The courts have inherent power to restrain the sale of mortgaged premises in foreclosure proceedings, but are reluctant to exercise such power except where it is shown that particular circumstances, extrinsic to the instrument, would render its enforcement in this manner inequitable and work irreparable injury, and that complainant has no adequate remedy at law. Furthermore, a party must show a probable right of recovery in order to obtain a temporary injunction of a foreclosure action.

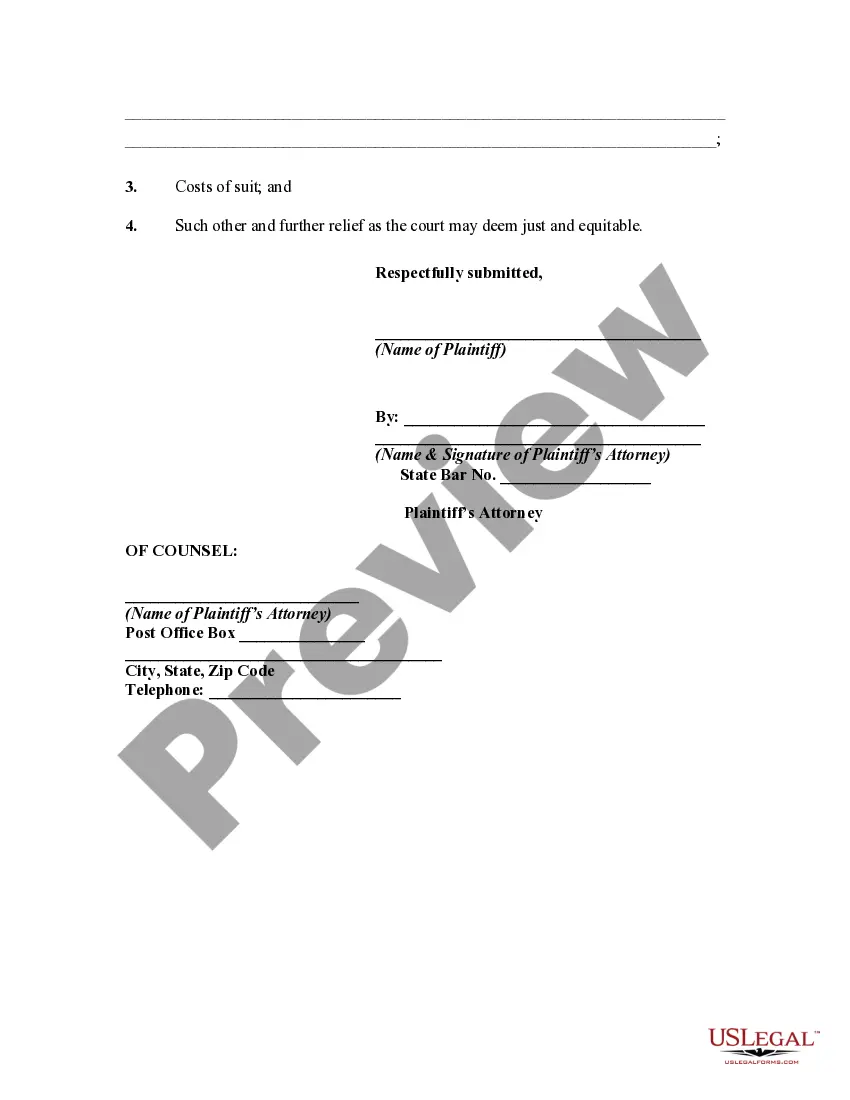

Maryland Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note In Maryland, a Complaint or Petition to Enjoin Foreclosure Sale can be filed due to a misunderstanding as to the terms of payment upon assuming a promissory note. When a borrower assumes a promissory note, there is often an expectation of clear and mutually agreed-upon terms regarding payment obligations. However, misunderstandings can arise, which may result in foreclosure proceedings. When filing a Complaint or Petition to Enjoin Foreclosure Sale in Maryland, it is crucial to provide a detailed description of the misunderstanding regarding the terms of payment upon assuming the promissory note. The complaint should clearly outline the facts and circumstances of the misunderstanding, including all relevant documents, communications, and agreements. By utilizing appropriate keywords, such as: 1. Maryland's foreclosure laws 2. Complaint to Enjoin Foreclosure Sale 3. Petition for Injunction in Maryland 4. Promissory Note terms of payment 5. Assumption of Promissory Note 6. Misunderstanding in payment obligations 7. Maryland's foreclosure process 8. Legal rights of borrowers 9. Mortgage agreements in Maryland 10. Breach of contract claim Different types of Complaints or Petitions to Enjoin Foreclosure Sale due to misunderstandings as to promissory note's terms of payment upon assumption of the note may include: 1. Alleged Misrepresentation: This type of complaint may arise when the borrower claims that the lender misrepresented or failed to disclose crucial terms of the promissory note at the time of assumption, resulting in a misunderstanding regarding payment obligations. 2. Unilateral Modification: If the lender unilaterally modifies the terms of the promissory note without the borrower's consent or proper notice, a complaint can be filed to enjoin foreclosure sale based on the argument that the borrower was not aware of the modified terms and therefore misunderstood their payment obligations. 3. Ambiguous or Vague Contracts: In cases where the terms of the promissory note are admissible to multiple interpretations, a complaint can be filed based on the argument that the borrower had a genuine misunderstanding regarding their payment obligations due to the ambiguous nature of the contract. 4. Lack of Clarity in Communication: If the lender or their representatives failed to effectively communicate or explain the terms of payment upon assumption of the promissory note to the borrower, resulting in a misunderstanding, a complaint can be filed to enjoin the foreclosure sale. It is essential to consult with an attorney experienced in Maryland foreclosure laws when filing a Complaint or Petition to Enjoin Foreclosure Sale due to a misunderstanding as to the terms of payment upon assumption of a promissory note. The attorney can assist in preparing a strong case, gathering relevant evidence, and navigating the legal process to protect the borrower's rights.