An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

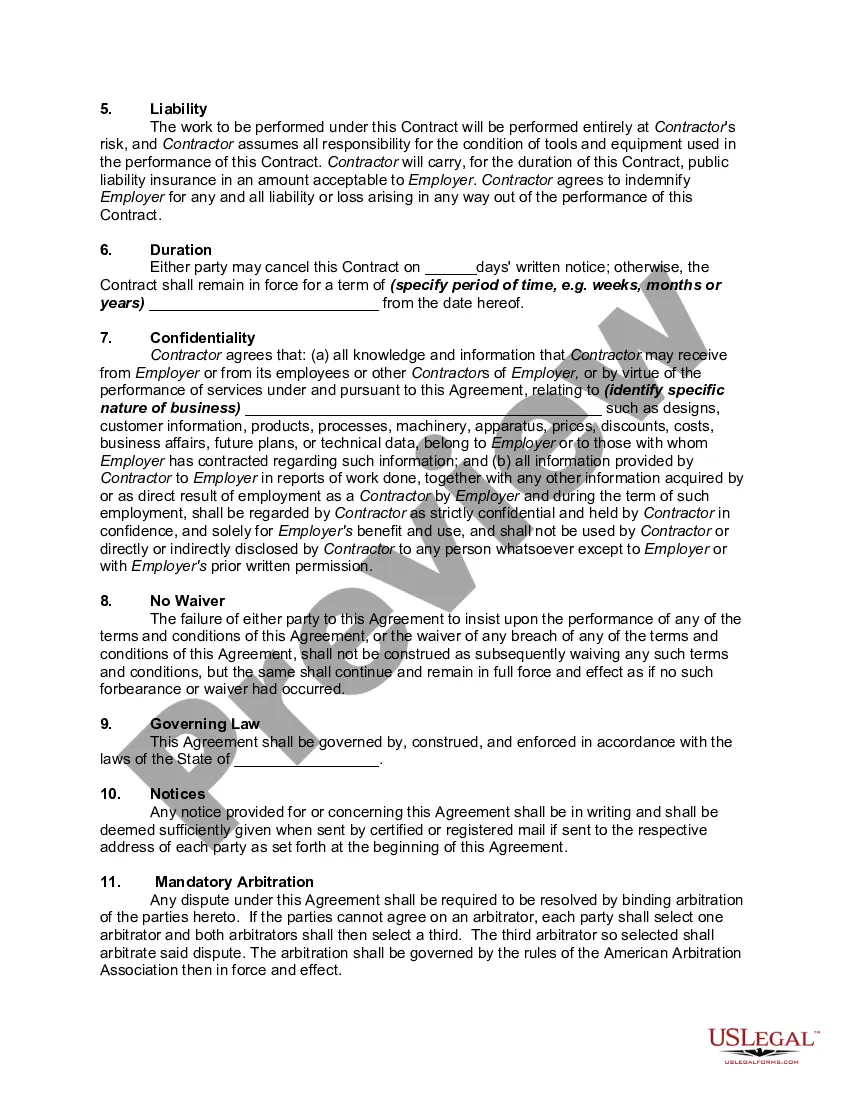

This form contains a confidentiality clause. The most important part of a confidentiality clause is the definition or description of the confidential information. Ideally, the contract should set forth as specifically as possible the scope of information covered by the agreement. However, the disclosing party may be reluctant to describe the information in the contract, for fear that some of the confidential information might be revealed in the contract itself.

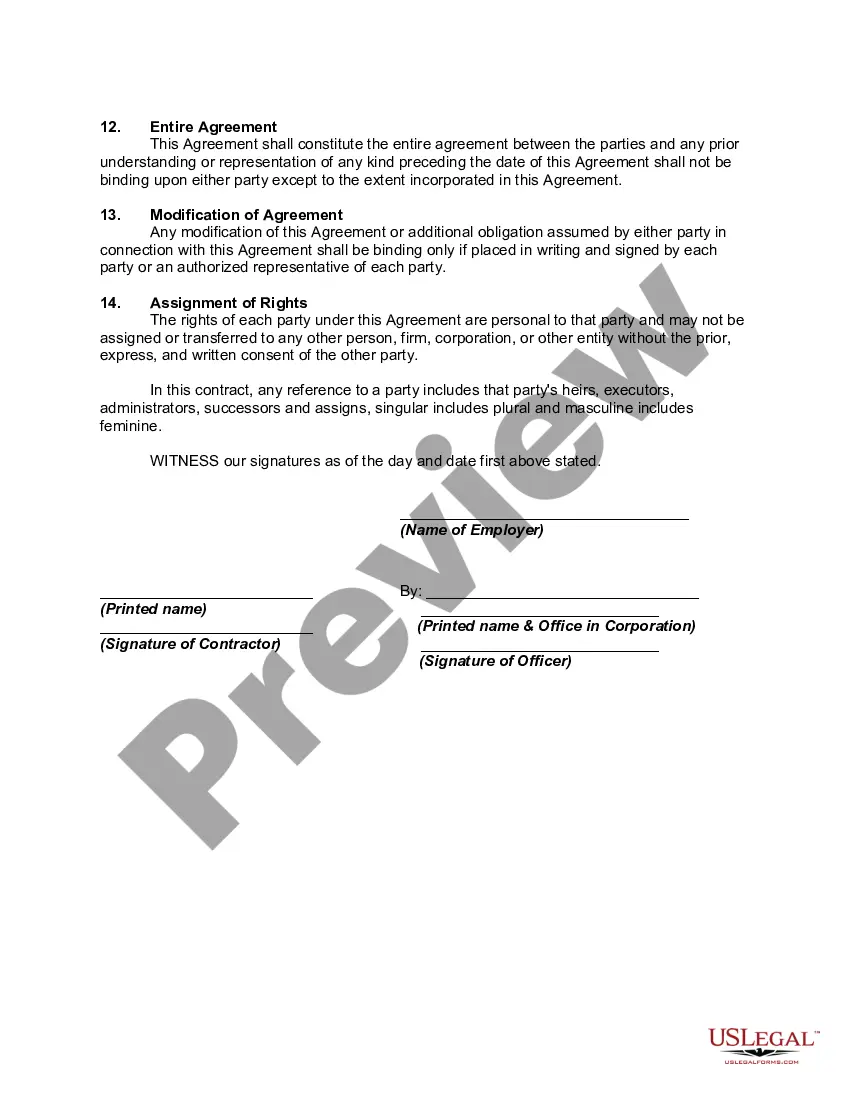

Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement is a legally binding agreement between a company or individual (referred to as the "Client") and an independent contractor (referred to as the "Contractor"). This contract outlines the terms and conditions under which the Contractor will provide services to the Client, while also ensuring the protection of confidential information. The Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement includes the following key provisions: 1. Parties to the Agreement: Clearly identifies the Client and the Contractor, including their legal names and contact information. 2. Engagement of Services: Specifies the scope of services to be provided by the Contractor, such as project goals, timelines, and deliverables. 3. Independent Contractor Status: States that the Contractor's relationship with the Client is that of an independent contractor and not an employee, ensuring compliance with Maryland labor laws. 4. Compensation and Payment Terms: Outlines the agreed-upon compensation structure, including rates, payment schedules, and any reimbursement policies. 5. Confidentiality Obligations: Establishes the Contractor's duty to maintain the confidentiality of any proprietary or sensitive information they come across during their engagement with the Client. This may include client lists, trade secrets, business strategies, or any other confidential information. 6. Non-Disclosure and Non-Compete Clauses: Prevents the Contractor from disclosing or using any confidential information acquired during the engagement for their own benefit or to compete against the Client's interests. 7. Intellectual Property: Addresses ownership of intellectual property rights related to the work produced by the Contractor during the engagement, ensuring that the Client retains full ownership or has the necessary licenses. 8. Termination of Agreement: Describes the circumstances under which either party can terminate the contract, as well as any notice periods or penalties involved. 9. Governing Law and Dispute Resolution: States that the contract is governed by Maryland law and outlines the preferred method for resolving any disputes that may arise, such as arbitration or mediation. Some different types of Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement can include variations based on the nature of the services provided. Examples may include: — Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement for IT Services: Specifically tailored for independent contractors providing information technology services, such as software development, network administration, or cybersecurity. — Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement for Creative Services: Suitable for independent contractors offering creative services like graphic design, writing, photography, or video production. — Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement for Consulting Services: Designed for independent contractors providing management or business consulting services, including strategic planning, market analysis, or financial advisory. In conclusion, the Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement is a crucial legal document that outlines the terms of engagement between a Client and a Self-Employed Independent Contractor while safeguarding the confidentiality of sensitive information. It is important to consult with a legal professional to ensure compliance with Maryland laws and to customize the agreement based on the specific requirements of the engagement.Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement is a legally binding agreement between a company or individual (referred to as the "Client") and an independent contractor (referred to as the "Contractor"). This contract outlines the terms and conditions under which the Contractor will provide services to the Client, while also ensuring the protection of confidential information. The Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement includes the following key provisions: 1. Parties to the Agreement: Clearly identifies the Client and the Contractor, including their legal names and contact information. 2. Engagement of Services: Specifies the scope of services to be provided by the Contractor, such as project goals, timelines, and deliverables. 3. Independent Contractor Status: States that the Contractor's relationship with the Client is that of an independent contractor and not an employee, ensuring compliance with Maryland labor laws. 4. Compensation and Payment Terms: Outlines the agreed-upon compensation structure, including rates, payment schedules, and any reimbursement policies. 5. Confidentiality Obligations: Establishes the Contractor's duty to maintain the confidentiality of any proprietary or sensitive information they come across during their engagement with the Client. This may include client lists, trade secrets, business strategies, or any other confidential information. 6. Non-Disclosure and Non-Compete Clauses: Prevents the Contractor from disclosing or using any confidential information acquired during the engagement for their own benefit or to compete against the Client's interests. 7. Intellectual Property: Addresses ownership of intellectual property rights related to the work produced by the Contractor during the engagement, ensuring that the Client retains full ownership or has the necessary licenses. 8. Termination of Agreement: Describes the circumstances under which either party can terminate the contract, as well as any notice periods or penalties involved. 9. Governing Law and Dispute Resolution: States that the contract is governed by Maryland law and outlines the preferred method for resolving any disputes that may arise, such as arbitration or mediation. Some different types of Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement can include variations based on the nature of the services provided. Examples may include: — Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement for IT Services: Specifically tailored for independent contractors providing information technology services, such as software development, network administration, or cybersecurity. — Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement for Creative Services: Suitable for independent contractors offering creative services like graphic design, writing, photography, or video production. — Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement for Consulting Services: Designed for independent contractors providing management or business consulting services, including strategic planning, market analysis, or financial advisory. In conclusion, the Maryland Contract with Self-Employed Independent Contractor with Confidentiality Agreement is a crucial legal document that outlines the terms of engagement between a Client and a Self-Employed Independent Contractor while safeguarding the confidentiality of sensitive information. It is important to consult with a legal professional to ensure compliance with Maryland laws and to customize the agreement based on the specific requirements of the engagement.