Maryland Non-Disclosure Agreement for Potential Investors: A Comprehensive Overview Introduction: A Maryland Non-Disclosure Agreement (NDA) for Potential Investors plays a crucial role in safeguarding confidential and proprietary information shared during the evaluation of investment opportunities. This legal document ensures that the investor, parties involved, and their respective interests are protected, thus fostering trust and encouraging open communication. In Maryland, there are several types of NDAs specifically designed to meet various investor needs. Let's delve into the details: 1. Standard Maryland NDA for Potential Investors: The standard NDA used in Maryland highlights the following key aspects: a. Parties involved: Clearly identifies all parties entering into the agreement, including the investor(s), the company or individual disclosing the information (the disclosed), and any other relevant parties. b. Definitions: Provides comprehensive definitions of confidential information, which may encompass trade secrets, financial data, technical specifications, marketing strategies, client lists, etc. These definitions ensure clarity and minimize disputes regarding what constitutes confidential information. c. Purpose: Sets out the purpose of the NDA, emphasizing that it is being used to protect the interests of both parties during investment discussions and evaluations. d. Confidentiality obligations: Specifies the obligations of the recipient (the investor) regarding the protection and non-disclosure of confidential information. It typically includes clauses regarding the restriction on sharing information with third parties, the duty to exercise reasonable care, and the requirement to use the disclosed information solely for evaluation purposes. e. Term: Specifies the duration of the NDA's effectiveness. It may be for a fixed term or extend indefinitely until the confidential information becomes publicly available, is no longer considered confidential, or both parties agree to terminate the agreement. f. Remedies and dispute resolution: Outlines the available remedies in case of a breach of the NDA. It may include injunctive relief, monetary damages, or both. The agreement also addresses how disputes will be resolved, often specifying arbitration as the preferred method. 2. Mutual Maryland NDA for Potential Investors: In certain situations, it is beneficial for both parties to exchange confidential information. A mutual NDA, also known as a two-way NDA, is employed to address this scenario. It ensures that each party's confidential information is protected and not disclosed without consent. 3. Unilateral Maryland NDA for Potential Investors: When only one party discloses confidential information to the investor, a unilateral NDA, also known as a one-way NDA, is used. This type of NDA provides protection to the disclosed without imposing similar obligations on the investor. 4. Maryland NDA with Non-Compete Clause: In some cases, the disclosed may require the investor not only to keep the confidential information private but also to refrain from entering into a competitive business or investing in a competing venture for a specific period. This variation includes non-compete provisions to ensure the protection of the disclosed's interests. Conclusion: Maryland Non-Disclosure Agreements for Potential Investors are essential legal tools designed to protect confidential information shared during investment discussions. By establishing clear obligations and remedies for breach, these NDAs foster trust and enable potential investors to evaluate opportunities in a secure and confidential manner. Understanding the various types of NDAs available, including the standard, mutual, unilateral, and those with non-compete clauses, allows investors to select the appropriate agreement depending on the specifics of their business engagements.

Maryland Non-Disclosure Agreement for Potential Investors

Description

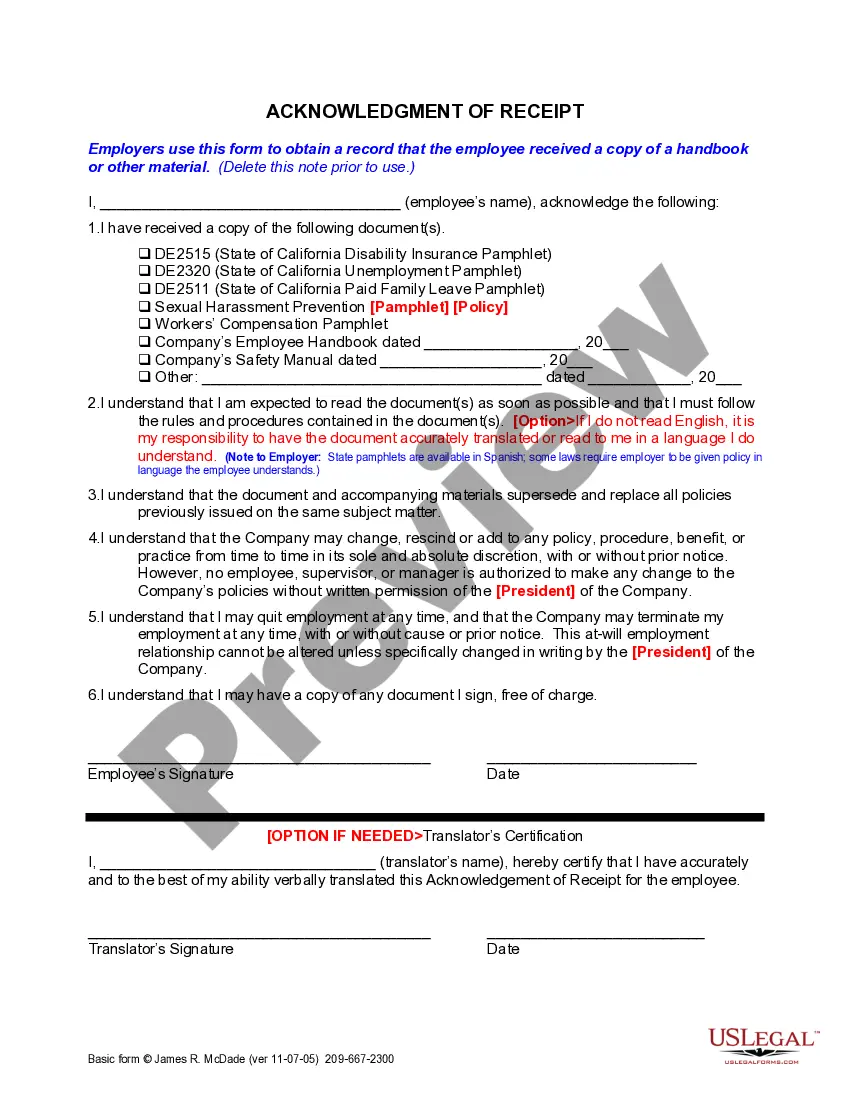

How to fill out Non-Disclosure Agreement For Potential Investors?

If you're seeking extensive, download, or print legal document templates, utilize US Legal Forms, the largest array of legal forms available online.

Take advantage of the site's straightforward and efficient search to find the documents you require.

Various templates for commercial and individual purposes are organized by categories and suggestions, or keywords.

Step 4. Once you've found the form you're looking for, click the Buy now button. Choose the payment plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the Maryland Non-Disclosure Agreement for Potential Investors with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Maryland Non-Disclosure Agreement for Potential Investors.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Review feature to examine the form's content. Remember to read the details.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the page to find alternative versions of the legal document template.

Form popularity

FAQ

Red flags for a Maryland Non-Disclosure Agreement for Potential Investors include vague definitions of confidential information, overly broad terms, and lacking specific obligations. Be cautious if the agreement does not clarify the duration of confidentiality or includes unreasonable penalties for breach. Identifying these issues beforehand can protect your interests and lead to a more effective partnership. Utilizing resources like U.S. Legal Forms can help you create a robust and clear NDA.

Key points of a Maryland Non-Disclosure Agreement for Potential Investors include defining what constitutes confidential information, establishing permission for disclosure, and outlining the duration of confidentiality obligations. Additionally, it's important to specify the consequences of any breaches. Highlighting these points ensures that both parties are on the same page, reducing risks and fostering a secure investment environment.

The rules of a Maryland Non-Disclosure Agreement for Potential Investors focus on protecting confidential information from unauthorized disclosure. Both parties must adhere to the defined terms and ensure that sensitive information is shared only under agreed conditions. Violating these rules can lead to potential legal consequences, so it's essential to understand and follow them carefully. Always consult legal resources for clarity and compliance.

Filling out a Maryland Non-Disclosure Agreement for Potential Investors involves several steps. First, you must identify the parties involved and clearly outline the confidential information being protected. It's also crucial to specify the duration of the agreement and any exceptions to confidentiality. Consider using online platforms like U.S. Legal Forms for templates that simplify this process, ensuring you don’t miss key components.

The five key elements of a Maryland Non-Disclosure Agreement for Potential Investors include the definition of confidential information, the obligations of the parties involved, the term of the agreement, the permitted disclosures, and the consequences of breach. Clearly defining these elements helps protect your sensitive information and ensures that both parties understand their responsibilities. This clarity fosters trust between you and your potential investors, enhancing future collaboration.

The three main types of NDAs are mutual NDAs, one-way NDAs, and employee NDAs. Mutual NDAs are used when both parties exchange information; one-way NDAs are for situations where only one party shares sensitive data. Employee NDAs often protect company information shared with employees and are particularly relevant for businesses seeking investment, making a Maryland Non-Disclosure Agreement for Potential Investors an important tool.

The primary difference between a mutual NDA and a one-way NDA lies in the direction of information sharing. A mutual NDA protects information exchanged by both parties, while a one-way NDA focuses solely on protecting the disclosing party's information. For potential investors, determining which type of Maryland Non-Disclosure Agreement is necessary can significantly impact your negotiation process.

Yes, you can create your own non-disclosure agreement, but it is essential to ensure it meets legal standards. Many people opt to use templates or professional services to draft an NDA tailored for their specific needs. Using platforms like USLegalForms can be beneficial in crafting a Maryland Non-Disclosure Agreement for Potential Investors that is legally sound and comprehensive.

An NDA generally consists of three key components: definition of confidential information, obligations of the receiving party, and the duration of confidentiality. Together, these components clarify what information is protected, the responsibilities of the parties involved, and how long the agreement remains in effect. A well-crafted Maryland Non-Disclosure Agreement for Potential Investors encompasses all these elements.

Yes, having an NDA for potential investors is often essential to protect sensitive business information. This agreement safeguards your ideas, strategies, and other proprietary data that you might share during discussions. Creating a Maryland Non-Disclosure Agreement for Potential Investors ensures that your critical information remains confidential.

Interesting Questions

More info

What Types of Disclosure Agreements Are Here? IPA's are the best solution for companies who want to restrict the use or sharing of trade secret information with employees or customers. There are four common types of disclosure agreements: 1) Limited Partnership Agreement What the Agreement Does: What it Does A limited partnership agreement is the best, most flexible, and cost-effective arrangement for controlling the use and knowledge of trade secret information. It is useful for many businesses and is a very effective way to implement a strong “no copying” philosophy by protecting trade secret material and preventing it from being disseminated or otherwise released. What It Should State : Limited Partnership agreements provide for all business interests to share and maintain appropriate copies of trade secret information in the enterprise. Trade secrets should be protected and managed from unauthorized duplication and non-disclosure.