Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

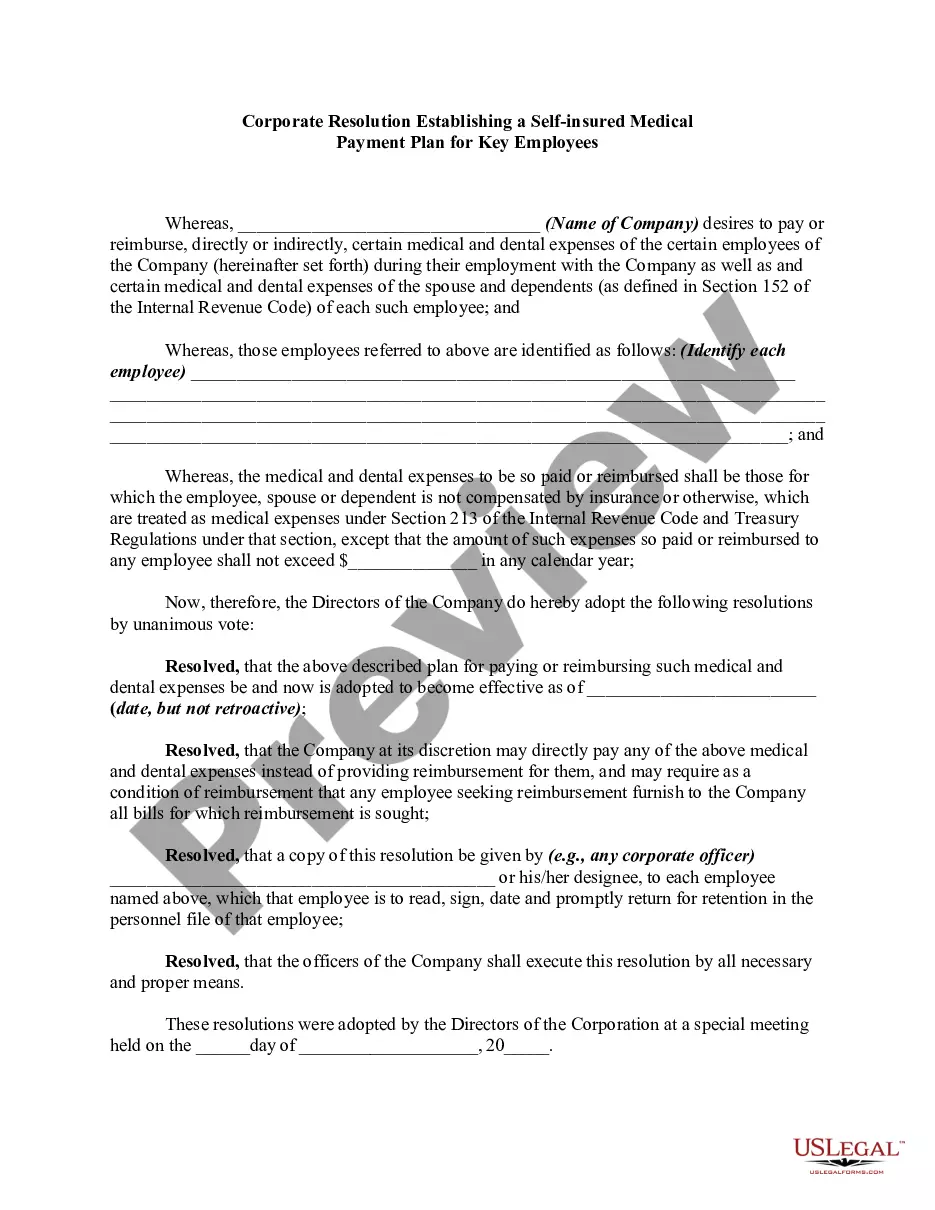

Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees

Description

How to fill out Corporate Resolution Establishing A Self-insured Medical Payment Plan For Key Employees?

If you require thorough, download, or create official document templates, utilize US Legal Forms, the largest selection of official forms, which are accessible online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees with just a few clicks.

Every official document template you purchase is yours permanently. You can access every form you have downloaded within your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form’s details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the official form template.

- Step 4. Once you have found the form you want, click the Buy now button. Choose your preferred pricing plan and enter your information to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Step 6. Choose the format of the official form and download it to your device.

- Step 7. Complete, edit, and print or sign the Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees.

Form popularity

FAQ

insured medical reimbursement plan is an arrangement where an employer takes on the financial risk of providing health benefits to employees. Rather than paying premiums to an insurance carrier, your company reimburses employees for their eligible medical expenses. By implementing a Maryland Corporate Resolution Establishing a Selfinsured Medical Payment Plan for Key Employees, you can offer tailored health benefits that meet the specific needs of your workforce. This plan may lead to higher employee satisfaction and lower costs over time.

insured medical expense reimbursement plan is a way for employers to reimburse employees for their medical expenses directly, rather than going through an insurance company. This type of plan often allows for greater customization to suit the workforce's needs. Through a Maryland Corporate Resolution Establishing a Selfinsured Medical Payment Plan for Key Employees, your organization can enhance benefits while maintaining control over healthcare spending. This approach can improve financial predictability and employee morale.

Medical Expense Reimbursement Plans (MERP) can provide significant value for businesses by offering tax advantages and flexibility in managing employee healthcare expenses. By adopting a Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, your company may provide personalized benefits while saving on insurance premiums. Moreover, these plans can enhance employee satisfaction by covering out-of-pocket medical expenses. It’s important to analyze the unique needs of your organization to determine if this option is right for you.

insured medical plan allows an organization, such as yours, to fund its own health benefits instead of purchasing an insurance policy. In this setup, the company pays for medical costs directly instead of using an insurer. This approach grants the company more control over the healthcare benefits offered to employees while potentially reducing overall costs. If you're interested in the Maryland Corporate Resolution Establishing a Selfinsured Medical Payment Plan for Key Employees, this could be a viable option for you.

insured medical reimbursement plan operates by allowing employers to reimburse employees for medical expenses incurred, rather than providing traditional health insurance coverage. Employers establish a fund to cover these expenses, and they must follow the guidelines set out in a Maryland Corporate Resolution Establishing a Selfinsured Medical Payment Plan for Key Employees. This approach enables businesses to maintain control over their healthcare costs while offering valuable benefits to key staff.

While a Medical Expense Reimbursement Plan (Merp) offers flexibility in managing healthcare costs, it comes with some disadvantages. For instance, employers might face challenges in predicting healthcare spending, leading to possible budget overruns. Furthermore, if not structured properly under a Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, a Merp may not provide the desired financial relief or meet regulatory standards.

In Maryland, employers are generally required to offer health insurance to employees if they meet certain criteria, particularly for businesses with 50 or more full-time employees. Understanding the specific requirements is essential, especially for businesses considering a Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. Compliance with state regulations helps employers avoid penalties and ensures that workers have access to necessary healthcare.

While you do not have to enroll in your employer's health insurance plan in Maryland, it is often in your best interest. Employers may offer plans tailored to meet the needs of employees. By helping to create a Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, your employer could provide tailored health benefits that promote wellness and financial security.

In Maryland, certain types of insurance coverage are mandatory, such as automobile liability insurance and workers' compensation. However, there is no statewide requirement for health insurance. Still, a Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can be beneficial for your organization. Offering health coverage can support a healthy and productive workforce.

Maryland state law emphasizes the importance of access to health insurance but does not mandate coverage for all employers. Companies can choose to implement a Maryland Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees as a viable option. By doing so, businesses can offer competitive benefits while engaging in responsible financial planning. Staying compliant with state and federal laws is crucial for the longevity of your business.