This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased

Description

How to fill out Bill Of Sale And Assumption Of Debt Secured By The Personal Property Being Purchased?

US Legal Forms - one of the largest collections of legal documents in the country - offers a broad selection of legal template files that you can download or print.

By using the website, you can access thousands of forms for business and individual purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased in just minutes.

If you already have a subscription, Log In and download the Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously obtained forms in the My documents tab of your account.

Make edits. Fill out, modify, print, and sign the downloaded Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

Each template you add to your account has no expiration date and is yours forever. So, if you want to download or print another copy, simply visit the My documents section and click on the document you need. Access the Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If this is your first time using US Legal Forms, here are simple steps to get started.

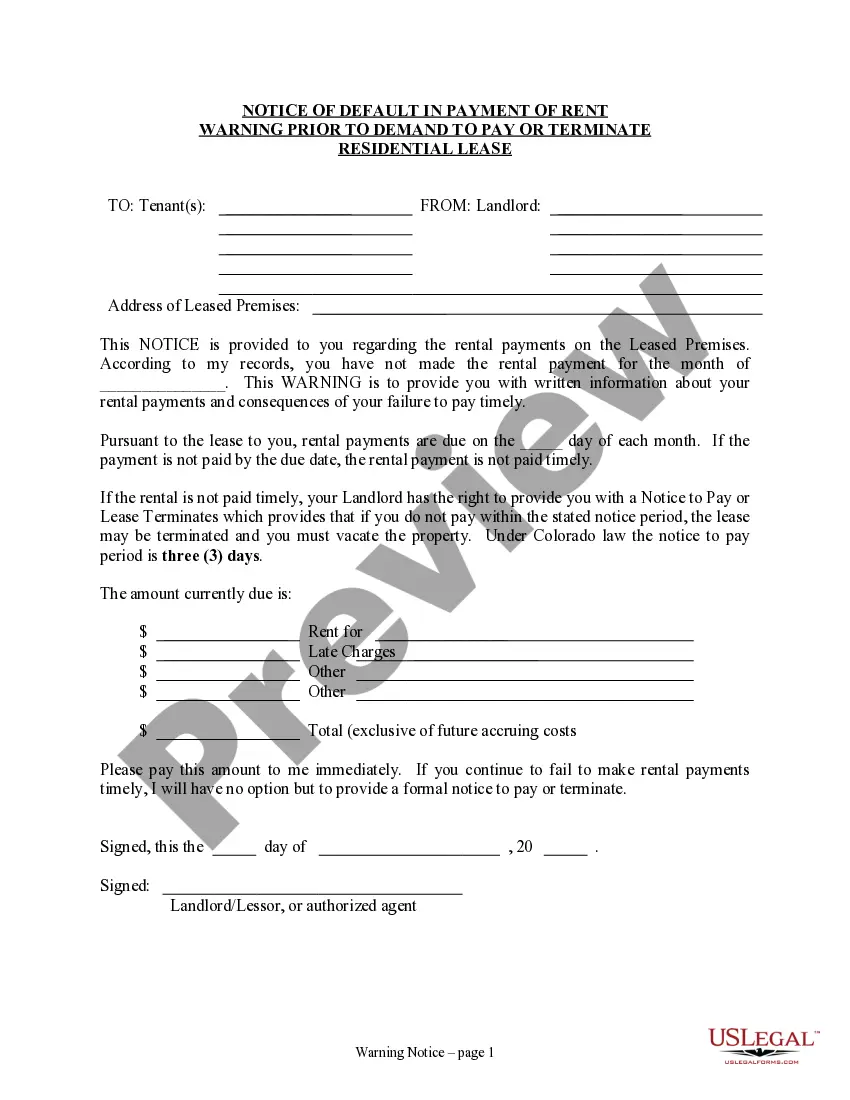

- Ensure you have selected the correct document for your city/region. Click the Preview button to review the form's details. Read the form information to confirm you have chosen the correct document.

- If the document does not meet your needs, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Buy now button. Then, choose your preferred pricing plan and provide your credentials to register for an account.

- Complete the payment. Use your Visa or Mastercard or PayPal account to finalize the transaction.

- Select the format and download the document to your device.

Form popularity

FAQ

Maryland does not require a notary for title transfers, but having your Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased notarized can provide peace of mind. Notarization simplifies the process and can help prevent disputes later. Understanding these requirements is crucial for a smooth title transfer.

To sell your car privately in Maryland, you will need the title, a completed Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, and any additional documents that verify your identity. This paperwork helps protect both you and the buyer during the sale. Be sure to gather all necessary paperwork before the transaction.

Yes, the seller must be present to notarize the title transfer in Maryland. This ensures that both parties are in agreement and are legally bound by the Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased. It's always advisable to complete this step for added security.

In Maryland, a notary is not required to transfer a car title; however, having a notarized Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased can help clarify the agreement between the buyer and seller. This can add a layer of protection for both parties. Always check local requirements as they may vary.

Transferring ownership of a car in Maryland involves signing the title over to the new owner and providing them with a completed Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased. It is essential to ensure that all details are filled out accurately to avoid issues later. This process not only establishes ownership but also facilitates a smooth transaction.

In Maryland, individuals and businesses that own personal property must file a personal property return with their local jurisdiction if their property exceeds a certain value. This applies to vehicles, equipment, and other tangible items. Proper documentation, including a Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, can assist in keeping your records organized.

To transfer ownership of a car in Maryland, you will need to complete the title and sign it over to the new owner. It is beneficial to create a Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased during this process. This documentation serves as proof of the transaction and protects both parties involved.

No, a notary is not required to transfer a car title in Maryland. However, having a signed Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased can provide extra protection and clarity in the transaction. It is always wise to ensure that the document is completed accurately to avoid any complications.

In Maryland, a bill of sale must include specific details, such as the names and addresses of both the buyer and seller, the date of the sale, and a description of the item being sold. It is advisable to include a Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased in this document for clarity. This ensures that both parties understand the terms of the transaction.

To transfer a car title to a family member in another state, you must first complete the title transfer process according to Maryland laws. This includes signing the title over to your family member and providing them with a Maryland Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased. Ensure that the transaction is correctly documented, as each state has its own requirements for title transfers.