Maryland Contract for Sale of Goods on Consignment

Description

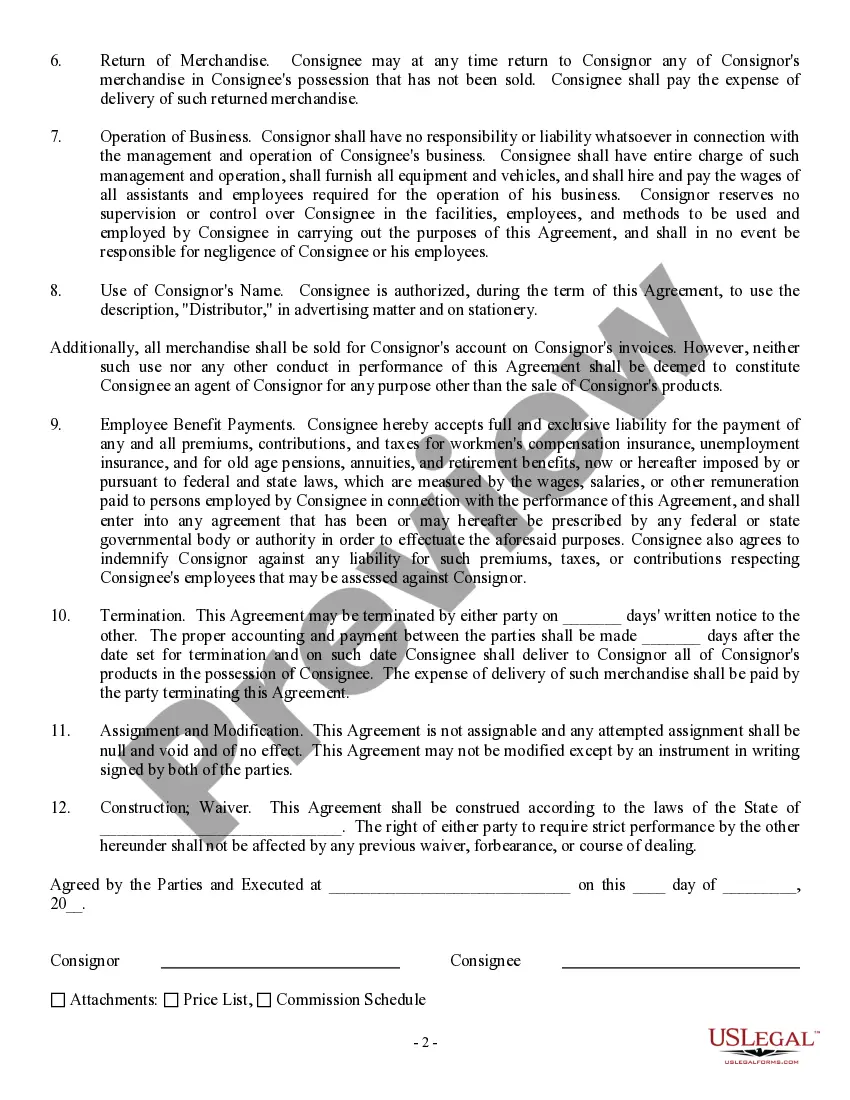

How to fill out Contract For Sale Of Goods On Consignment?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal template formats that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal reasons, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Maryland Contract for Sale of Goods on Consignment in moments.

If you already have an account, Log In to download the Maryland Contract for Sale of Goods on Consignment from the US Legal Forms catalog. The Download button will be available on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill in, modify, print, and sign the downloaded Maryland Contract for Sale of Goods on Consignment. Each template you add to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Maryland Contract for Sale of Goods on Consignment with US Legal Forms, the most comprehensive catalog of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to examine the form's content.

- Read the form description to ensure you have chosen the right one.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Selling on consignment can pose risks, such as delays in payment and potential loss of goods. In a Maryland Contract for Sale of Goods on Consignment, the seller may face uncertainty regarding when payments will be received. Moreover, managing unsold inventory can become cumbersome, particularly if the consignee does not actively promote sales.

Goods sold on consignment can often be returned to the seller if they do not sell. In a Maryland Contract for Sale of Goods on Consignment, this return policy is usually specified, allowing the consignee to send back unsold inventory. This flexibility can help reduce the risk for consignees when managing inventory.

A consignment is not considered a sale until the goods are sold to a buyer. In a Maryland Contract for Sale of Goods on Consignment, the seller transfers the right to sell to the consignee while retaining ownership until the transaction completes. Therefore, a consignment serves more as a sales agreement rather than an outright sale.

Consignment involves providing goods to another party for sale while retaining ownership. In a Maryland Contract for Sale of Goods on Consignment, the seller allows the consignee to sell the goods on their behalf. The seller receives payment only when the goods sell, maintaining control over the items until a sale occurs.

To terminate a consignment agreement, follow the terms outlined in your contract regarding termination. Usually, this includes providing written notice to the other party. A Maryland Contract for Sale of Goods on Consignment typically outlines the required steps, ensuring a smooth and respectful conclusion.

Yes, consignment sales may require a 1099 form for tax reporting purposes. If a consignor earns more than a certain threshold, the consignee must issue a 1099. Adhering to the Maryland Contract for Sale of Goods on Consignment is essential in keeping track of income for accurate 1099 reporting.

A consignment contract establishes a partnership between the consignor and consignee. The consignor gives goods to the consignee for sale, while agreeing on commission and payment terms. With a Maryland Contract for Sale of Goods on Consignment, each party's rights and obligations are clearly defined, aiding smooth operations.

To set up a consignment agreement, start by drafting a clear contract that outlines key terms. Include details such as the commission rate and conditions for sale. Utilizing a Maryland Contract for Sale of Goods on Consignment simplifies this process, ensuring your agreement meets state requirements.

The percentage of a consignment agreement typically varies based on negotiations between the parties involved. Generally, consignment sellers retain a percentage of the sale, which can range from 25% to 60%. This arrangement helps you earn while utilizing a Maryland Contract for Sale of Goods on Consignment.

Yes, consignment sales are reported to the IRS. Both the consignor and consignment seller must report their income during tax season. If you use a Maryland Contract for Sale of Goods on Consignment, you must keep accurate records of your transactions to ensure proper reporting.