credit is denied based on financial information submitted by the applicant, such as bank statements, tax returns, or asset declarations, this type of notice would be given. 4. Denial based on character references: In some cases, credit denials can occur due to character references provided by individuals who may have knowledge of the applicant's financial behavior or trustworthiness. This type of notice would outline the reasons for denial based on such references. Regardless of the specific type of Maryland Notice of Denial of Credit for Personal, Family, or Household Purposes, the document should contain essential information such as: — The name and contact information of the creditor or lending institution — The name and contact information of the consumer who applied for credit — The specific reason(s) for the denial of credit based on information received — The date on which the denial decision was made — Contact information for the person or entity providing the information leading to the denial — A statement informing the consumer of their right to obtain a free copy of their credit report from a consumer reporting agency within a specified timeframe — Instructions on how to dispute the accuracy or completeness of the information provided by the person other than a consumer reporting agency. — A statement highlighting the consumer's rights under the Fair Credit Reporting Act and the Maryland law — Any additional state-mandated disclosures or requirements that may apply. It is important to consult with legal professionals or credit experts to ensure the accuracy and compliance of the Maryland Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency, as the specific requirements may vary depending on the jurisdiction and individual circumstances.