Have you been in a placement the place you require files for both enterprise or individual uses virtually every working day? There are tons of lawful papers themes accessible on the Internet, but discovering versions you can depend on isn`t straightforward. US Legal Forms provides a huge number of develop themes, just like the Maryland Security Agreement in Accounts and Contract Rights, that are written to meet federal and state demands.

Should you be already informed about US Legal Forms internet site and have your account, merely log in. Afterward, you are able to down load the Maryland Security Agreement in Accounts and Contract Rights format.

Should you not come with an account and would like to begin using US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is to the correct city/state.

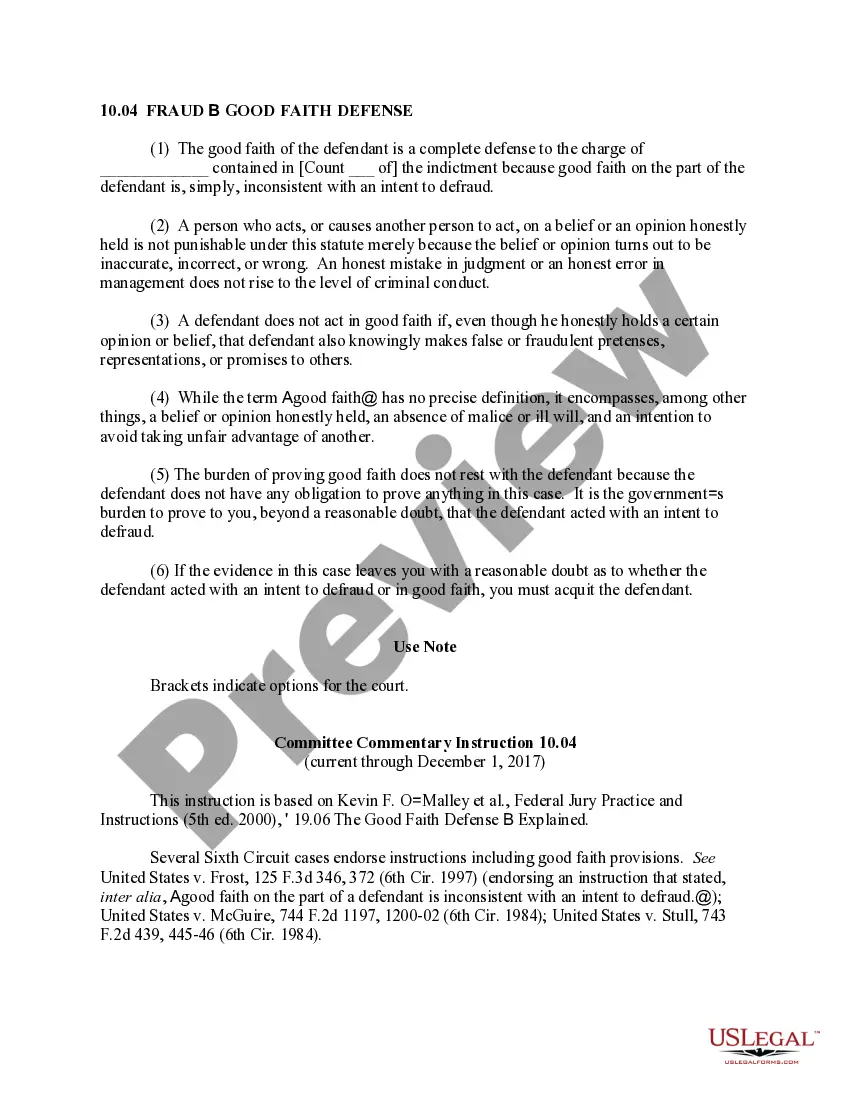

- Make use of the Preview option to examine the form.

- Look at the information to actually have chosen the appropriate develop.

- In the event the develop isn`t what you are searching for, use the Research discipline to discover the develop that meets your needs and demands.

- Whenever you find the correct develop, click Acquire now.

- Pick the pricing program you need, fill out the specified information and facts to create your bank account, and pay for an order with your PayPal or Visa or Mastercard.

- Choose a practical data file file format and down load your copy.

Locate all the papers themes you may have purchased in the My Forms menus. You can obtain a additional copy of Maryland Security Agreement in Accounts and Contract Rights at any time, if necessary. Just go through the essential develop to down load or print the papers format.

Use US Legal Forms, one of the most considerable variety of lawful kinds, to save lots of efforts and prevent mistakes. The assistance provides expertly manufactured lawful papers themes that you can use for an array of uses. Create your account on US Legal Forms and initiate making your life a little easier.