An IOU is usually an informal document acknowledging a debt. The term is derived from the phrases I owe unto and I owe you. An IOU differs from a promissory note in that an IOU is not a negotiable instrument as defined by the Uniform Commercial Code and generally does not specify repayment terms such as the time of repayment. IOUs usually specify the debtor, the amount owed, and sometimes the creditor.

Maryland Debt Acknowledgment - IOU

Description

How to fill out Debt Acknowledgment - IOU?

Have you ever been in a situation where you require documents for either professional or personal purposes nearly every day.

There are numerous official document templates accessible online, but finding ones you can trust isn't simple.

US Legal Forms offers thousands of form templates, including the Maryland Debt Acknowledgment - IOU, that are designed to comply with state and federal regulations.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

Select a convenient document format and download your version.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Debt Acknowledgment - IOU template.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

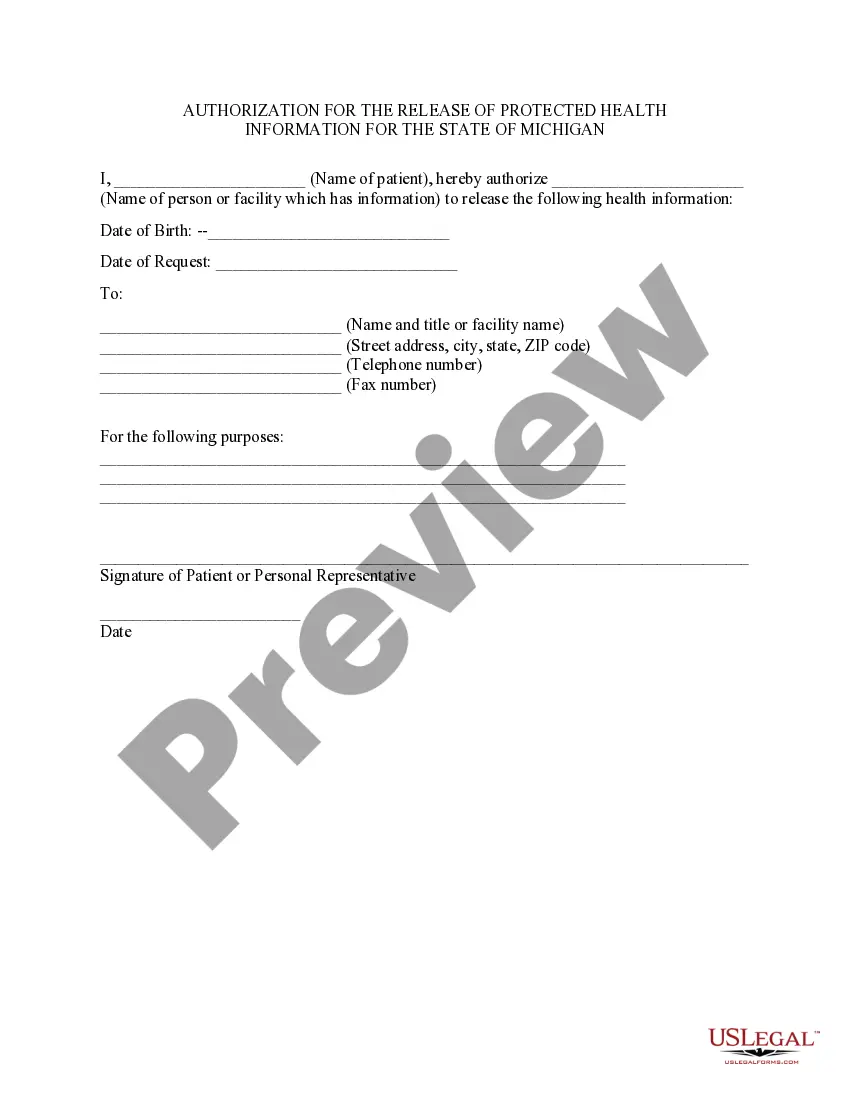

- Utilize the Review button to evaluate the document.

- Read the details to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the form that fits your needs and requirements.

- If you locate the correct form, click Buy now.

Form popularity

FAQ

An IOU is a written promise that you will pay back some money that you have borrowed. IOU is an abbreviation for 'I owe you'.

Cash typically includes coins, currency, funds on deposit with a bank, checks, and money orders. Items like postdated checks, certificates of deposit, IOUs, stamps, and travel advances are not classified as cash.

Essentials of an IOU Name of the debtor. Name of the creditor. Amount of money in question (written out in both words and numbers). When the debt will be repaid. ... If interest is to be charged until the debt is repaid, the details of how the interest is calculated should be spelled out. Signatures of both parties.

An IOU is a written promise that you will pay back some money that you have borrowed. IOU is an abbreviation for 'I owe you'.

I, the undersigned [BORROWER NAME] (the ?Borrower?), hereby confirm and acknowledge to [LENDER NAME] (the ?Lender?) that I am indebted to said Lender in the amount of $[AMOUNT] (the ?Debt?) as of the date set forth below.

An IOU (abbreviated from the phrase "I owe you") is usually an informal document acknowledging debt. An IOU differs from a promissory note in that an IOU is not a negotiable instrument and does not specify repayment terms such as the time of repayment.

An IOU, a phonetic acronym of the words "I owe you," is a document that acknowledges the existence of a debt. An IOU is often viewed as an informal written agreement rather than a legally binding commitment.

An IOU is a legal document that can be introduced in a court of law?though whether or not it is binding is open to dispute. Some authorities feel an IOU isn't binding at all; it's merely the acknowledgement that a debt exists.