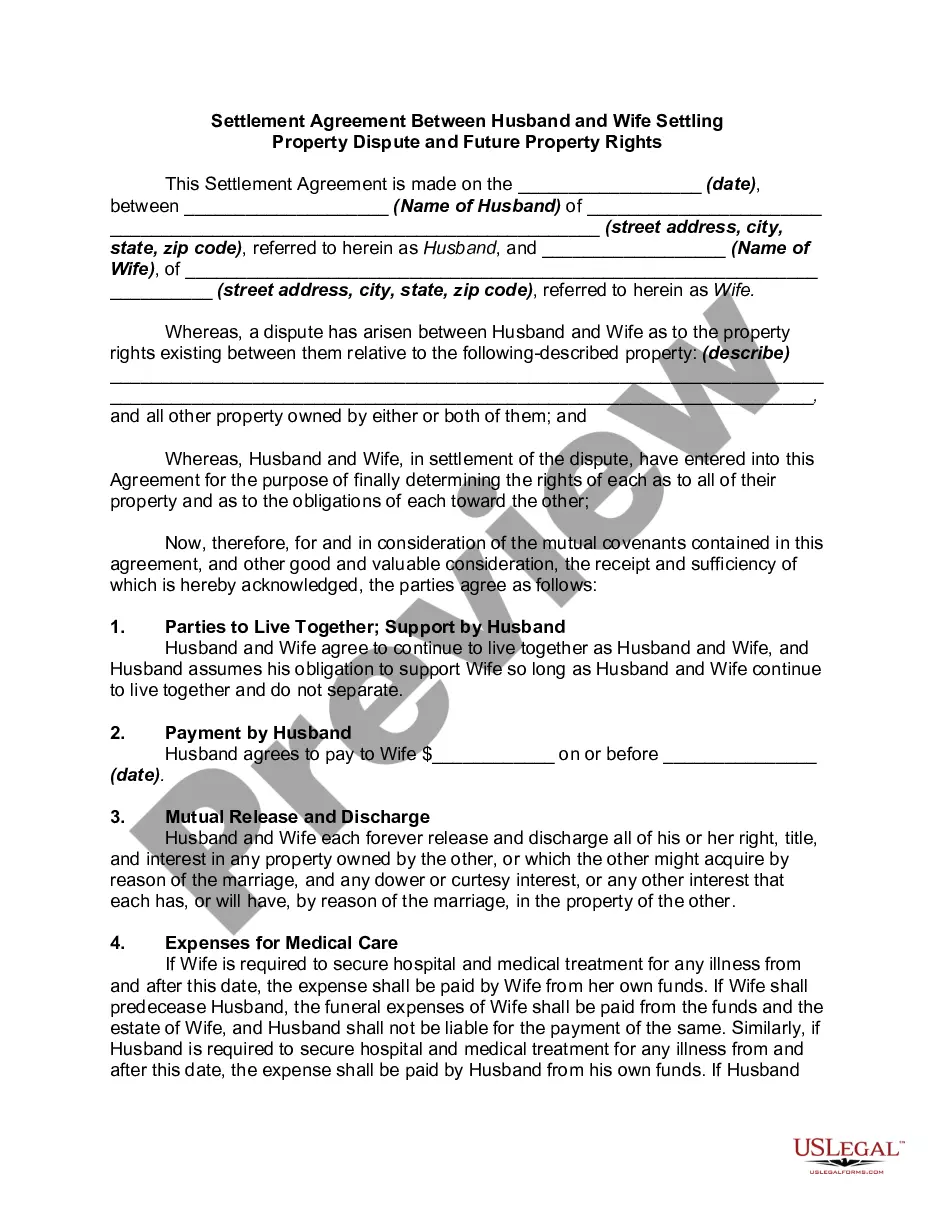

This form is a post-nuptial agreement between husband and wife. A post-nuptial agreement is a written contract executed after a couple gets married, to settle the couple's affairs and assets in the event of a separation or divorce. Like the contents of a prenuptial agreement, it can vary widely, but commonly includes provisions for division of property and spousal support in the event of divorce, death of one of the spouses, or breakup of marriage.

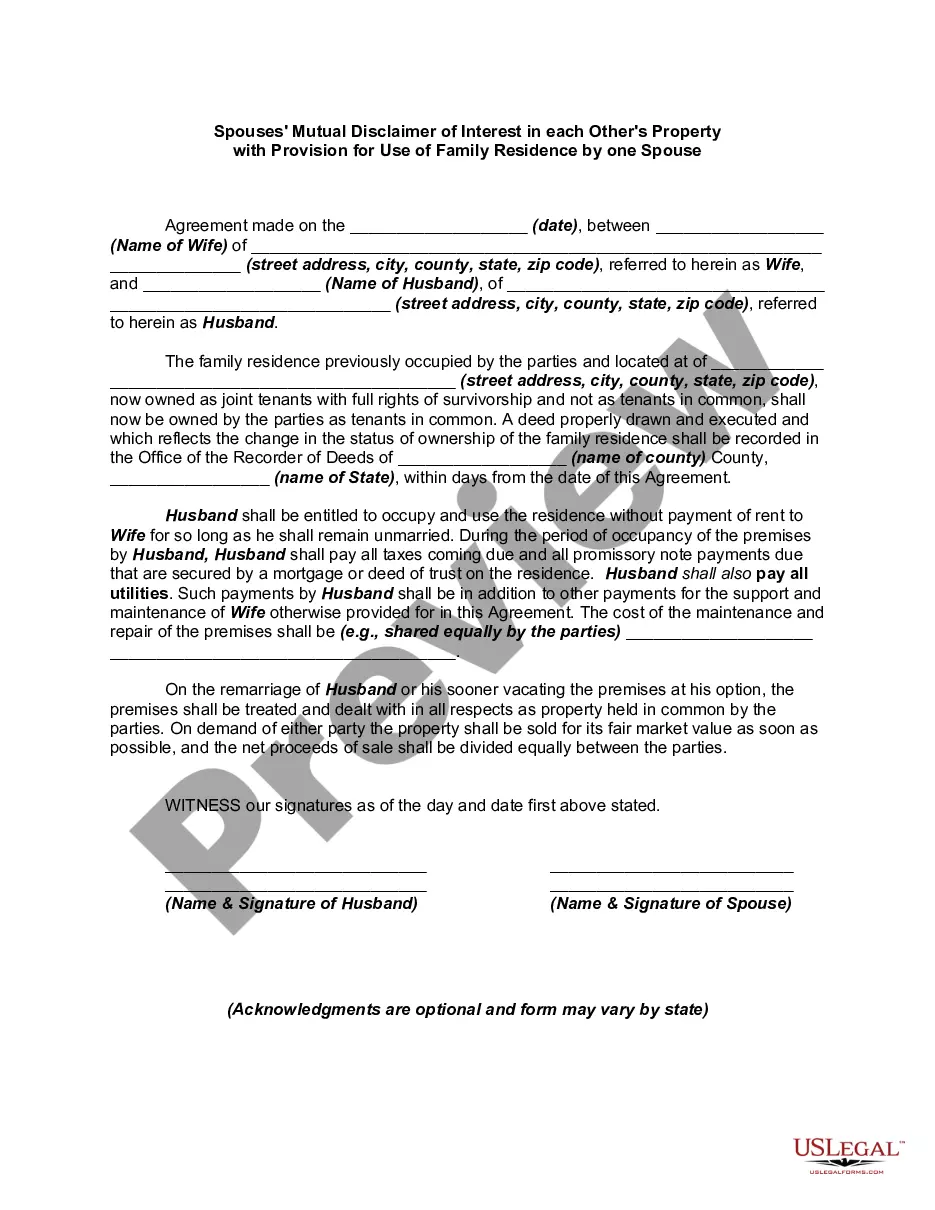

Maryland Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse

Description

How to fill out Spouses' Mutual Disclaimer Of Interest In Each Other's Property With Provision For Use Of Family Residence By One Spouse?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal paperwork templates that you can download or print.

By using the website, you will access thousands of forms for business and personal use, categorized by types, states, or keywords. You can locate the latest templates, such as the Maryland Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by one Spouse, within minutes.

If you already have a monthly subscription, Log In and download the Maryland Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by one Spouse from the US Legal Forms catalog. The Acquire button will appear on each form you view. You have access to all previously obtained forms from the My documents section of your account.

Process the purchase. Use your Visa or Mastercard or PayPal account to complete the transaction.

Choose the format and download the form to your device.Make edits. Fill out, modify, print, and sign the downloaded Maryland Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by one Spouse. All templates added to your account have no expiration date and are yours permanently. Therefore, if you want to download or print another copy, just go to the My documents section and click on the form you desire. Access the Maryland Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by one Spouse with US Legal Forms, one of the most comprehensive catalogs of legal paperwork templates. Utilize a vast range of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Ensure you've selected the correct form for your jurisdiction/county.

- Click on the Preview button to review the form's details.

- Check the form description to confirm you have selected the right form.

- If the form doesn’t meet your needs, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the payment plan you want and provide your credentials to register for an account.

Form popularity

FAQ

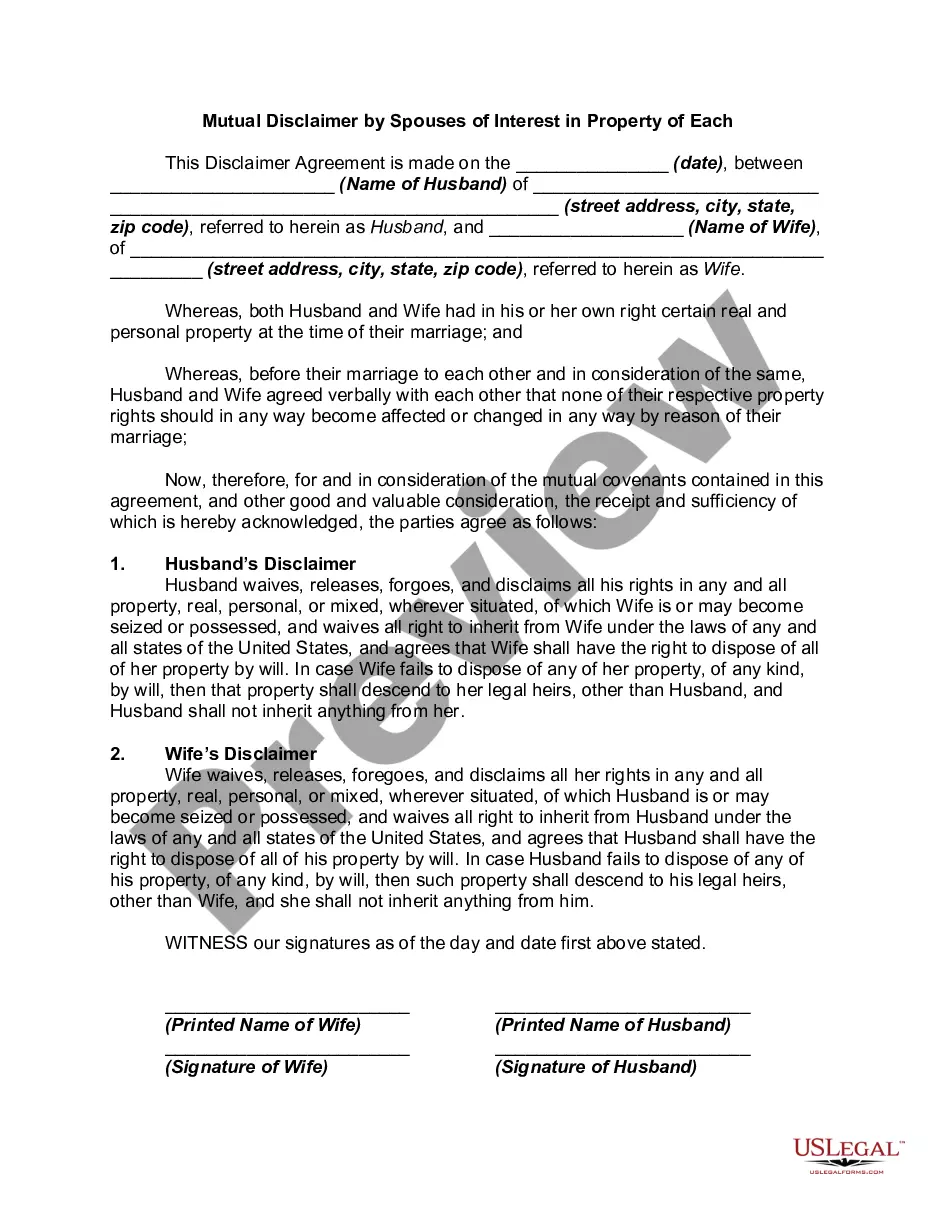

(1) Requirements. A disclaimer is a qualified disclaimer only if it is in writing. The writing must identify the interest in property disclaimed and be signed either by the disclaimant or by the disclaimant's legal representative. (2) Delivery.

Marital property includes real property (such as a home or land) that the spouses own as tenants by the entirety unless the spouses have a valid written agreement to the contrary. Marital property also includes any property either or both spouses acquired during the marriage.

Disclaimer may be revoked if procured by undue influence.

A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

The regulations provide that if an interest in property passes from a decedent to one other than the surviving spouse in a taxable transfer, and the person makes a qualified disclaimer, and the surviving spouse becomes entitled to such interest in property as a result of the disclaimer, the property is treated as

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

In the world of estates and trusts, a disclaimer is a refusal to accept a gift or a bequest. It may sound strange to refuse a gift but a disclaimer is a useful tool for tax, asset protection and estate planning.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

A nonqualified disclaimer needs to be carefully considered. As noted above, the disclaimant is treated as having made a gift. Because the original donor was likely already subject to transfer tax on the original transfer, a nonqualified disclaimer could result in double taxation for transfer-tax purposes.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.