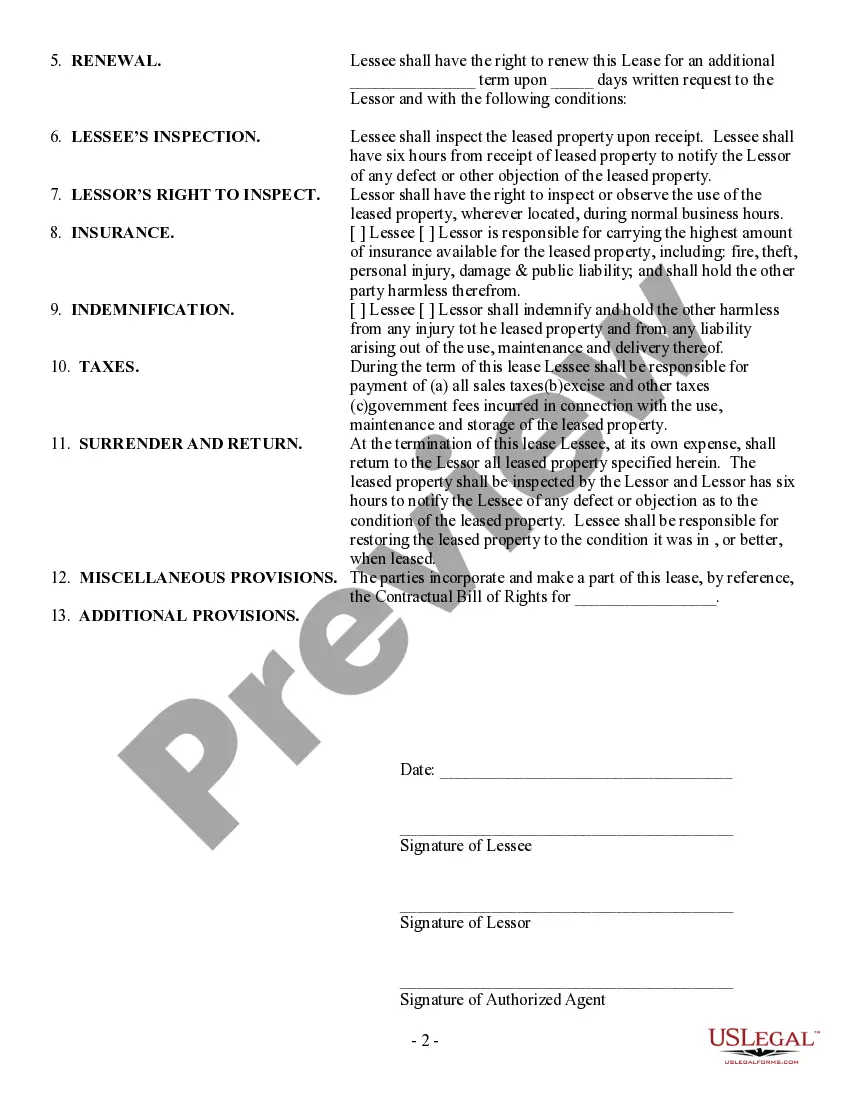

The Maryland Simple Equipment Lease is a legal document that establishes an agreement between a lessor (the equipment owner) and a lessee (the individual or business seeking to use the equipment). This lease outlines the terms and conditions surrounding the lease of equipment, making it a crucial document for both parties involved. The Maryland Simple Equipment Lease is designed to be easily understandable and accessible to parties of all levels of legal expertise. It provides a straightforward framework for leasing equipment, ensuring that the terms are clear and specific, preventing any misunderstandings or disputes. Some essential components covered in the Maryland Simple Equipment Lease include: 1. Parties Involved: This section identifies the lessor and lessee, stating their names and contact information. Any additional parties involved, such as guarantors or co-lessees, may also be mentioned. 2. Equipment Identification: It is essential to describe, in detail, the equipment being leased. This can include its make, model, serial number, and any specific features or accessories. Accurate equipment identification helps avoid confusion and ensures that the lessee understands the equipment they are leasing. 3. Lease Term: The lease term defines the duration for which the equipment is being leased. It specifies the lease start and end dates, outlining the exact period during which the lessee will have access to and use the equipment. 4. Rental Payments: This section outlines the rental fees and the payment structure agreed upon by both parties. It specifies the dates when rental payments are due, as well as any penalties for late payment or defaulting on the lease. 5. Security Deposit: The Maryland Simple Equipment Lease may require the lessee to provide a security deposit to protect the lessor against any damage or loss of the equipment during the lease term. 6. Insurance Requirements: This clause specifies the type and amount of insurance coverage the lessee must secure for the duration of the lease. It ensures that in case of any damage or loss, the equipment is adequately protected. 7. Maintenance and Repairs: The lease outlines the responsibilities of both the lessor and lessee regarding equipment maintenance and repairs. It may state that the lessee is responsible for routine maintenance, while the lessor covers major repairs and replacements. 8. End of Lease: This section provides information on what happens at the end of the lease term. It may include options such as returning the equipment, renewing the lease, or purchasing the equipment at a predetermined price. Types of Maryland Simple Equipment Lease: While the "Maryland Simple Equipment Lease" generally refers to a standard lease agreement for various types of equipment, there might be specific versions or variations depending on the industry or the equipment being leased. For example, Maryland might have specific clauses for equipment leases in the transportation industry, construction industry, or medical equipment leases. These specialized leases would include industry-specific terms and conditions to ensure they are tailored to the equipment's unique requirements.

Maryland Simple Equipment Lease

Description

How to fill out Maryland Simple Equipment Lease?

Are you presently in a location where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the Maryland Simple Equipment Lease, designed to meet federal and state requirements.

Once you find the correct form, click on Buy now.

Select the pricing plan you need, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you will be able to download the Maryland Simple Equipment Lease template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct state/area.

- Use the Review option to examine the form.

- Check the description to ensure you have selected the right document.

- If the form is not what you are looking for, use the Search field to locate the document that suits your needs.

Form popularity

FAQ

While renting and leasing both allow you to use equipment, they involve different commitments and timeframes. Renting is generally more flexible, while leasing, such as a Maryland Simple Equipment Lease, involves more specific terms and longer commitments. It's essential to choose based on your project duration and equipment needs.

Leasing tends to involve longer terms and may require a credit check or application process, while renting typically allows for short-term use with less commitment. A Maryland Simple Equipment Lease is a great option for those seeking longer-term access to equipment without the need for large upfront costs. Clarifying these differences can help you select the best option for your needs.

Yes, equipment leases can often be tax-deductible. Businesses may deduct lease payments as business expenses, which can help reduce taxable income. However, it is wise to consult a tax professional to ensure you fully understand the implications of a Maryland Simple Equipment Lease on your taxes.

Leasing and renting both involve paying for the use of equipment, but they differ in duration and terms. Typically, leasing agreements like a Maryland Simple Equipment Lease are long-term and may include an option to buy at the end. Renting usually means a shorter commitment for immediate needs. Therefore, choosing the right option depends on your specific situation.

To create a rental agreement for equipment, begin by clearly identifying the equipment involved and specifying the rental terms. Include details such as rental duration, payment amount, and responsibilities of each party. You can simplify this process by using the Maryland Simple Equipment Lease templates available on our US Legal Forms platform.

At the end of a lease, you usually have several options regarding the equipment. Common choices include purchasing the equipment for a residual value, renewing the lease, or returning the equipment to the lessor. This flexibility makes the Maryland Simple Equipment Lease appealing for businesses that want to adapt to changing needs. Consider your options carefully, as they can impact your future financial decisions.

An equipment lease functions as a contract where one party provides equipment to another in exchange for payments over time. Under a Maryland Simple Equipment Lease, you get access to the necessary equipment without outright purchasing it, allowing for flexibility. Payments are typically made monthly, making budgeting easier. At the lease's end, you can choose to buy, renew, or return the equipment, providing options that suit your business's needs.

In Maryland, businesses that own personal property, like equipment, must file a personal property return. This includes anyone leasing equipment under a Maryland Simple Equipment Lease. By filing, you help ensure that the property is correctly assessed for tax purposes. It is crucial for compliance, so consult a tax professional if you have questions about your specific obligations.

Leasing equipment for your business starts with assessing your needs and budget. Research various offers to find a suitable Maryland Simple Equipment Lease that meets your requirements. Utilize resources like USLegalForms to access lease templates, and ensure you understand the terms before signing any agreement.

Yes, you can get a lease under your LLC. When you pursue a Maryland Simple Equipment Lease, the leasing company typically requires documentation proving the LLC’s status. This allows your LLC to obtain equipment while protecting your personal assets.

Interesting Questions

More info

If there is no damage, but the property may experience flooding or other disasters, the landlord may seek a temporary stay from the court for the protection of the property. If the judge grants a stay, the landlord is not required to make the repairs until the stay ends. After the rental period ends, no one is allowed possession of the property without paying rent and no one is allowed to move into, or sell, the property. Lease Terminates At End of Rent Payment Period A landlord generally has the right to terminate a rental agreement when the tenant has paid the first date rent and the monthly rental period ends. However, if the tenant has not paid rent at the end of the last cycle of any month, but has not yet given written notice of termination of the tenancy at the close of a month at which the tenant still owes rent, such a tenant becomes liable for the payment of rent.