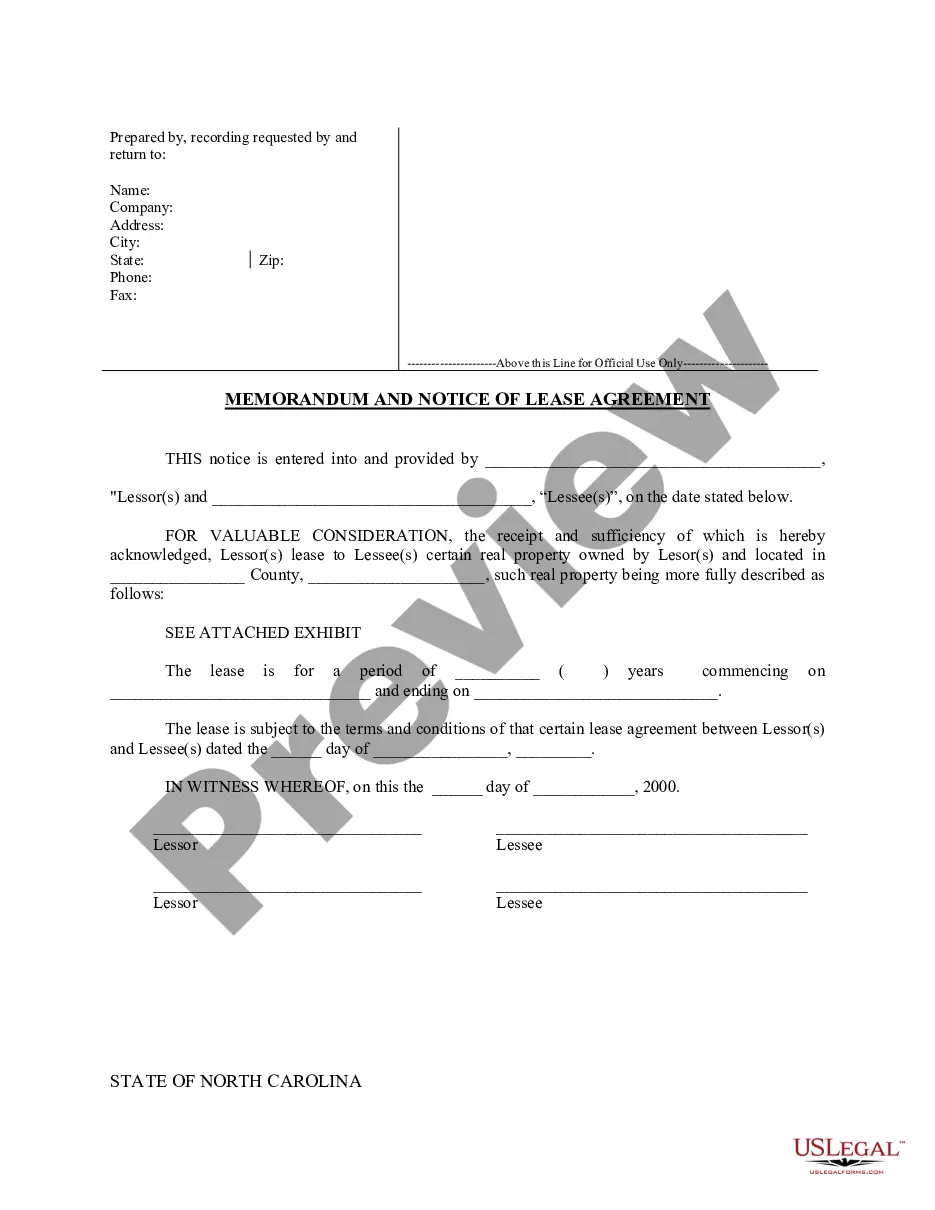

Maryland Triple Net Lease for Commercial Real Estate is a type of lease agreement that is commonly used in the state of Maryland. This lease structure is popular among commercial property owners and tenants as it provides certain advantages and responsibilities for each party involved. A Triple Net Lease, also known as NNN lease, is a lease agreement where the tenant agrees to pay for all the operating expenses related to the property, in addition to the base rent. These operating expenses typically include property taxes, insurance premiums, and maintenance costs. The tenant assumes the responsibility for these expenses, thus relieving the landlord of financial burdens associated with the property. In the context of Maryland, there are various types of Triple Net Leases available for commercial real estate. Some common types include: 1. Single Tenant Triple Net Lease: This type of lease involves a single tenant who leases the entire commercial property. It is most commonly seen in smaller properties, such as standalone retail stores or small office buildings. 2. Multi-Tenant Triple Net Lease: In a multi-tenant lease, multiple tenants occupy different spaces within the same commercial property. Each tenant is responsible for their proportionate share of expenses, based on the size or location of their rented space. 3. Ground Lease with Triple Net Provisions: This lease type is typically entered into when a tenant wants to lease only the land and construct their own building. The tenant is responsible for all costs associated with the land, building construction, and ongoing expenses. 4. Absolute Triple Net Lease: In an absolute triple net lease, the tenant assumes responsibility for not only property taxes, insurance, and maintenance costs but also for the structural repairs and replacement of major components, such as the roof and HVAC system. Maryland Triple Net Leases offer benefits for both landlords and tenants. For landlords, this lease structure ensures a predictable income stream without the need to manage expenses directly. On the other hand, tenants have more control over their leased space and can customize it to their specific needs without relying on the landlord. It is important for both parties to carefully review and negotiate the terms and conditions of a Maryland Triple Net Lease to ensure a mutually beneficial agreement. Seeking professional legal and real estate advice is highly recommended ensuring compliance with state laws and protection of interests.

Maryland Triple Net Lease for Commercial Real Estate

Description

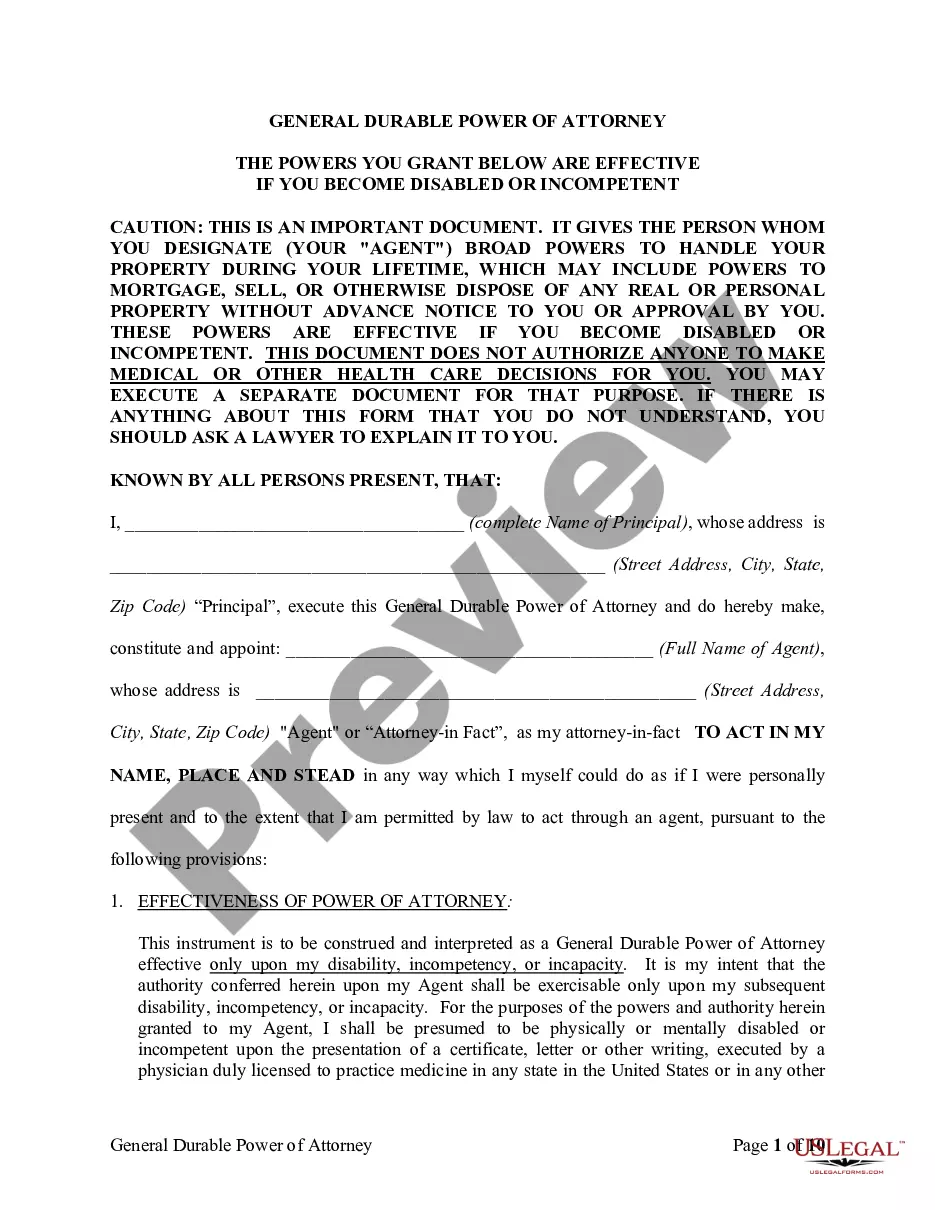

How to fill out Maryland Triple Net Lease For Commercial Real Estate?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal document formats that you can download or print. By using the website, you can access a multitude of forms for business and personal use, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Maryland Triple Net Lease for Commercial Real Estate in just a few moments.

If you already have a subscription, Log In and download the Maryland Triple Net Lease for Commercial Real Estate from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously acquired forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Maryland Triple Net Lease for Commercial Real Estate. Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents area and click on the document you need. Access the Maryland Triple Net Lease for Commercial Real Estate with US Legal Forms, the most extensive library of legal document formats. Utilize a vast array of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/region. Click the Review button to examine the form's content.

- Check the form details to confirm that you have selected the right document.

- If the form does not suit your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, pick the payment plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

Structuring a triple net lease involves clearly defining the responsibilities of both the landlord and the tenant. Typically, the lease outlines that the tenant will cover property taxes, insurance, and all maintenance costs in addition to the base rent. It is crucial to have explicit terms regarding each party's obligations to avoid disputes. If you are exploring options, consider using US Legal Forms as a practical solution to create structured agreements for a Maryland Triple Net Lease for Commercial Real Estate.

A common example of a NNN lease includes a retail store leasing space in a shopping center. In this scenario, the tenant is responsible for paying not only the rent but also the property taxes, insurance, and maintenance costs associated with the space. This type of lease provides landlords with a steady income stream while transferring operational responsibilities to the tenant. Understanding concepts like this is essential when considering a Maryland Triple Net Lease for Commercial Real Estate.

While a Maryland Triple Net Lease for Commercial Real Estate can offer reduced base rent, it also has drawbacks. Tenants bear the financial responsibility for operating expenses, which can fluctuate. Additionally, if a property has unexpected maintenance issues, the costs fall solely on the tenant. It is wise to thoroughly assess the lease terms, as this helps you make an informed decision.

In a Maryland Triple Net Lease for Commercial Real Estate, operating expenses typically include property taxes, insurance, and maintenance costs. These expenses are the responsibility of the tenant and can vary significantly based on the property type and location. By understanding these expenses, tenants can better budget for their monthly costs. This transparency can create a smoother landlord-tenant relationship.

Getting approved for a Maryland Triple Net Lease for Commercial Real Estate requires demonstrating financial reliability and a comprehensive understanding of lease responsibilities. You should prepare to show your business’s financial documents and possibly a lease guarantee. Using a platform like UsLegalForms can help you navigate these requirements and ensure you meet all necessary criteria.

While a Maryland Triple Net Lease for Commercial Real Estate offers benefits such as lower base rent, it does come with drawbacks. Tenants bear the responsibilities of property taxes, insurance, and maintenance costs, which can add financial pressure. It’s essential to carefully consider these obligations to avoid unexpected expenses.

Qualifying for a Maryland Triple Net Lease for Commercial Real Estate involves showcasing your business's financial strength and operational history. Landlords often look for established businesses with a proven track record. A solid business plan and adequate insurance coverage also play crucial roles in satisfying landlord requirements.

To get approved for a Maryland Triple Net Lease for Commercial Real Estate, you typically need to demonstrate sound financial stability and responsible business practices. Landlords assess your credit history, income, and business reputation. Providing thorough documentation, such as tax returns and financial statements, can significantly enhance your chances of approval.

To get started in a triple net lease, first, research properties that fit your business needs and budget. Next, consult with a real estate professional who understands the Maryland Triple Net Lease for Commercial Real Estate. They can help you navigate the process, negotiate terms, and ensure you understand all aspects of the lease before making a commitment.

$24.00 sf yr means that the rent for the commercial space is $24 per square foot per year. This figure usually includes the base rent along with estimated triple net expenses, which cover property taxes, insurance, and maintenance. Understanding this calculation is vital when entering into a Maryland Triple Net Lease for Commercial Real Estate, as it directly affects your overall lease agreement costs.

Interesting Questions

More info

For the first time in history, it can be used to make investments on a financial level, since a triple owner-ship requires the participation of two (or more) owners and no collateral, but the investor can pay cash. Triple Lease is the preferred method of financing for personal holdings, since an investor can simply deposit cash without risk. For small investors, the triple lease allows them to take ownership of their investments without the obligation to secure a lender. For individuals whose assets have limited liquidity, the triple lease allows them to obtain a loan from a potential lender without the risk that they will default. Triple lease offers benefits for investors, which are usually related to the investor's financial position. When using triple lease, the investor is usually unable to take advantage of other tax deductions, such as the IRA tax deduction or the qualified dividend expense deduction.