Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

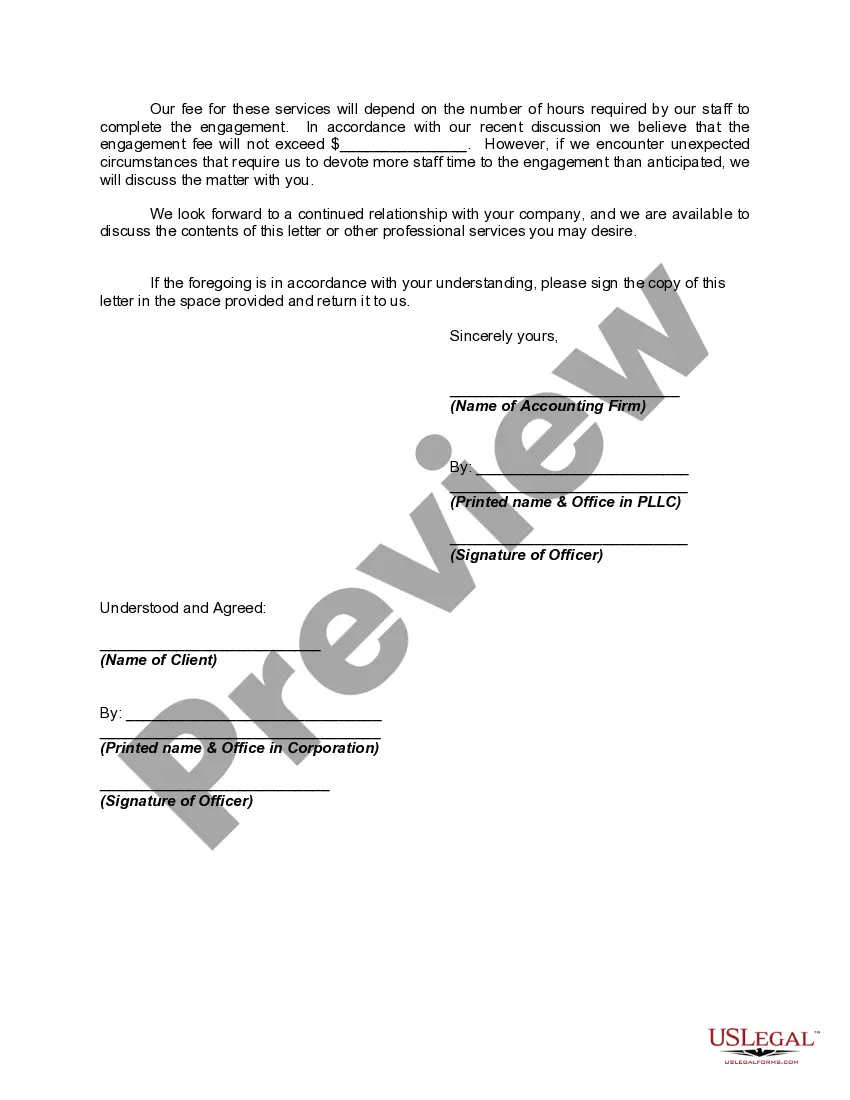

Maryland Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm plays a crucial role in establishing a clear understanding between an accounting firm and its client regarding the scope of work, responsibilities, and expectations related to the review of financial statements and compilation services. The engagement letter typically begins with an introductory paragraph, highlighting the accounting firm's name, address, and contact information, as well as the client's name and address. It further emphasizes that the purpose of the letter is to define the terms of the engagement and facilitate effective communication. The following sections outline the specific details of the engagement: 1. Objective and Scope: This section outlines the purpose of the engagement, which may include a review of financial statements or compilation services. It describes the nature and extent of the review or compilation, clarifying that these procedures do not constitute an audit. 2. Responsibilities of the Accounting Firm: This part describes the tasks the accounting firm will perform, such as conducting the review or compilation in accordance with relevant accounting standards, obtaining necessary management representations, and expressing an opinion or assurance, if applicable. The letter will also mention that an engagement team comprised of qualified professionals will carry out the assignment. 3. Responsibilities of the Client: This section outlines the client's responsibilities, such as providing accurate and complete financial records, ensuring compliance with applicable laws and regulations, and making management representations as required. It emphasizes the importance of the client's cooperation in order to facilitate an efficient engagement. 4. Limitations and Restrictions: This part clarifies any limitations or restrictions associated with the engagement, such as the accounting firm's reliance on the client's information, the possibility of material misstatements going undetected, or the inability to provide absolute assurance. 5. Timeline and Fee Structure: This section specifies the expected timeline for completing the engagement and the fee structure. It may include details about hourly rates, fixed fees, or any other billing arrangements agreed upon by both parties. Different types of Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm in Maryland could include variations in terms of the services provided or the industry-specific regulations to be followed. For instance: — Maryland Engagement Letter for Review of Financial Statements for Nonprofit Organizations: This type of engagement letter may include specific considerations related to accounting standards applicable to nonprofits, such as Financial Accounting Standards Board (FAST) guidelines or regulations by the Maryland Nonprofit Corporation Act. — Maryland Engagement Letter for Review of Financial Statements for Government Entities: An engagement letter tailored for government entities would need to address the specific rules and regulations set forth by bodies like the Governmental Accounting Standards Board (GAS) or the Maryland State Board of Accountancy. In conclusion, the Maryland Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a vital document that ensures a clear understanding between the accounting firm and its client. It outlines the scope of work, responsibilities, and limitations, allowing for a smooth and professional engagement process.Maryland Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm plays a crucial role in establishing a clear understanding between an accounting firm and its client regarding the scope of work, responsibilities, and expectations related to the review of financial statements and compilation services. The engagement letter typically begins with an introductory paragraph, highlighting the accounting firm's name, address, and contact information, as well as the client's name and address. It further emphasizes that the purpose of the letter is to define the terms of the engagement and facilitate effective communication. The following sections outline the specific details of the engagement: 1. Objective and Scope: This section outlines the purpose of the engagement, which may include a review of financial statements or compilation services. It describes the nature and extent of the review or compilation, clarifying that these procedures do not constitute an audit. 2. Responsibilities of the Accounting Firm: This part describes the tasks the accounting firm will perform, such as conducting the review or compilation in accordance with relevant accounting standards, obtaining necessary management representations, and expressing an opinion or assurance, if applicable. The letter will also mention that an engagement team comprised of qualified professionals will carry out the assignment. 3. Responsibilities of the Client: This section outlines the client's responsibilities, such as providing accurate and complete financial records, ensuring compliance with applicable laws and regulations, and making management representations as required. It emphasizes the importance of the client's cooperation in order to facilitate an efficient engagement. 4. Limitations and Restrictions: This part clarifies any limitations or restrictions associated with the engagement, such as the accounting firm's reliance on the client's information, the possibility of material misstatements going undetected, or the inability to provide absolute assurance. 5. Timeline and Fee Structure: This section specifies the expected timeline for completing the engagement and the fee structure. It may include details about hourly rates, fixed fees, or any other billing arrangements agreed upon by both parties. Different types of Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm in Maryland could include variations in terms of the services provided or the industry-specific regulations to be followed. For instance: — Maryland Engagement Letter for Review of Financial Statements for Nonprofit Organizations: This type of engagement letter may include specific considerations related to accounting standards applicable to nonprofits, such as Financial Accounting Standards Board (FAST) guidelines or regulations by the Maryland Nonprofit Corporation Act. — Maryland Engagement Letter for Review of Financial Statements for Government Entities: An engagement letter tailored for government entities would need to address the specific rules and regulations set forth by bodies like the Governmental Accounting Standards Board (GAS) or the Maryland State Board of Accountancy. In conclusion, the Maryland Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a vital document that ensures a clear understanding between the accounting firm and its client. It outlines the scope of work, responsibilities, and limitations, allowing for a smooth and professional engagement process.