Maryland Triple Net Lease for Industrial Property

Description

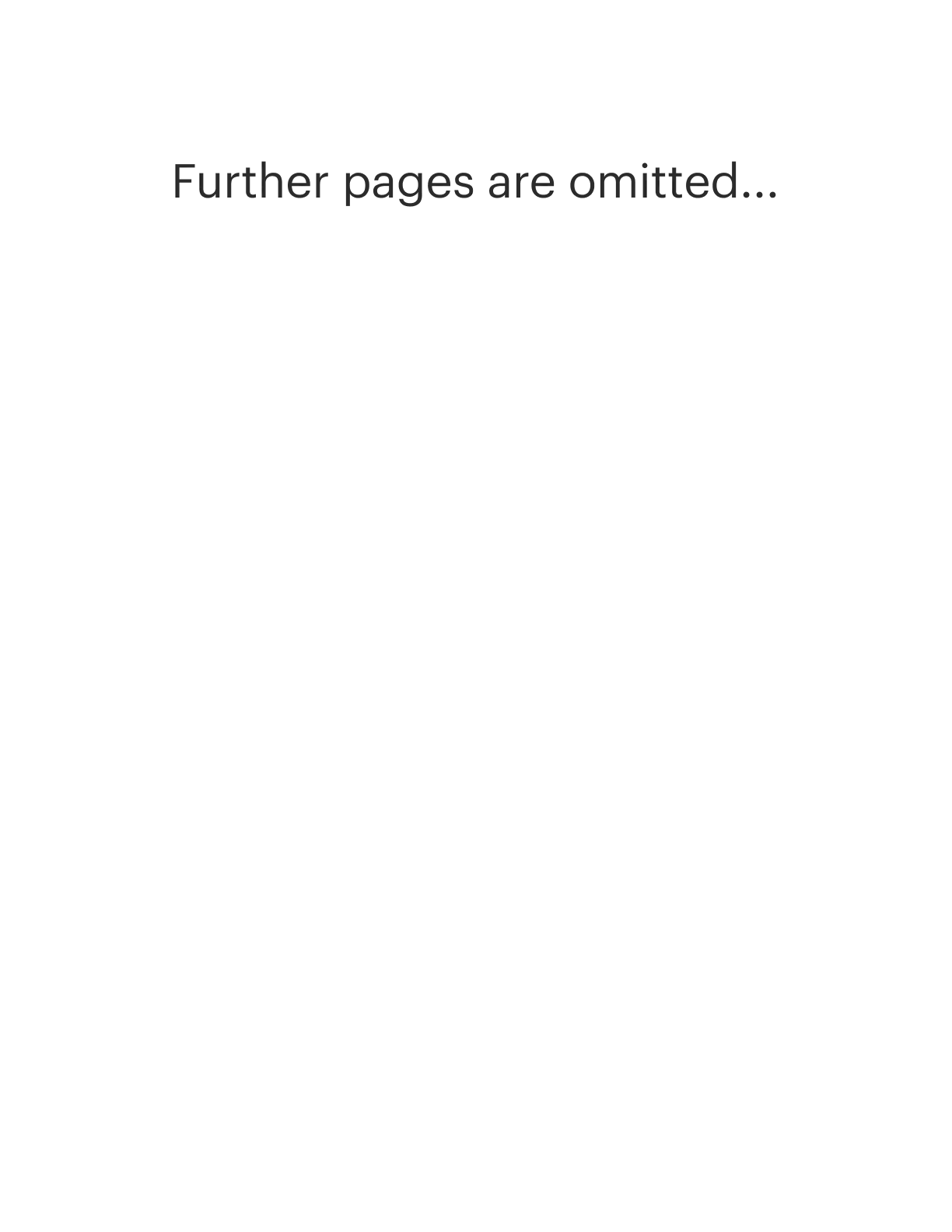

How to fill out Triple Net Lease For Industrial Property?

If you seek extensive, acquire, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available on the web.

Take advantage of the site’s straightforward and user-friendly search functionality to locate the documents you require.

A multitude of templates for business and personal purposes are categorized by type and state, or keywords.

Step 3. If you are dissatisfied with the form, use the Search box at the top of the page to find alternative versions of the legal form type.

Step 4. Once you have found the form you want, click the Get now button. Choose the subscription plan you prefer and enter your details to create an account.

- Utilize US Legal Forms to locate the Maryland Triple Net Lease for Industrial Property in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the Maryland Triple Net Lease for Industrial Property.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct area/region.

- Step 2. Utilize the Preview feature to review the form’s details. Don’t forget to read the description.

Form popularity

FAQ

The primary difference between commercial and industrial leases lies in the type of activities allowed on the premises. Commercial leases generally cover retail, office spaces, and various business services, whereas Maryland Triple Net Lease for Industrial Property specifically caters to manufacturing or distribution operations. Furthermore, industrial leases often include specific terms regarding equipment use and operational hours that commercial leases might not account for. Recognizing these differences is essential for businesses when selecting a suitable property.

Industrial gross refers to a lease type where the landlord includes most operational costs like maintenance, taxes, and insurance in the rental rate. In contrast to a Maryland Triple Net Lease for Industrial Property, where tenants bear these responsibilities, an industrial gross lease simplifies the financial obligations for tenants. This type of lease is advantageous for businesses that prefer predictable expenses and less management. Understanding industrial gross helps tenants decide which lease structure works best for their needs.

The key difference between industrial gross and NNN leases lies in how expenses are handled. With a Maryland Triple Net Lease for Industrial Property, tenants are responsible for property taxes, insurance, and maintenance costs, while the industrial gross lease typically includes those expenses in the rent. This means that in a gross lease, the landlord manages most of the operational costs rather than the tenant. Understanding these distinctions helps businesses choose the lease type that aligns best with their financial strategies.

One downside of a Maryland Triple Net Lease for Industrial Property is that tenants may face unpredictable costs due to fluctuating expenses like property taxes and maintenance fees. This could lead to financial strain if not properly managed. Moreover, tenants must handle more responsibilities, which can be daunting for those unfamiliar with property management.

A Maryland Triple Net Lease for Industrial Property generally includes provisions for property taxes, insurance premiums, and maintenance obligations. Often, it also outlines the tenant’s responsibilities, such as routine upkeep and minor repairs. Understanding these elements helps create a clear agreement, reducing disputes and enhancing the landlord-tenant relationship.

Typically, a Maryland Triple Net Lease for Industrial Property does not cover the landlord's mortgage payments and certain capital expenditures, like major renovations or substantial repairs. Additionally, utilities may fall under the tenant's responsibility, depending on the lease terms. This division of financial responsibilities allows landlords to focus on property management while tenants handle operational costs.

In a Maryland Triple Net Lease for Industrial Property, the tenant usually covers three main expenses: property taxes, insurance, and maintenance costs. These costs provide a clearer understanding of the total financial commitment for tenants and help landlords avoid unforeseen expenses. As a result, both parties can enjoy a more streamlined leasing experience.

The Maryland Triple Net Lease for Industrial Property often applies to industrial facilities such as warehouses, manufacturing plants, and distribution centers. These properties typically have stable, long-term tenants who seek predictable costs. This benefits landlords as they secure steady income with less management effort, making these properties ideal for triple net leases.

To qualify for a Maryland triple net lease for industrial property, you generally need to demonstrate strong financial stability and a positive credit history. Landlords typically look for businesses that can reliably cover property expenses such as taxes, insurance, and maintenance. It’s essential to have a solid business plan and show that your operations align with the property requirements. Using platforms like uslegalforms can help you understand the documentation needed to streamline the process.

To calculate commercial rent under a triple net lease, first determine the base rent per square foot, then add the tenant's share of property expenses. For a Maryland Triple Net Lease for Industrial Property, this might include property taxes, insurance, and maintenance costs. Understanding this calculation allows tenants to assess the total financial commitment involved in leasing the property.