Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books.

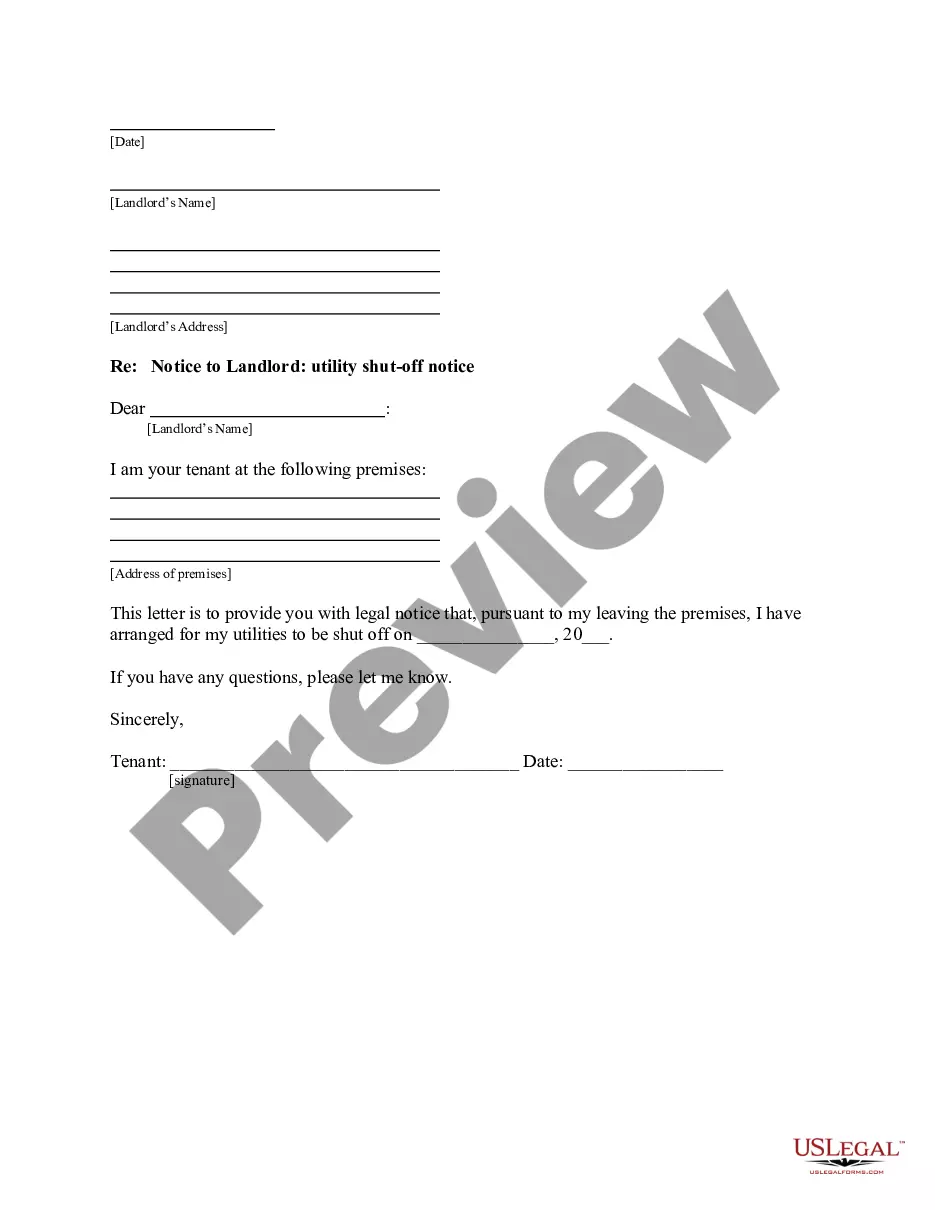

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Maryland Engagement Letter Between Accounting Firm and Client For Audit Services: A Comprehensive Overview Introduction: A Maryland Engagement Letter serves as a formal agreement between an accounting firm and a client for the provision of audit services. This detailed description will delve into the key components, importance, and variations of Maryland Engagement Letters for Audit Services, highlighting keywords such as Maryland, engagement letter, accounting firm, client, and audit services. Key Components of Maryland Engagement Letter Between Accounting Firm and Client For Audit Services: 1. Parties involved: The letter should clearly identify the accounting firm, including its name, address, and contact details, as well as the client's information. 2. Nature of the engagement: The letter outlines the purpose of the engagement, emphasizing that it is specifically for audit services. 3. Scope of services: It defines the scope, duration, and objectives of the audit, including the financial statements, internal controls, compliance checks, and other specific areas to be examined. 4. Responsibilities: Both the accounting firm and the client have defined responsibilities, such as providing accurate and complete information, access to necessary records, and cooperation throughout the audit process. 5. Fees and payment terms: The engagement letter should incorporate details about the fees, billing frequency, payment terms, and any additional expenses related to the audit services. 6. Professional standards: Mention that the accounting firm will conduct the audit in accordance with Generally Accepted Auditing Standards (GAS) and any additional industry-specific audit standards applicable in Maryland. 7. Confidentiality: Address the confidentiality of client information and the responsibility of the accounting firm to protect sensitive data obtained during the audit engagement. 8. Limitation of liability: Specify any limitations on the accounting firm's liability for errors, omissions, or damages arising from the audit engagement, in compliance with Maryland laws and regulations. 9. Termination: Include provisions regarding the termination of the engagement and the process to address disputes or disagreements that may arise. 10. Governing law: Indicate that the engagement letter shall be governed by the laws of Maryland and that any legal disputes will be resolved in Maryland courts. Types of Maryland Engagement Letters for Audit Services: While there can be numerous variations, some common types of engagement letters include: 1. General Purpose Audit Engagement Letter: Applicable when the accounting firm provides comprehensive audit services covering financial statements and internal controls. 2. Compliance Audit Engagement Letter: Used when the audit is focused on ensuring compliance with specific regulations or industry standards. 3. Financial Statement Audit Engagement Letter: Specifically outlines the scope of auditing the client's financial statements. 4. Internal Control Audit Engagement Letter: Pertains to an audit primarily focused on evaluating and improving the client's internal controls. 5. Limited Scope Audit Engagement Letter: Applicable when the audit services are limited to specific areas of the client's operations or financial statements. Conclusion: A Maryland Engagement Letter between an accounting firm and a client for audit services is a crucial document that establishes the expectations, responsibilities, and boundaries of the audit engagement. By encompassing the essential components mentioned above, it ensures a transparent and mutually beneficial relationship between both parties. Understanding the different types of engagement letters can help in tailoring the document to suit specific audit requirements.