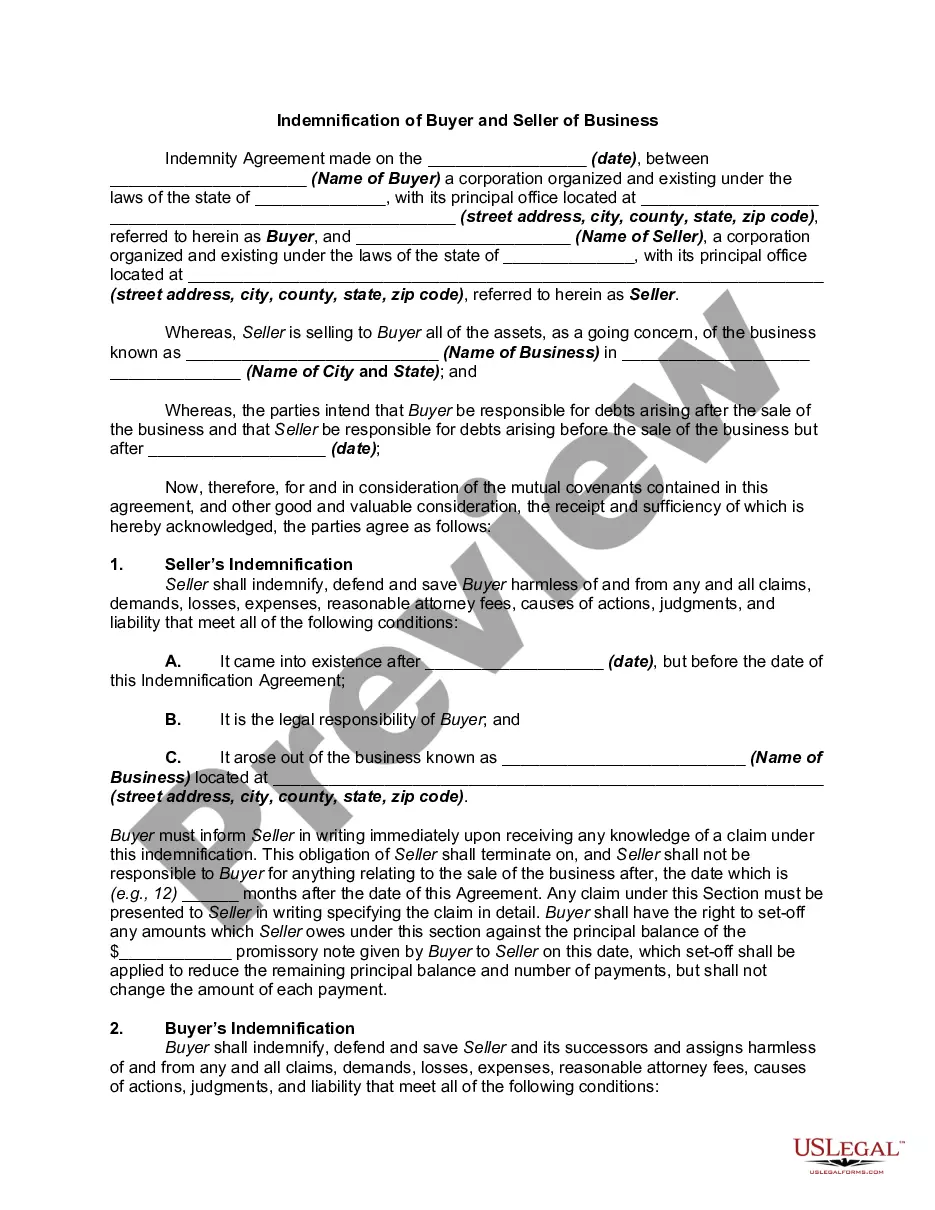

Indemnification is the act of making another "whole" by paying any loss another might suffer. This usually arises from a clause in a contract where a party agrees to pay for any monetary damages which arise or have arisen.

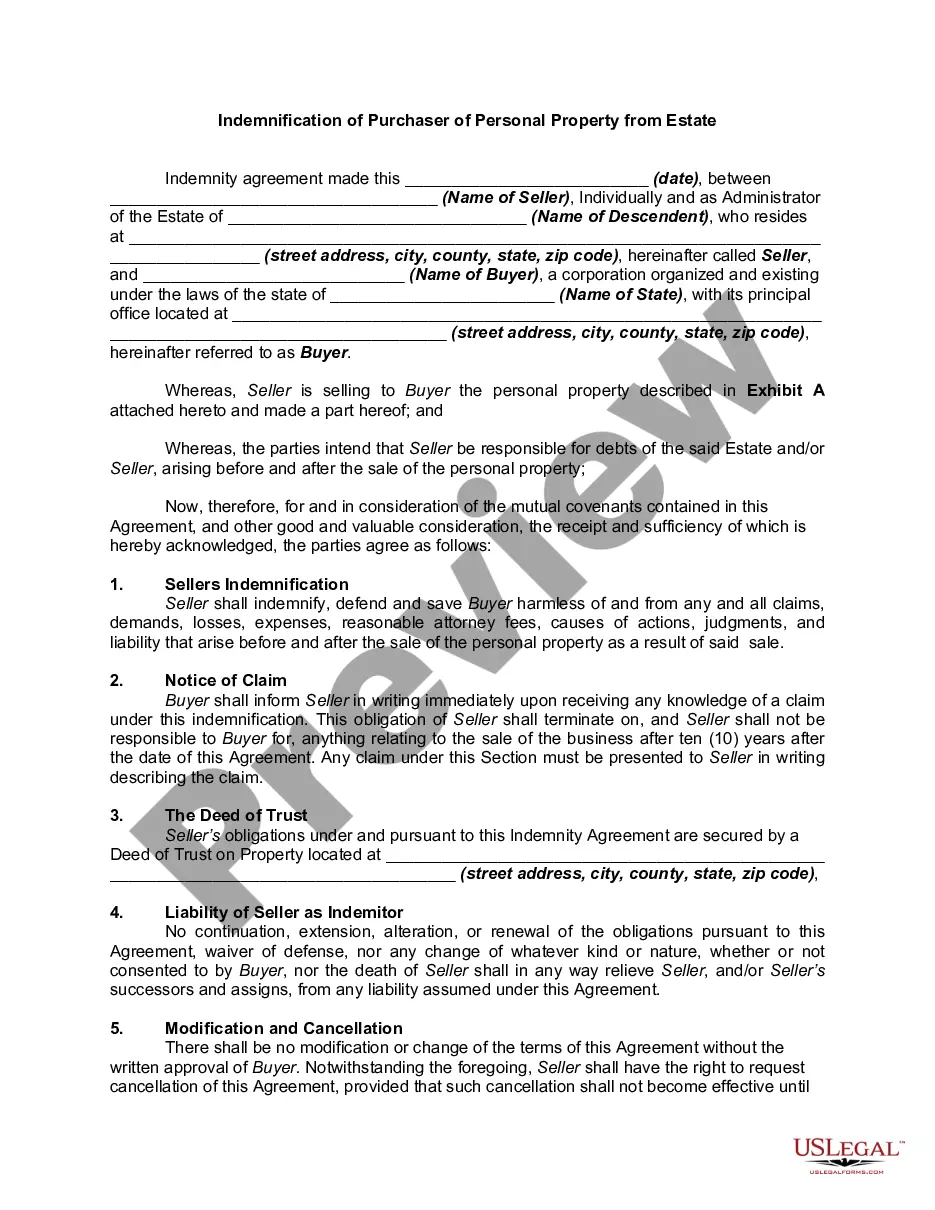

Maryland Indemnification of Purchaser of Personal Property from Estate

Description

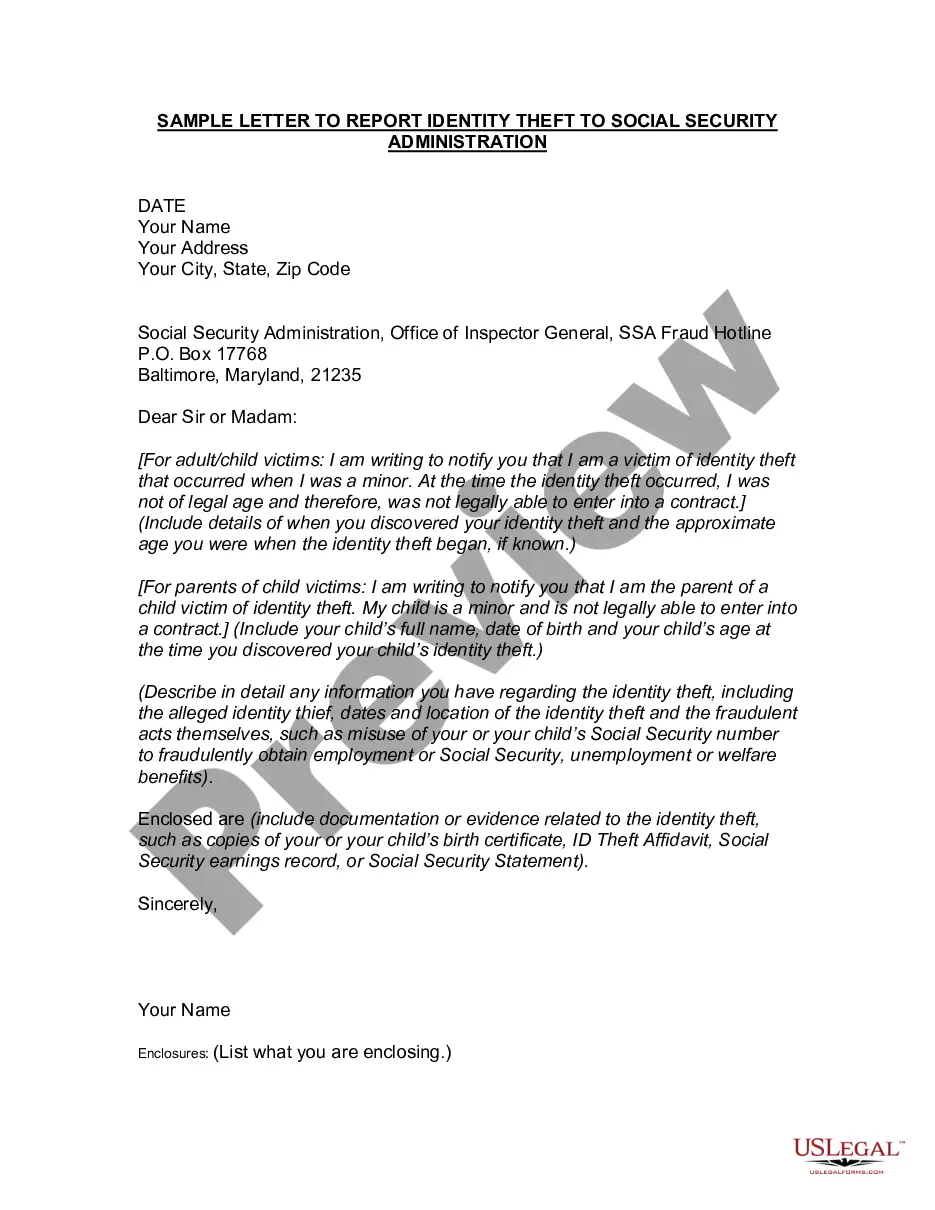

How to fill out Indemnification Of Purchaser Of Personal Property From Estate?

If you wish to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the necessary documents.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

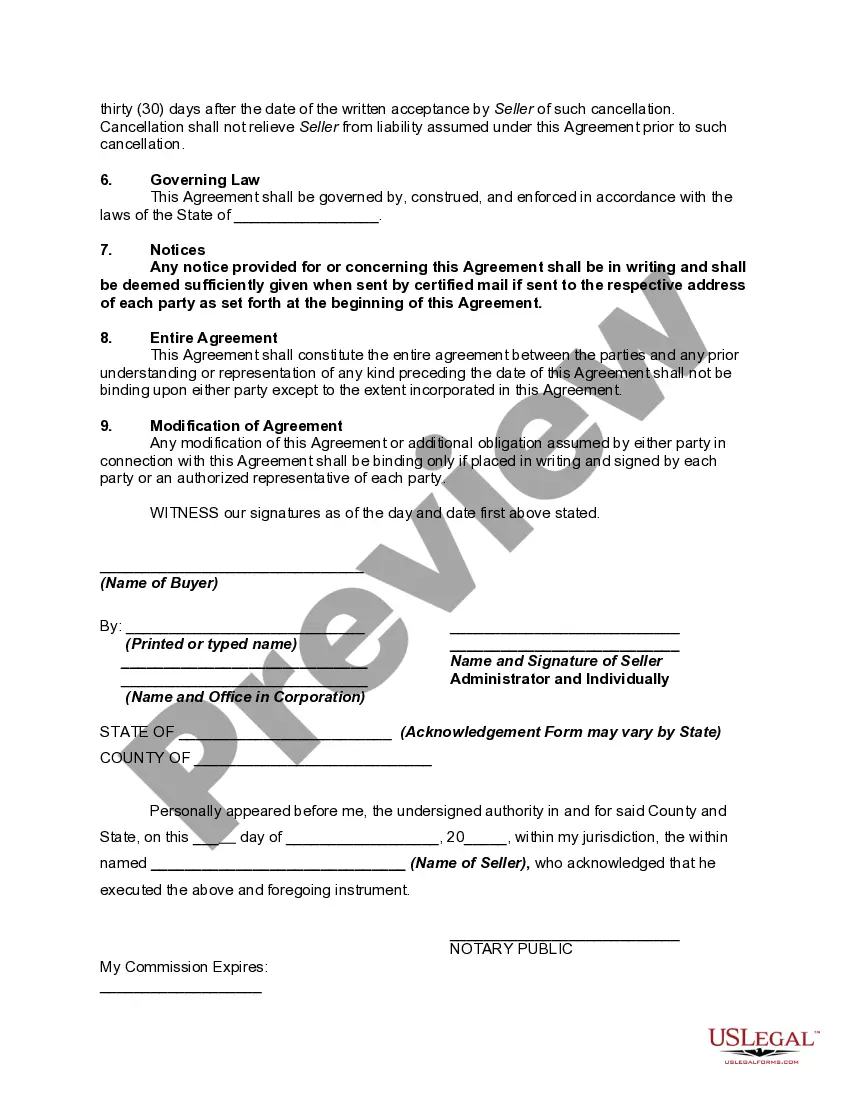

Step 4. Once you have located the form you require, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the purchasing process. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Maryland Indemnification of Purchaser of Personal Property from Estate with just a few clicks.

- If you are a current user of US Legal Forms, Log In to your account and select the Download option to locate the Maryland Indemnification of Purchaser of Personal Property from Estate.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Do not forget to read the description.

- Step 3. If you are dissatisfied with the type, use the Search area at the top of the screen to find other variations of the legal document format.

Form popularity

FAQ

Transferring property after the death of a parent with a will in Maryland involves identifying the executor named in the will. This executor must file the will with the Orphan's Court and follow the legal process to validate the will. Once validated, the executor can transfer the property to the designated beneficiaries. For assistance, consider using resources from US Legal Forms to navigate the Maryland indemnification of purchaser of personal property from estate.

Rule 6 414 in Maryland addresses the limitations on claims against an estate concerning personal property distribution. This rule helps protect heirs and purchasers by clarifying timelines and duties for fulfilling liabilities. Knowing the intricacies of this rule can greatly benefit buyers and sellers in the context of Maryland Indemnification of Purchaser of Personal Property from Estate.

In Maryland, a surviving spouse does not automatically inherit all assets unless there are no children or other heirs. The laws divide the estate's assets according to the decedent's family structure and whether a will exists. Understanding these laws is vital when considering aspects like the Maryland Indemnification of Purchaser of Personal Property from Estate, as they can influence inheritance outcomes.

Rule 6 417 in Maryland provides guidance regarding the sale of personal property from an estate. It outlines procedures to facilitate the transaction while ensuring that the purchaser is protected under Maryland law. Understanding this rule can provide essential insights for those involved in the Maryland Indemnification of Purchaser of Personal Property from Estate, as it impacts the lawful sale of estate assets.

Creditors in Maryland have a period of six months to make their claims against an estate after notice has been published. This timeframe is crucial for collecting debts and will ultimately impact the Maryland Indemnification of Purchaser of Personal Property from Estate if claims are not resolved timely. Effective management of these claims helps ensure a smoother estate settlement process.

In Maryland, an executor has three years from the date of the decedent's death to settle the estate. This timeframe allows for any complex issues, such as dealing with creditors or contested claims. However, it is advisable to complete the process sooner to avoid any potential complications with the Maryland Indemnification of Purchaser of Personal Property from Estate.

The 3-year rule in the context of a deceased estate typically refers to the limitation on claims against the estate after the estate has been closed in Maryland. After this period, creditors have limited recourse to recover debts owed by the deceased. This rule relates closely to the Maryland Indemnification of Purchaser of Personal Property from Estate, helping to clarify the rights of both creditors and heirs.

Creditors have up to six months after an estate is opened to make claims against it in Maryland. This timeframe allows the estate administrator to settle debts while managing other estate matters. It’s essential to know these timelines to effectively apply the Maryland Indemnification of Purchaser of Personal Property from Estate rules.

Yes, Maryland law does have guidelines concerning how long an estate can take to settle. Generally, the process should be completed within a year; however, complexities can extend this timeframe. Staying informed about these requirements ensures you comply with the Maryland Indemnification of Purchaser of Personal Property from Estate regulations.

In Maryland, the statute of limitations for collecting most debts is three years. However, certain types of debts may have different timeframes. Understanding these timelines can help you apply the Maryland Indemnification of Purchaser of Personal Property from Estate appropriately in order to protect your interests.